NZSA Disclaimer

Guanglin “Alan” Lai probably thought it was in the bag.

After all, with Agria’s 44.3% shareholding, it would be tough to overturn a proposal (announced on February 13th) to remove three independent directors from the Board and elect three new independent directors, plus himself.

Yet, the recent action by Agria in flexing its muscle to force Board change at PGG Wrightson (PGW) highlights that a (rare) united front across NZ capital markets stakeholders can make a real difference. Yesterday (March 22nd), PGW announced that the call for a Special Meeting had been withdrawn by Agria, noting that “Agria and the PGW Board have determined that the current composition and the majority of the membership of the Board continue to have an appropriate balance of expertise, skills, and independence.“

Quite the change from a month ago – although Agria had not exactly been forthcoming about their reasons for a Board change in the first place.

NZSA’s position on the proposal was made clear on the morning of February 16th, while the independent directors affected by the proposal showed some genuine steel by announcing a change in the Chair later that afternoon.

By March 8th, NZSA had sent an email to PGW shareholders. We made clear that we wouldn’t support Agria’s proposals and would add some resolutions of our own to any special meeting:

- That the Board determine the constitutional settings required for PGG Wrightson to include a minority investors voting regime within its Constitution, whereby a controlling shareholder with greater than 30% of shares would not be able to vote on the election or re-election of independent directors.

- That a revised Constitution, including any amendments determined by the Board under Resolution (1), is tabled for consideration by shareholders as a special resolution at the next Annual Shareholders Meeting of PGG Wrightson.

- That Meng Foon be removed as a Director of PGG Wrightson.

Tellingly, however, it was clear that whether capital markets stakeholders were expressing concern publicly or not, there was genuine bafflement as to the actions taken by Agria. A united front amongst stakeholders is rare – even amongst shareholders, it is difficult to achieve universal alignment on an issue, let alone amongst other stakeholders.

But it was clear after only a few conversations that Agria had ‘misread the room’.

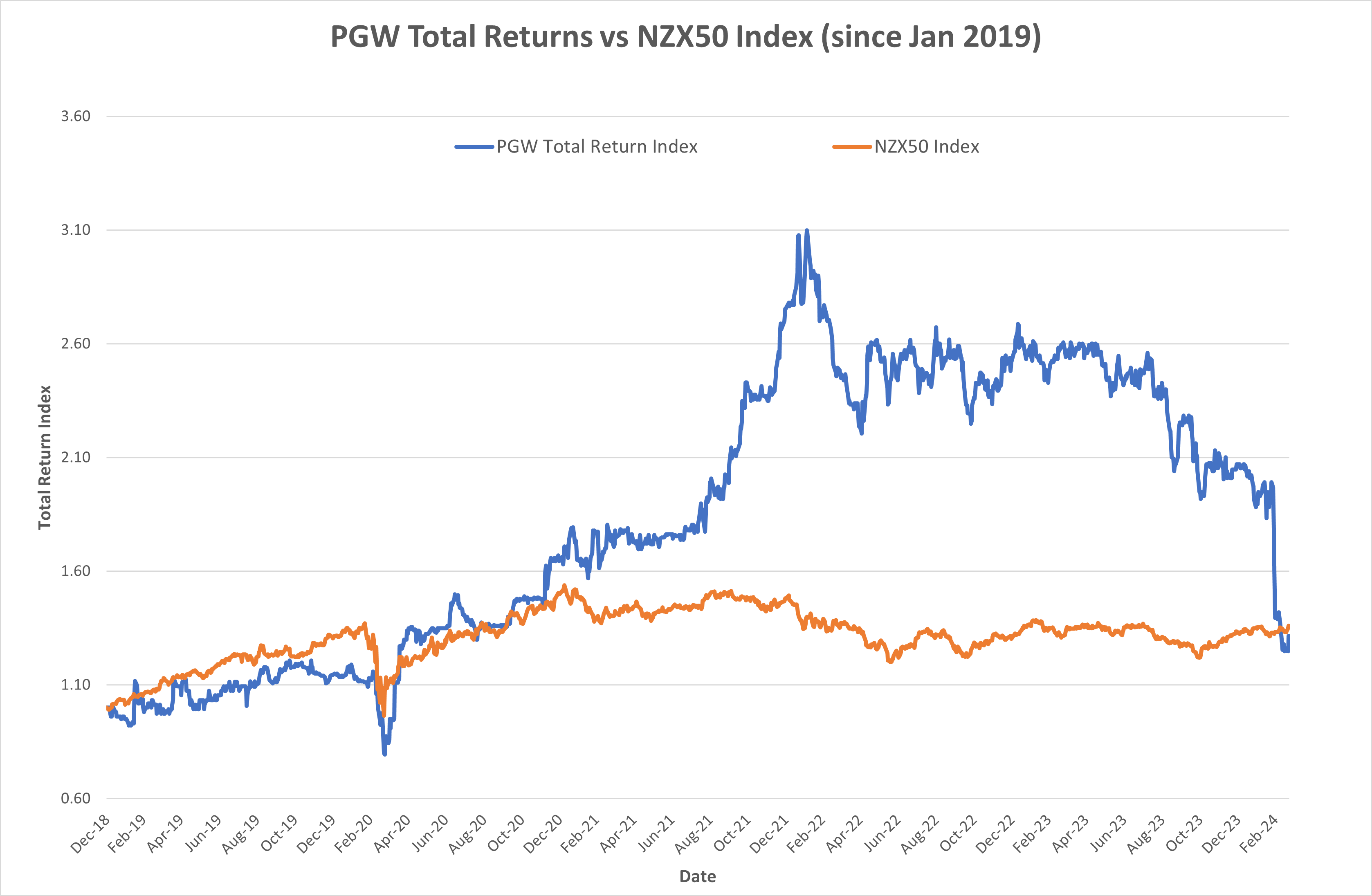

An attempt in mid-March to paint PGW’s share price and profitability performance as unacceptable did not seem to be well received, with the graph below perhaps offering some insight as to why this argument was given scant attention.

Note that the significant decrease during February reflects both a pause in dividend, a decision taken by the re-shuffled Board on February 16th, and the unfolding governance drama. NZSA notes that the company has essentially taken on debt to pay past dividends, and therefore welcomes the Board’s decision to consider a more sustainable dividend policy.

Lessons

There is plenty to take away from the situation so far.

For example, it is still not clear is why the directors nominated by Agria (Wilson Liu, Vena Crawley and Traci Haupapa) allowed themselves to be nominated in the first place. We note the comments made by PGW’s (new, independent) Chair, Garry Moore, in an NBR article of March 22nd that he thinks Agria received poor advice that influenced both the actions of Alan Lai and the nominee directors – but that in itself opens up more questions about exactly how Agria’s call for director nominations was made and the judgement of nominees in supporting an unwelcome boardroom coup.

There’s a clear learning for potential directors in how they respond to any approach to be nominated as a director. At the least, perhaps a degree of due diligence and an honest skills self-assessment, when compared with the skills needed by the company, might be a good place to start before accepting nominations.

For Boards, NZSA has nothing but praise by the stand taken by the independent directors of PGW – Garry Moore, Sarah Brown and Charlotte Severne. While we might be on the cusp of determining our Beacon Award winner for 2023, our award for 2024 might look like a foregone conclusion at this early stage of the year (on the other hand, there is still 9 months and 8 days to go in what is already a crazy year, so who knows what’s next).

It is often too easy for directors to hide behind platitudes, a pattern typically bemoaned by small shareholders.

Perhaps there is an argument for a ‘time and a place’, but having the courage of conviction and the integrity to stand up for what you believe in – and put your name to it – ultimately helps any individual live with themselves. It’s already too easy in our social-media driven world to hide behind a veil of anonymity, while stoking the 21st-century equivalent of a witch hunt.

When it comes to PGW, this was indeed the right time and place for the independent directors to stand up and be counted.

NZX and Market Precedent

When it comes to the NZX, we also think the actions at PGW are a perfectly-timed example of why NZSA is advocating so strongly for a minority interests regime. We set out our position in our note to PGW shareholders – we’ve also now added that (short) commentary to our website at this link.

A third of all companies listed on the NZX have a shareholder that would be deemed as a “controlling shareholder” under the NZSA proposal. We believe this is a high proportion compared to other capital markets around the world. Many of the issues studied by NZSA over the past year have involved the impacts that can be wielded by a major shareholder – and it’s a common theme through many of our ongoing company assessments.

The NZX will shortly release a second round of consultation relating to director independence settings, following consultation in mid-2023. This is unlikely to include any consideration of a minority interests voting regime. In short, we implore the NZX to re-consider this approach – PGW forms the latest strong example of the potential impacts on investor confidence in affected issuers if left unchecked.

Notably, we do not believe a minority interests provision in the Listing Rules will have any impact on compliance costs for issuers – it is simply a process or ‘structure’ that does not lead to any increased costs.

There are already elements of the rules, codes and guidance that reflect (positive) variances to other exchanges – because it makes sense in a New Zealand context. As an example, late last year the NZX published a guidance note, complete with template, on CEO Remuneration Reporting. Its sets a different standard, both in scope and voting, as compared with the ASX – but is fit-for-purpose for New Zealand given the smaller scale of our issuers and the differences in the thresholds required to add resolutions to a company meeting (disclaimer – NZSA played some role its development).

The situation begun by Agria in relation to PGW has the potential to set an unwanted precedent for many other companies on the NZX. In this context, we consider it to be no shame that the NZX has the ability to set some precedent for itself.

Perhaps what has transpired at PGW may also give the investment advisers at our biggest law firms and investment banks pause for thought as well. Certainly, had a minority interests voting regime been in place, the Agria proposal is unlikely to have received the light of day.

What’s next for PGG Wrightson?

The proposals raised by Agria have undoubtedly acted as a distraction for the PGW Board during 2024.

First, the company is in the midst of an agri-sector downturn, driven by drought, interest rates and economic recession – that would be plenty to contend with on its own without the various goings on amongst its governors. The company will no doubt look to focus on managing through the current phase of the economic cycle competently – a priority that will be welcomed by shareholders.

Second, though, judging by comments made by Moore to NBR, it looks like there is scope for at least one more Board member to replace an existing director.

“Moore said the Institute of Directors had determined that director Meng Foon, who had consistently voted with Agria although nominally an independent director, was neither independent nor competent.”

NBR, March 22nd 2024

Moore has clearly enjoyed his recent dose of plain-speaking in relation to the Agria proposal.

Third, NZSA does not believe this is the end of the saga. Alan Lai’s re-kindling of interest in PGW will not have gone un-noticed by the regulators populating various offices along The Terrace. We will continue to observe any specific response with interest.

And last – NZSA is unlikely to give up on its call for minority interests voting, whether applied across the NZX or in the specific resolutions we prepared for any Special Meeting at PGW. The situation at PGW has bolstered the case – and has perhaps created sudden awareness of its benefits in the minds of the current independent directors and shareholders.

Oliver Mander

NZSA would also like to thank the many, many shareholders who gave their support to NZSA over the last fortnight – and to the good people at Computershare who had to deal with the influx of requests! We will ensure that we use your support wisely.

4 Responses

Top marks. To be honest I wasn’t sure that you would have any impact. Much as I admire many things about the Chinese, I have also noticed that when needs must, they can be very patient and play a long game, so this may not be over yet, but rather a temporary retreat before they regroup, and come back with another tactic. For instance, can they increase their shareholding & make a takeover offer?

Thanks Patricia. As we noted, we do not believe this is the end of the saga. All we can do is keep a watchful eye and continue to put pressure on the wider market to ensure this not become a precedent.

Congratulations NZSA! I could not believe the actions by Alan Lai! I thought he had been kicked out of the company – leaving it as only a shell, which struggled on. I’m sure there are others like me: small shareholders, interested in developing NZ equity within the NZX and brassed off with one-man-band tactics. NZSA, you have done a great job especially for small shareholders like me.

Thank you NZSA ! I have been alarmed at the direction PGW was going as its place in the pastoral scene of NZ should not be at the whim of an un-balanced Board Well done!