NZSA Disclaimer

We’ve watched with ever-raising eyebrows as the governance dilemma at Sanford’s continues to unfold over the last fortnight. The latest in the saga is the release of the company’s Notice of Meeting (NoM) for its shareholder meeting, to be held in late December.

The NoM includes a nomination for John Strowger as a Board Member. The Notice of Meeting indicates that John Strowger would not be an independent director, thanks to his association with Tasman Equity Holdings. Together with Arden Capital and Past Limited Partnership, he is a representative of this (collective) 14.7% shareholder.

This would leave Sanford’s with two independent directors (David Mair and Chair, Sir Robert McLeod) and two non-independent directors (Craig Ellison and John Strowger) following the shareholder’s meeting.

However, there are a few other factors at play. John Strowger is the Chair of NZX-listed Skellerup, and is therefore associated with Skellerup CEO David Mair – an independent Board member of Sanford (in practice, he is David’s boss). We also note that David Cushing (a 3.7% shareholder of Sanford) is also a Board member of Skellerup.

We also note that Sir Robert McLeod’s wife is the sister of John Strowger’s partner.

We know that New Zealand can be a small place and that all of the individuals involved are respected and capable members of the business community. Nonetheless, on the face of it, this all seems a little too close for comfort when it comes to exercising independent judgement. While the election of John Strowger per se may be appropriate, we believe that David Mair and Sir Robert McLeod would be hard-pressed to maintain full independence given the nature and cross-dependency of relationships.

There is a strong argument to make that no director on the Sanford’s Board could be considered independent should John Strowger be elected – placing the company squarely in breach of the NZX Listing rules when it comes to maintaining a minimum of two independent directors.

On the face of it, this calls into question the judgement of the whole Board in allowing Sanford to be in this situation.

The situation highlights the ‘unconscious bias’ (and that might be being kind) that exists amongst the director community, in favouring individuals that they know. While New Zealand might be a land of opportunity for some, I am now unfortunately cynical enough to know that our country is not a meritocracy. NZSA continues to call on Board’s to maintain an open mind when seeking nominations and/or appointing Directors. That will have a longer-term benefit for New Zealand’s director pool, with new perspectives resulting in better decisions on behalf of shareholders in the short-term.

In the case of Sanford’s, NZSA would be very interested in learning exactly how the nomination process worked and whether it was accompanied by a supporting recruitment process.

Additionally, we note that Ngāi Tahu Investments has maintained relative silence while the events of the last few weeks have played out. That’s unusual in the context of their past behaviour at Sanford’s – they have previously offered clear market signals as to their intentions when it came to supporting individual directors.

NZSA would be very keen for Ngāi Tahu to inform the market as to their intentions when it comes to supporting John Strowger.

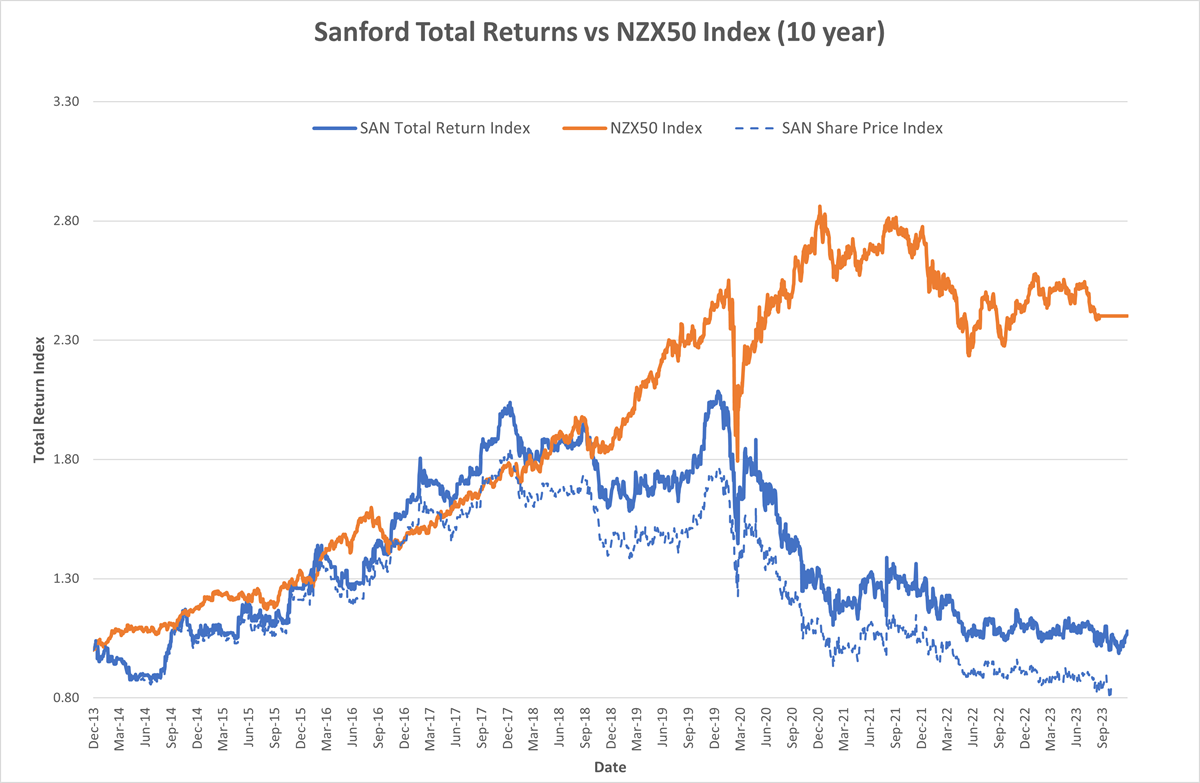

Regardless, though, their silence adds to an emerging body of evidence that Sanford is now dominated by a small group of wealthy private investors. This should act as a ‘red flag’ for investors, with the potential for the company to become a plaything for the interests of those investors at the expense of minorities (potentially similar to what has transpired at Metro Performance Glass). Whether that ‘red flag’ creates opportunity or downside for investors is a matter of investor judgement.

Abby Foote

Two weeks ago, the news was all about the departure of Abby Foote. She departed in a (relative) blaze of glory with her reasons departing from the traditionally anodyne statements made to the NZX.

I am no longer aligned with the view of the majority of the board as to the best interests of the organisation in particular as it relates to actions by significant but minority shareholders which are making it increasingly difficult to govern the organisation in accordance with the expectations of the NZX Corporate Governance Code and my view as to good practice for listed companies.

Abby Foote, as per NZ Herald article, Nov 13th 2023

The startling revelations associated with Abby Foote’s departure and best-practice governance have suddenly been brought into sharp focus. Initial speculation (including from NZSA’s November 11th Briefing) centred on whether this was a case of 19.9% shareholder Ngāi Tahu ‘flexing its muscle’. A week later, NZSA did consider the possibility of other interests affecting Ms Foote’s decision:

It’s worth pointing out that Sanford’s contains other significant minority shareholders, including well-known investors Chris Spencer & Jonathan McHardy (14.7%), Masfen Securities (7.5%) and Christchurch-based David Cushing (3.7%). In the absence of information, it remains unclear as to whether Ms Foote’s concerns relate to Ngāi Tahu or to this collective group of shareholders as a whole.

Oliver Mander, NZSA CEO, Briefing Newsletter, November 18th

Director Independence Matters

The troubles at Sanford also give rise to a more systemic issue – is it time for a more fundamental, systemic change to how we enshrine director independence in New Zealand? Back in June this year, NZSA made a submission to NZX calling for the introduction of a minority interests regime as a feature of the NZX Listing Rules. This would stipulate that where a listed issuer has 30% or more of its shares owned by a single shareholder, that shareholder (or shareholders, where they are acting in concert) is/are unable to vote on the election or re-election of independent directors.

We will shortly launch our own consultation as we include a preference encouraging listed issuers to voluntarily adopt such a regime within our own policies relating to Director Independence (these are the policies that NZSA uses in assessing listed issuers for our company assessment reports).

We note that as the Board would retain the ability to appoint (subject to shareholder vote) or remove directors, this would likely result in greater market discussion and/or consultation as to who might be acceptable as independent directors. Essentially each shareholder class would hold a ‘power of veto’ over the other under this NZSA proposal.

In Sanford’s case, the NZSA proposal would not be threatening to the likes of Abby Foote or Mark Cairns (a former director of Sanford who resigned only 18 months into the role); their nomination would be likely to garner minority shareholder support. However, were this test to be applied to the re-election of David Mair and Sir Robert McLeod as independent directors, one suspects that minority shareholders would have their say.

There is some argument to say that this would not be applicable at Sanford, as no shareholder controls more than 30%. However, we are curious as to the point where the interests of Tasman Holdings (14.7%) and Ngāi Tahu (19.9%) become aligned.

This is why NZSA is calling on 19.9% shareholder Ngāi Tahu Investments to offer transparency as to their voting intentions. A clear ‘against’ vote from Ngāi Tahu would be concrete evidence that there is no intent for the major shareholder groups to be acting ‘in concert’ with the 14.7% shareholding represented by John Strowger’s election. To be clear, however, an ‘in favour’ vote would not be explicit evidence of an ‘in concert’ arrangement either (but would not rule it out).

Voting

Over the next few days, NZSA will be publishing it’s assessment report relating to Sanford. We have no objection to John Strowger as an individual Board Member, but we need to be mindful of the impact his election would have on the wider Board Composition.

In the absence of further information, it is difficult for NZSA to support an election that would cause potential for the company to breach the Listing Rules and the NZX Corporate Governance Code (let alone NZSA policies).

Oliver Mander

Postscript: The Sanford ASM on December 18th 2023 was one of the last of the year. In the event, John Strowger put up a spirited defence of his position that squarely addressed the issues raised by NZSA. He received nearly 99% of votes cast in favour of his election. Tellingly, however, Ngāi Tahu abstained from voting.

NZSA’s assessment was clear in stating it’s respect for all of the individuals involved – their quality was never the concern. At the ASM, we challenged the Board to pursue Board stability and better alignment amongst Sanford’s differing shareholder groups.