NZSA Disclaimer

Many shareholders and investors will have observed the events at Rakon over the last week, starting with the company’s announcement and notice of meeting issued on August 4th. The announcement noted that the election of three independent directors would not be supported by major shareholder Brent Robinson, his related family interests (19.67%) nor Siward Crystal Technologies (12.19%). In separate statements, Robinson is also supported by a further major shareholder, Mike Daniel (6.9%).

Late in the week, NZ Shareholders’ Association (NZSA) put three additional resolutions to be tabled at the company’s Annual Shareholder Meeting coming up on August 22nd. This includes resolutions for the Board to consider the constitutional amendments required to support a minority investors voting regime at Rakon and also calling for the removal of Brent Robinson as a Director.

These are not steps taken lightly by NZSA, particularly given the long association of the Robinson family with Rakon. Our proposal to Rakon’s shareholders reflects the importance NZSA places on independent governance that benefits all shareholders – but also highlights our desire to encourage a constructive conversation around the around the governance and leadership culture required to support more effective collaboration between major shareholders and minority holders in listed companies.

Ultimately, we want to encourage debate as to what good governance looks like at Rakon, and ensure effective representation for individual investors in Rakon into the long term.

Your vote matters.

NZSA encourages all shareholders to vote.

If you can’t vote at the meeting, please complete this form and email to Rakon’s share registrar, Computershare at corporateactions@computershare.co.nz – this will allow NZSA to vote on your behalf.

Context and Performance

NZSA has set out four key reasons for including these resolutions within the Rakon annual shareholder meeting. This includes the preservation of long-term governance independence at Rakon, the strong set of capabilities demonstrated by Rakon’s current independent directors, and the lack of rationale for any change from a corporate performance perspective.

We also noted the lack of return for shareholders during Brent Robinson’s long tenure.

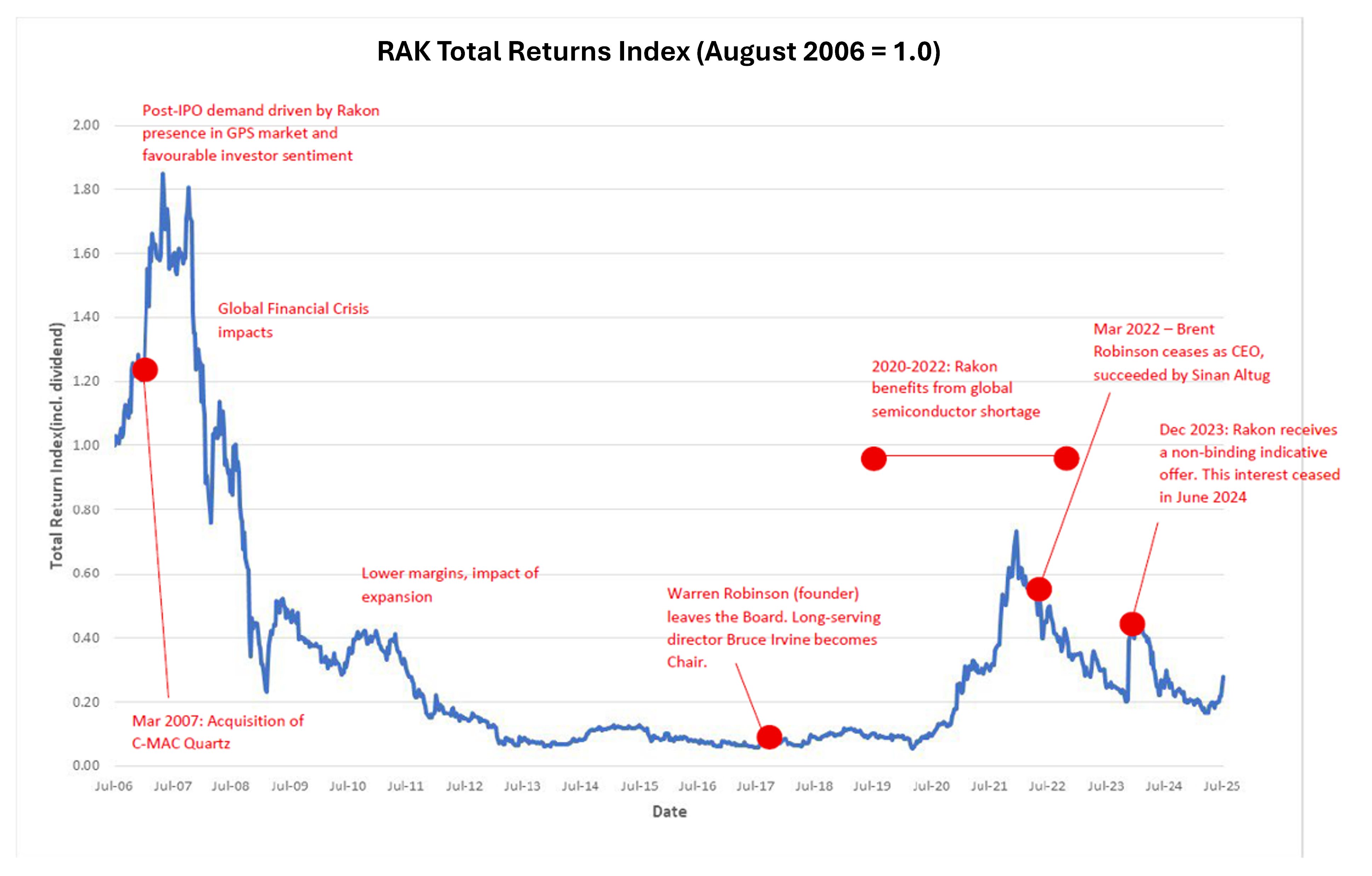

When departing the CEO role in March 2022, Rakon’s share price was already reducing from a recent peak. A $10,000 investment at the time of Rakon’s IPO was worth approximately $5,500 at the time of his departure, but as low as $600 for much of the previous decade.

Between March 2012 – December 2020, the Rakon share price was below $0.50, reaching depths between $0.20-$0.30 during that period. It then rose to a peak in January 2022 (approx. $2.20) as the company benefitted from market conditions associated with a global shortage of semi-conductors. At the time of Brent’s resignation in March 2022, the shares were trending down again, trading at approx. $1.70. This trend continued until December 2023 ($0.60), when the company announced the receipt of a non-binding indicative offer (NBIO). This saw a sharp increase in the share price to $1.30, reversed in mid-2024 as the NBIO did not proceed.

The shares are currently trading between $0.70-$0.80, with a cautiously positive outlook for further improvement.

As shown in the graph above, NZSA contends that the company has benefitted strongly from independent governance and its first ‘non-family’ CEO, in place since March 2022.

Minority Interests Voting Regime

Unsurprisingly, there has been a significant reaction to the NZSA proposals.

Robinson has framed the proposed minority voting regime as curtailing shareholder influence in this NBR article. Regardless of the headline, the impact is the opposite. The NZSA proposal encourages a level playing field when it comes to the election of independent directors, giving a voice to Rakon’s 4,300 minority shareholders to balance the power wielded by the three shareholder groups holding approximately 39% of Rakon shares.

NZX has plenty of companies that are dominated by a single shareholder. Most have respect for the many individual, minority shareholders that make up the balance of their share registers. We believe that minority shareholder provisions will ultimately lend credibility to all Board members, whether independent or non-independent, and encourage greater collaboration in Board composition between major shareholders, their Board representatives and independent directors.

NZSA does not have a mortgage on a potential solution – if there are other ideas out there, let’s hear them. In the case of Rakon, let the Rakon Board debate them and put a recommendation to shareholders. We’ll be listening.

Governor? Or Executive?

Yesterday, NZ Shareholders’ Association became aware of a letter written by Robinson. You can read the letter in this Business Desk article.

In carrying out his activism as a major shareholder Robinson’s letter and other public statements also reveal a conflation of two key, yet distinct, roles: executive and governor.

His passion for Rakon’s business is worthy of praise, reflecting the unique relationship that many founding family directors have with the company their forebears started. However, some statements blur governance/executive boundaries, cutting across the accountability of Rakon’s existing management team, including CEO Sinan Altug. At the very least, this risks undermining the CEO’s authority and could contribute to the risk of Altug leaving the company.

More fundamentally, however, NZSA observes commentary made by Kirsten Patterson, Institute of Directors CEO, in this BusinessDesk article related to the events at Rakon. Noting Robinson’s earlier statement that “I do feel that the priorities from the board have been too heavily biased towards the governance of the company rather than the business objectives of driving growth“, Patterson observed that:

It’s a revealing comment. And one that suggests the very idea of governance is being misunderstood – even by those seeking to lead.

There’s plenty of conversation around the role of governance and their relationship to shareholders. NZSA has long railed against “box ticking” when it comes to governance practices; our own assessments of NZX listed companies reflect a balance of best practice, situational context and strategic priorities. We believe, as shoud all investors, in the value of companies taking on appropriate risk to deliver returns for their shareholders. Governance structures support the development of risk-balanced strategies, seek assurance and provide coaching in execution and hold management to account in their delivery

None of that is “procedural” or compliance-focused. It is enabling, value-adding and long-term in nature.

In Rakon’s case, we see no evidence that the current independent directors are doing anything to compromise those strong governance outcomes.

Board Composition

Robinson himself notes that “the composition of a board is perhaps the most significant factor in the success or failure of a company.” NZSA could not agree more. This is precisely why we are concerned about the loss of governance capability at Rakon. Three independent directors have already departed in recent months while Lorraine Witten, the current Chair, will step down at the shareholder meeting and a further three recently appointed independent and highly capable directors may be removed – all within a 12-month period.

In Oscar Wilde’s The Importance of Being Earnest, Lady Bracknell states that “To lose one parent, Mr. Worthing, may be regarded as a misfortune; to lose both looks like carelessness.” I’m sure corporate governance was not top of Wilde’s mind in creating this script, but there is strong allegory to the objective observation that can be made by minority shareholders on the potential loss of seven independent directors within 12 months. In Wilde’s language, that perhaps speaks less to misfortune or even carelessness, but to intent.

The proposals made by NZSA are not “procedural games” that distract from effective strategy execution. Rather, the actions we are taking are a direct reaction to the lack of support shown by three major Rakon shareholders for the value of great governance, independence and diversity of thought.

Regardless of outcome, we wish all Rakon directors, shareholders and staff well. We all want the best for this company.

Oliver Mander

UPDATED: 7 hours after this article was published, independent Directors Jon Raby and Dr. Lisbeth Jacobs announced they were withdrawing their nominations as Rakon directors at the upcoming shareholder meeting. While disappointed, we see this as further evidence supporting the NZSA position, as outlined in this article. We remain concerned as to the status and nature of the governance culture at Rakon and the conditions under which independence is tolerated.