If you’re not yet a member, join now for access to a whole lot more!

5 December 2025

Napier Port Holdings Limited (NPH)

The company will hold its Annual Shareholders Meeting at 10.30am Wednesday 17 December 2025.

The location is Napier War Memorial Centre, 48 Marine Parade, Napier.

You can also join the meeting online at this link.

Company Overview

The company operates the country’s fourth largest port by container volume. The key metrics for the year were:

- 248 charter vessel calls (up 5.1%)

- 3.4 million tonnes bulk cargo (down 1.7%)

- 264 container vessel calls (up 7.3%)

- 2.7 million tonnes log exports (down 5.8%)

- 250,000 TEU container volumes (up 9.1%)

- 34,300 TEU handled through Port Pack (down 14.38%)

- 78 cruise ship calls (down 12.4%).

The Hawke’s Bay Regional Investment Company Limited (HBRIC) holds 55% of the shares. They do not appoint any Directors to the Board but do vote on all Directors.

Stephen Moir will retire from the Board at the ASM. Hamish Stevens was appointed to the Board 12 August 2025.

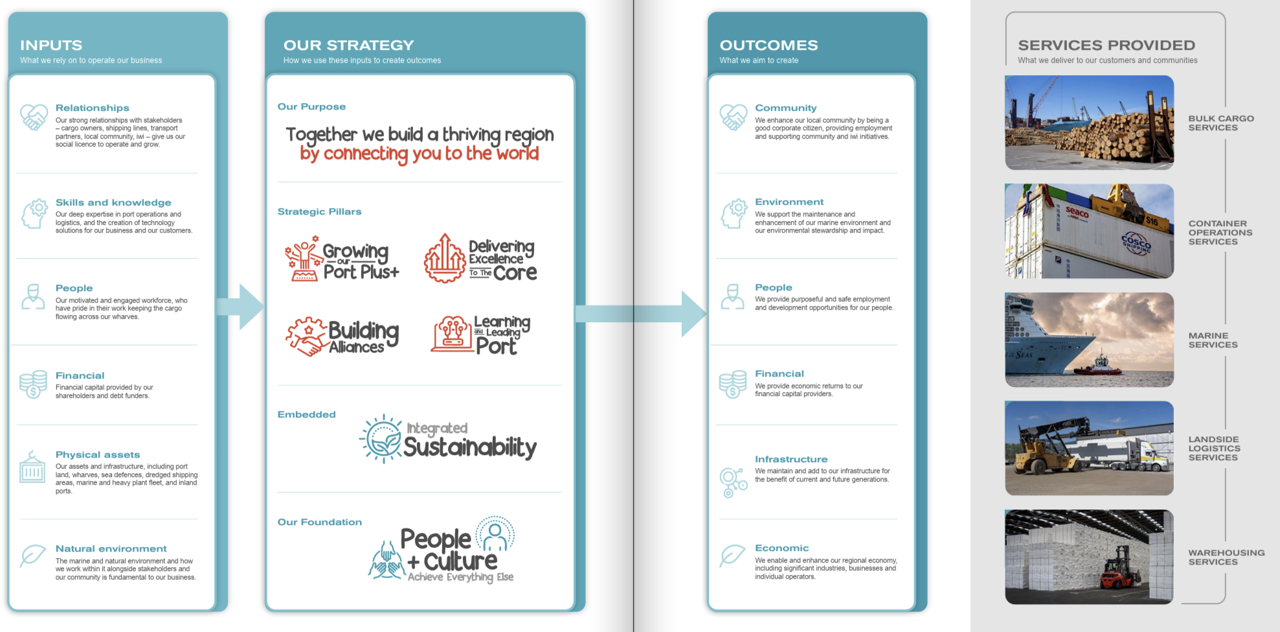

Current Strategy

The company offers a thorough disclosure of its strategy and its affinity with the Hawkes Bay region, with a core purpose of building a thriving region by “connecting you to the world”. Core strategic initiatives are based on

- Growing our port

- Delivering excellence in operations

- Building Alliances

- Learning and leading

Previous Year Shareholder Meeting

NZSA recorded the following key items at last year’s annual shareholder meeting:

- Good result for the year despite the challenges of Cyclone Gabrielle recovery and that cargo volumes were continuing to get back on track.

- The company had entered into a JV with Port Otago to own and operate a new dredge vessel.

- The company guided that its underlying result from operating activities would be within the range $55-59m and that the company was in a strong position to grow dividends.

The meeting report is available at this link.

Disclaimer

To the maximum extent permitted by law, New Zealand Shareholders Association Inc. (NZSA) will not be liable, whether in tort (including negligence) or otherwise, to you or any other person in relation to this document, including any error in it.

Forward looking statements are inherently fallible.

Information on www.nzshareholders.co.nz and in this document may contain forward-looking statements and projections. For any number of reasons, the future could be different – potentially materially different. For example, assumptions may be wrong, risks may crystallise, unexpected things may happen. We give no warranty or representation as to any future financial performance or any other future matter. We may not update our website and related materials for changes.

There is no offer or financial advice in our documents/website.

Information included on www.nzshareholders.co.nz and in this document is for information purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any person’s individual circumstances or objectives. Prior to making any investment decision, NZSA recommends that you seek professional advice from a licensed financial advice provider.

There are no representations as to accuracy or completeness.

The information, calculations and any opinions on www.nzshareholders.co.nz and in this document are based upon sources believed reliable. The NZSA, its officers and directors make no representations as to their accuracy or completeness. All opinions reflect our judgement on the date of communication and are subject to change without notice.

Please observe any applicable legal restrictions on distribution

Distribution of our documents and materials on www.nzshareholders.co.nz (including electronically) may be restricted by law. You should observe all such restrictions which may apply in your jurisdiction.

Key

The following sections calculate an objective rating against criteria contained within NZSA policies.

|

Colour |

Meaning |

|

G |

Strong adherence to NZSA policies |

|

A |

Part adherence or a lack of disclosure as to adherence with NZSA policies |

|

R |

A clear gap in expectations compared with NZSA policies |

|

n/a |

Not applicable for the company |

Governance

NZSA assessment against its key policy criteria are summarised below.

|

A |

Directors Fees: The Remuneration Policy on the company’s website provides for special exertion payments to Directors. It is not clear whether these are included in the Director Fee Pool or if any payments were made in FY25. We would suggest the Annual Report includes a table that more clearly defines payments to Directors.

|

G |

Director Share Ownership: Directors are not required to own shares.

|

A |

CEO Remuneration: The company discloses its remuneration policy on its website, which includes an overview of the remuneration philosophy applicable to the company. The People and Remuneration Committee are responsible for implementing the policy.

Incentives: The CEO is paid a short-term incentive (STI) in cash and a long-term incentive (LTI) by way of Performance Share Rights.

NZSA encourages fulsome disclosure in relation to any incentive payments made to the CEO, including disclosure of measures (or measure ‘groups’), weightings, targets, and the level of achievement versus target for each component associated with any awards. This methodology is supported by the NZX Remuneration Reporting Template.

The STI maximum is 30% of base salary. We are pleased to note following our comments last year, the measures and weightings are now disclosed – however the achievement against each measure is not disclosed. The overall achievement for FY25 was 96% of the maximum.

The relationship of the share rights awarded is disclosed as 30% of base remuneration, although this is contained deep within a footnote to the CEO Remuneration table. The disclosure of quantum of LTI relates to the year paid/vested. There is no disclosure of outstanding share rights or the relationship of LTI award to base salary.

NZSA expects clearer disclosure to avoid ‘conflation’ between these two concepts. The NZX Remuneration Reporting Template provides templates for tables that help to remove confusion in the relationship between LTI awards and vesting.

Vesting is over a three-year assessment period, based on total shareholder returns (TSR) – a method favoured by NZSA. NZAS prefers a weighting towards LTI to align with the long-term interests of shareholders.

The company does not disclose the gender pay gap and CEO/employee remuneration ratio.

Golden Parachutes: The Annual Report includes the following clear statement. “The Company’s employment agreement with the CEO provides for a standard termination notice period of 6 months to be given by either party, and includes specific provisions related to redundancy consisting of 6 months base salary compensation, and relating to mutually agreed termination without notice in certain circumstances that provides for a payment of 9 months base salary.”

|

G |

Director Independence: A majority of Directors are independent.

|

G |

Board Composition: The Annual Report includes a collective skills matrix – however we would prefer that it attributes skill sets to individual Directors to demonstrate how they contribute to the governance of the company.

While the company does not participate in the Future Directors Programme, discussions with the company have revealed that Napier Port Holdings runs their own Board Observer programme. NZSA supports the initiative as part of NZX50 companies developing the next generation to sustain effective governance. While we appreciate that the company does not wish to ‘showboat’ unnecessarily, we believe that some disclosure would provide evidence of the company’s commitment to ongoing governance sustainability.

|

G |

Director Tenure: NZSA looks for evidence of ongoing succession or ‘staggered’ appointment dates that reduce the risks associated with effective knowledge transfer in the event of succession. We also prefer a term maximum of 9-12 years, unless there are exceptional circumstances that may apply.

Director appointment dates range from 2019 to 2025. We note three of the seven Directors were appointed in 2019 when the company listed on NZX however it appears there are succession plans in place to ensure an orderly rotation without the loss of institutional knowledge.

|

G |

ASM Format: Napier Port Holdings Limited is holding a ‘hybrid’ meeting, (i.e., physical, and virtual), a format preferred by NZSA as a way of promoting shareholder engagement while maximising participation.

|

G |

Independent Advice for the Board & Risk Management: NZSA looks for evidence, through disclosures, that a Board has access to appropriate internal and external expertise to support board assurance activities. The Board Charter discloses that Directors can seek internal and independent external advice and that they have access to executive officers. It is less clear as to the extent to which internal assurance staff have unfettered access to the Board – although we note that Board approves the internal audit plan undertaken by an external firm.

The company offers excellent disclosure of all risks (strategic, environmental, financial, and business), and their mitigations. There is good disclosure relating to the processes by which these are governed and managed. Unsurprisingly, the company has a strong focus on health and safety risk management. We note the company publishes a separate Climate Change Related Disclosure Report.

Audit

NZSA assessment against its key policy criteria are summarised below.

|

G |

Audit Independence: Good disclosure.

|

A |

Audit Rotation: The company ensures the Lead Audit Partner is rotated at 5 years as required by the NZX Listing Rules. Notwithstanding audit tenure, NZSA also expects disclosure of the appointment dates of the Lead Audit Partner and Audit Firm to improve transparency for investors.

NZSA notes that under the Public Audit Act 2001, the Auditor-General is the auditor and therefore makes the decision on auditor appointments and audit rotation for Napier Port.

Environmental Sustainability

|

G |

Overall approach: Napier Port Holdings (NPH) has issued a full climate-related disclosure report in alignment with the Aotearoa New Zealand Climate Standards, without relying on adoption provisions. While Napier Port’s climate reporting is well developed, references to broader environmental sustainability frameworks are minimal in the 2025 disclosures.

|

G |

Sustainability Governance: Governance around climate matters appears strong. The board maintains a director skills matrix that includes “sustainability” as a discrete competency, though it also highlights that further capability development may be warranted. The Health, Safety and Sustainability Committee (HSSC), composed of all directors, met at least three times in 2025 and oversees ESG strategy and the Climate Change Risk Assessment (CCRA). Responsibility for delivering the sustainability strategy sits at the senior management level, with clear lines of reporting to the board.

|

G |

Strategy and Impact: Sustainability remains one of Napier Port’s four strategic pillars. The company describes it as essential to building resilience and enabling long-term value creation. Napier has undertaken a full scenario analysis using three climate scenarios. However, while the company articulates its transition ambition (net zero by 2050), a dedicated climate adaptation roadmap with time-bound milestones has not yet been disclosed, although some supporting capital investment activity is evident. NZSA notes that although the port has refreshed its overarching strategy to 2035, the climate component still lacks actionable, interim goals.

|

G |

Risk and Opportunity: The CCRA process identifies and quantifies a broad set of physical and transition risks. The value chain assessment includes upstream exposures such as regional growers and transport corridors. Opportunities are disclosed but with less specificity than risks. For example, potential benefits from electrification and modal shift are discussed, but not modelled or financially scoped.

|

G |

Metrics and Targets: Napier Port continues to disclose Scope 1, 2, and 3 greenhouse gas emissions with a five-year comparative history. In 2025, total emissions increased due to expanded Scope 3 coverage. While operational emissions intensity improved in some areas, the company has yet to adopt short- or medium-term science-aligned reduction targets. The company states that it is not yet in a position to set short- or medium-term emissions reduction targets and will consider doing so once internal planning documents and decarbonisation pathways are further developed. NZSA encourages the company to adopt interim reduction targets to support accountability and clarity of progress.

|

G |

Assurance: Napier Port’s greenhouse gas emissions (Scopes 1–3) were subject to limited assurance by EY. This step provides increased confidence in emissions data. However, assurance did not extend to the broader climate-related narrative disclosures. NZSA recommends that Napier consider a phased expansion of the assurance scope to include non-emissions climate disclosures, particularly those that underpin financial or strategic claims.

Ethical and Social

NZSA assessment against its key policy criteria are summarised below.

|

G |

Whistleblowing: Good disclosure.

|

A |

Political Donations: The Annual Report discloses that NPH subsidiaries made donations in FY25. NZSA expects an explicit disclosure around whether political donations are made.

Financial & Performance

|

Policy Theme |

Assessment |

|

Capital Management |

G |

|

Takeover or Scheme |

n/a |

Napier Port’s share price rose from $2.32 to $3.31 (as of 22nd October 2025) over the last 12 months – a 43% increase. This compares favourably with the NZX 50 which rose 4% in the same period. The capitalisation of NPH is $662m placing it 43rd out of 115 companies on the NZX by size and makes it a large company.

|

Metric |

2021 |

2022 |

2023 |

2024 |

2025 |

Change |

|

Revenue |

$109.5m |

$114.5m |

$118.4m |

$141.4m |

$157.7m |

12% |

|

EBITDA |

$43.8m |

$40.1m |

$37.2m |

$52.0m |

$64.2m |

23% |

|

NPAT |

$23.2m |

$20.4m |

$16.6m |

$24.8m |

$30.9m |

24% |

|

EPS1 |

$0.116 |

$0.102 |

$0.083 |

$0.124 |

$0.154 |

24% |

|

PE Ratio |

26 |

28 |

26 |

21 |

21 |

|

|

Capitalisation |

$612m |

$572m |

$430m |

$510m |

$662m |

30% |

|

Current Ratio |

0.66 |

1.43 |

1.49 |

1.16 |

1.10 |

-5% |

|

Debt Equity |

0.35 |

0.44 |

0.43 |

0.38 |

0.39 |

3% |

|

Operating CF |

$34.8m |

$33.0m |

$37.2m |

$53.9m |

$63.6m |

18% |

|

NTA Per Share1 |

$1.77 |

$1.95 |

$1.98 |

$2.09 |

$2.13 |

2% |

|

Dividend1 |

$0.075 |

$0.075 |

$0.0525 |

$0.09 |

$0.145 |

61% |

1 per share figures based off actual shares at balance date (not weighted average)

Revenues keep increasing year on year, and this trend continued in 2025 with NPAT also increasing substantially.

Revenue rose 12% to $157.7m, and although operating expenses were up, these were well contained with an EBITDA of $64.2m reported. NPH increased NPAT by 24% to $30.9m. This delivered EPS of $0.154 and places NPH on a still high PE ratio of 21.

Operating cashflows were strong at $63.6m, and NTA per share rose to $2.13. NPH trades at a 55% premium to its NTA.

The company is in sound financial position, with the current ratio at 1.10. The debt equity ratio was static at 0.39. This is low and there is headroom should they require funds to expand.

On the back of this impressive result, the company increased their dividend to $0.145 including a special dividend. This is the highest since we started following this company. Dividends are fully imputed.

Page 23 of an investor presentation provided some mainly non-quantifiable forward-looking statements but the company also provided “guidance for FY2026 underlying result from operating activities of between $70m and $74m”.

The controlling shareholder, with a 55% holding is the Hawke’s Bay Regional Investment Company Limited (wholly owned by the Hawkes Bay Regional Council). Minority shareholders will have no say in the governance of the company.

Resolutions

1. To elect Hamish Stevens as an Independent Director.

Hamish Stevens was appointed to the Board in August 2025 and is therefore required to offer himself for election. He is currently Chair of Pharmaco Ltd, Embark Early Education Ltd, and East Health Services Ltd. He is Director and Chair of the Audit Committee at Counties Energy Ltd, and Director and Chair of the Audit and Risk Committee at Radius Residential Care Ltd.

He has previously held governance roles at Marsden Maritime Holdings Ltd (Chair of Audit and Risk Committee), Pacific Radiology Group Ltd (Chair of Audit and Risk Committee), Restaurant Brands Ltd (Chair of Audit and Risk Committee), Waikato Regional Council Audit and Risk Committee (Independent Chair), AsureQuality Ltd (Chair of Audit and Risk Committee), DTS Food Assurance Ltd (Chair), and Smart Environmental Ltd (Chair of Audit Committee). Hamish is a qualified accountant and a chartered fellow of the Institute of Directors.

We will vote undirected proxies IN FAVOUR of this resolution.

2. To re-elect Kylie Clegg as an Independent Director.

Kylie Clegg was appointed to the Board in August 2022. She is a professional director with governance experience across industries including transport, infrastructure, health, and sport. Kylie has recently finished as Deputy Commissioner of Health New Zealand | Te Whatu Ora. Previous roles include Auckland Transport, Waitematā District Health Board (Deputy Chair) and Counties Manukau District Health Board involving governance across complex organisations with large capital infrastructure programmes. Her experience is further complemented by governance roles with Sport New Zealand, High Performance Sport New Zealand, Halberg Foundation and New Zealand Olympic Committee. Prior to her governance career, Kylie was a corporate lawyer specialising in mergers and acquisitions, IPOs, and securities law with experience in the manufacturing, forestry, banking, and investment sectors. Kylie is a member of the Institute of Directors and brings leadership skills developed as captain of the New Zealand Black Sticks hockey team at the Sydney 2000 Olympics

We will vote undirected proxies IN FAVOUR of this resolution.

3. To re-elect Dan Druzianic as a Non-Independent Director.

Dan Druzianic was appointed to the Board in August 2022. He is a chartered accountant, business advisor and professional director with broad experience across business sectors including agribusiness, health, infrastructure, property, and investment. He holds a Commerce degree from Lincoln University, is a Fellow of the Institute of Chartered Accountants of Australia and New Zealand and is a member of the New Zealand Institute of Directors. Dan resides in Hawke’s Bay and has recently finished as Chair of the Hawke’s Bay Regional Investment Company Limited. He also sits on the Board of the Unison Group and Bostock New Zealand Limited.

We will vote undirected proxies IN FAVOUR of this resolution.

4. That the Board is authorised to fix the auditor’s remuneration for the coming year.

This is an administrative resolution.

We will vote undirected proxies IN FAVOUR of this resolution.

Proxies

You can vote online or appoint a proxy at https://nz.investorcentre.mpms.mufg.com/voting/NPH

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 10.30am Monday 15 December 2025.

Please note you can appoint the Association as your proxy. We will have a representative attending the meeting.

The Team at NZSA