Date Submitted: January 31st 2024

To: Financial Markets Authority

Tap/Click here to download submission

The NZ Shareholders’ Association (NZSA) appreciates the opportunity to present this submission on the proposals contained within the target consultation for this topic. NZSA would welcome any further enquiry related to clarification or additional information.

Key Submission Points – Signatures

The problem statement relates to the requirement of Part 7A of the FMC Act which requires two directors to sign and date the climate statements and group climate statements. An exemption is sought from the requirement for two directors of some of the overseas banks which are Climate-Reporting Entities (CREs) to sign and date the climate statements and group climate statements. Instead, it is proposed the CEO of the NZ branch sign instead.

A similar exemption already exists for the signing of financial statements.

Question 1: Do you agree there is a problem? If so, do you agree that it makes sense for the FMA to grant some form of relief to address the problem?

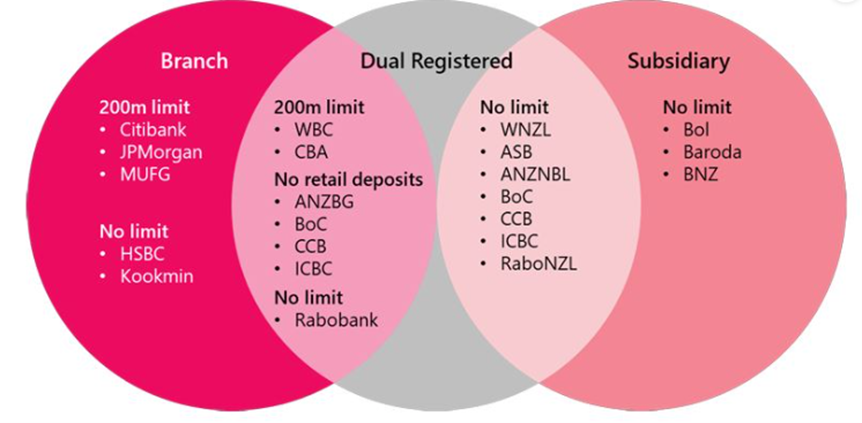

Response: The current structure of registered overseas banks in New Zealand is as set out below. These represent 22 of the 27 registered banks currently operating in New Zealand.

Source: The RBNZ confirms major changes for NZ branches of overseas banks | interest.co.nz

Foreign-owned banks are registered either as branches or subsidiaries of their global parent. In its recent review[1], the RBNZ limited the maximum size of a ‘branch’ to $15 billion in total assets.

For the largest and most well-known Australian-owned banks (including BNZ, WNZL, ASB/CBA and ANZ), NZSA does not necessarily believe there is a problem – New Zealand operations constitute a significant portion of their global operations and should attract appropriate Board discussion and oversight at the ‘parent’ level. We accept that for smaller subsidiaries (eg, Bank of Baroda), there may be a requirement for additional engagement between local (NZ) managers and the ‘parent’ directors. We don’t believe this results in a negative outcome for New Zealanders.

NZSA would prefer a regime that aligns with this RBNZ distinction – ie, if a bank is registered solely as a ‘branch’ operation, the exemption proposed by the FMA in relation to signing CRD should apply, otherwise, any disclosures should be signed by the ‘parent’ directors. Under this NZSA submission, the exemption would therefore not apply to a bank that is dual-registered as both branch and a subsidiary.

Financial Statements Signature: While we recognise this is at odds with the exemption applying to financial statements, we would prefer that this exemption itself is amended to align with the NZSA submission and the recent RBNZ policy review limits; ie, where a bank is registered solely as a branch, the exemption would also apply to the signing of financial statements, however if the bank is a subsidiary or dual-registered, this should be signed by the directors of the ‘parent’ company.

Impact: In practical terms, this means that the FMA exemption proposal would apply to 5 overseas banks registered as branches in New Zealand: Citibank, JP Morgan, MUFG, HSBC and Kookmin. All other banks (including the major Australian-owned banks operating in New Zealand) would require signatures from their ‘parent’ company directors.

Question 2: What form of relief do you think would be most suitable? Do you have any comments on the following options:

FMA gives an exemption as requested to 5 overseas banks on the condition that CEO of the NZ branch signs the climate statements instead of 2 directors.

Response: Where the bank is registered as a branch of the overseas parent, NZSA is supportive of this relief.

FMA gives an exemption to all overseas banks and makes the condition that they sign the climate statements in the same manner as their BPSA disclosure documents ie an agent for the directors and the NZ CEO (or their agent) have to sign

Response: NZSA prefers a distinction to be made between subsidiaries and branches, with branches receiving an exemption to the FMCA requirements relating to CRD signatures.

No action approach while overseas jurisdictions are still developing their mandatory climate reporting requirements?

Response: NZSA does not believe this approach is practical for any stakeholder.

Are there any other options we should consider?

Response: Please note NZSA’s preferences as expressed in Question 1, distinguishing between branches and subsidiaries of foreign-owned banks.

Thank you for the opportunity to present this submission. We would welcome further discussion and engagement on the points raised by NZSA. Please contact me on 021 190-5343 or via ceo@nzshareholders.co.nz should further clarification be required.

Oliver Mander

CEO, NZ Shareholders’ Association

January 31st 2024