If you’re not yet a member, join now for access to a whole lot more!

8 November 2025

Sky Television Limited (SKT)

The company will hold its Annual Shareholders Meeting at 10.30am Friday 21 November 2025.

The location is The Maritime Room, Princes Wharf, Auckland.

You can also join the meeting online at this link.

Company Overview

Sky’s primary activity is to operate as a creator and distributor of media content services. It also offers broadband services. The company was founded 35 years ago.

Sky TV connects New Zealanders with sport and entertainment content across a range of product options. It offers over 70 satellite channels, 12 dedicated sports channels and streams and 40 Sky Go channels streaming online 24/7.

In August 2025 it completed the acquisition of Discovery TV for $1 cash free and debt free. During the year it has secured coverage of the Summer and Winter Olympic Games to 2032 and extended its local and international rugby coverage out to the early 2030’s.

A resolution to approve the Rugby Rights Transaction negotiated with NZ Rugby and SANZAAR for broadcast rights to rugby content is on the agenda for the ASM.

Current Strategy

The company’s purpose is to Share Stories, Share Possibilities and Share Joy through being “Aotearoa NZ’s most engaging and essential media company.” Sky TV aims to be a “responsible and sustainably profitable, Aotearoa-focused business”. The company structures its outcomes into the following ‘strategic pathways’:

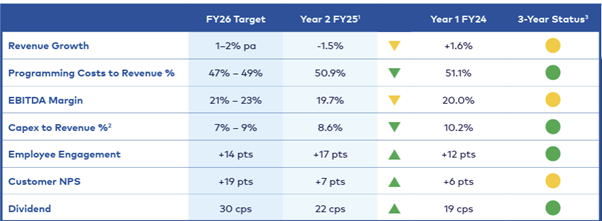

Additionally, from a financial perspective, the company set a range of targets to be achieved by FY26, and provided a ‘report card’ on FY25.

Previous Year Shareholder Meeting

NZSA recorded the following key items at last year’s annual shareholder meeting:

- Strong financial position (net cash of $38m) and strong free cash flow generation ($23.7m, up 43% on FY23).

- Negotiating with NZ Rugby/SANZAAR for a renewal of the next exclusive broadcast rights, noting that the present contract started in Dec 2019 expires in Dec 2025.

- Intends to pay a dividend of at least $0.21 net per share and by FY26 it plans to raise that distribution to $0.30 net per share.

The meeting report is available at this link.

Disclaimer

To the maximum extent permitted by law, New Zealand Shareholders Association Inc. (NZSA) will not be liable, whether in tort (including negligence) or otherwise, to you or any other person in relation to this document, including any error in it.

Forward looking statements are inherently fallible.

Information on www.nzshareholders.co.nz and in this document may contain forward-looking statements and projections. For any number of reasons, the future could be different – potentially materially different. For example, assumptions may be wrong, risks may crystallise, unexpected things may happen. We give no warranty or representation as to any future financial performance or any other future matter. We may not update our website and related materials for changes.

There is no offer or financial advice in our documents/website.

Information included on www.nzshareholders.co.nz and in this document is for information purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any person’s individual circumstances or objectives. Prior to making any investment decision, NZSA recommends that you seek professional advice from a licensed financial advice provider.

There are no representations as to accuracy or completeness.

The information, calculations and any opinions on www.nzshareholders.co.nz and in this document are based upon sources believed reliable. The NZSA, its officers and directors make no representations as to their accuracy or completeness. All opinions reflect our judgement on the date of communication and are subject to change without notice.

Please observe any applicable legal restrictions on distribution

Distribution of our documents and materials on www.nzshareholders.co.nz (including electronically) may be restricted by law. You should observe all such restrictions which may apply in your jurisdiction.

Key

The following sections calculate an objective rating against criteria contained within NZSA policies.

|

Colour |

Meaning |

|

G |

Strong adherence to NZSA policies |

|

A |

Part adherence or a lack of disclosure as to adherence with NZSA policies |

|

R |

A clear gap in expectations compared with NZSA policies |

|

n/a |

Not applicable for the company |

Governance

NZSA assessment against its key policy criteria are summarised below.

|

G |

Directors Fees: In general, good disclosure. There is no disclosure as to whether special exertion benefits are paid to Directors, although we note that no such payments were made in FY25.

|

G |

Director Share Ownership: Directors are not required to own shares a position supported by NZSA.

|

G |

CEO Remuneration: The company discloses its remuneration policy on its website, which includes an overview of the remuneration philosophy applicable to the company. The People and Performance Committee are responsible for implementing the policy.

Incentives: The CEO is paid a short-term incentive (STI) in cash and a long-term incentive (LTI) by way of Performance Rights.

NZSA encourages fulsome disclosure in relation to any incentive payments made to the CEO, including disclosure of measures (or measure ‘groups’), weightings, targets, and the level of achievement versus target for each component associated with any awards. This methodology is supported by the NZX Remuneration Reporting Template.

The STI is awarded at a target of 50% of base salary. The measures, weightings, and level of achievement against each component are well-disclosed, with the overall STI award for FY25 being made at 52% of target.

Performance rights are awarded under the LTI at 50% of base salary. Vesting then occurs after a three-year performance assessment period. Measures determining the level of eventual share vesting are well-disclosed, with an equal apportionment between relative total shareholder return measure (rTSR) and absolute TSR (aTSR).

NZSA prefers a weighting towards the LTI to ensure the CEO is aligned with the interests of long-term shareholders.

The company includes a table showing the amount paid to the CEO. While we expect a clear disclosure showing the amount earned in the reporting period, although we acknowledge these are easily calculated from the available disclosures.

The company discloses the CEO/employee remuneration ratio but not the gender pay gap.

Golden Parachutes: In the interests of transparency, NZSA believes there should be explicit disclosure around the severance terms and notice periods associated with the CEO, including whether specific termination payments are offered.

Sky offers explicit disclosure around the severance terms and notice periods associated with the CEO. The notice period for the CEO is 6 months and redundancy pay are capped at 44 weeks.

|

G |

Director Independence: All Directors are independent.

|

G |

Board Composition: The Annual Report includes a skills matrix that attributes skill sets to individual Directors to describe how they contribute to the governance of the company.

The company does not participate in the IoD’s Future Director programme (or similar) designed to develop and mentor the next generation of Directors. NZSA expect NZX50 companies to participate as part of a responsibility to develop and mentor the next generation of Directors.

The nature of the company’s board indicates a commitment to thought, experiential and social diversity, with relevant experience for Sky.

|

G |

Director Tenure: NZSA looks for evidence of ongoing succession or ‘staggered’ appointment dates that reduce the risks associated with effective knowledge transfer in the event of succession. We also prefer a term maximum of 9-12 years, unless there are exceptional circumstances that may apply.

Directors’ appointment dates range from 2017 to 2023 indicating a commitment to good succession planning.

|

G |

ASM Format: Sky Television Limited is holding a ‘hybrid’ meeting, (i.e., physical, and virtual), a format preferred by NZSA as a way of promoting shareholder engagement while maximising participation.

|

G |

Independent Advice for the Board & Risk Management: NZSA looks for evidence, through disclosures, that a Board has access to appropriate internal and external expertise to support board assurance activities. We also look for evidence that Boards are across their risk management responsibilities.

In both cases there are appropriate disclosures. We note the statement in the Board Charter that “When directors seek clarification regarding information provided to directors, or are seeking information about Sky generally, this can be sought directly from the appropriate senior executive, but the CEO should also be advised.” Directors are also able to seek external advice, at Sky’s expense, with the prior approval of the Chair. The Company Secretary is directly accountable to the Board. Sky’s internal audit function is outsourced to EY, with the Board Audit & Risk Committee retaining accountability for the internal audit plan.

Sky offers clear disclosure as to the principal strategic, business, and financial risks impacting its operations, although there is more limited discussion relating to mitigations. In addition, the company publishes a separate 31-page Climate Related Disclosures Statement.

Audit

NZSA assessment against its key policy criteria are summarised below.

|

G |

Audit Independence: Good disclosure.

|

A |

Audit Rotation: The company ensures the Lead Audit Partner is rotated at 5 years as required by the NZX Listing Rules. There is no disclosure as to the tenure of the current audit firm.

NZSA also expects disclosure of the appointment dates of the Lead Audit Partner and Audit Firm in the Annual Report to improve transparency for investors.

Environmental Sustainability

|

G |

Overall approach: Sky Television’s second Climate-Related Disclosure Report (CRD) shows improvements in governance, strategy, risk assessment, and emissions disclosures. While the company remains cautious and measured, particularly in setting climate targets, it shows improved awareness of its climate-related responsibilities. NZSA advocates for a broad, risk-based understanding of environmental sustainability, and Sky’s disclosure indicates a growing integration of climate factors within its strategic, operational, and risk frameworks.

|

G |

Sustainability Governance: Sky maintains a governance structure, with oversight by the board and its Audit & Risk Committee. Day-to-day climate management is handled by the Sustainability Governance Committee (SGC), chaired by the Chief Corporate Affairs Officer, and the Risk Governance Steering Committee. In the 2025 Annual Report, Sky again discloses a board skills matrix, listing sustainability management as one of the eight assessed attributes, with several directors having primary or secondary competency in this area.

|

G |

Strategy and Impact: In FY25, Sky updated its climate scenario analysis, using external consultants to refresh physical and transition risk modelling. Sky applied Adoption Provision 2, deferring disclosure of anticipated financial impacts while it builds capability and refines analysis. NZSA notes Sky’s operational emphasis on low-emissions initiatives and resilience-building measures, such as upgrades to its satellite infrastructure, technical business continuity systems, and adoption of lower-emissions customer equipment. Sky acknowledges its limited carbon footprint as a media business and is cautious about overcommitting where quantification remains imprecise, particularly in Scope 3.

|

G |

Risk and Opportunity: Sky’s 2025 disclosure provides a detailed inventory of both physical and transitional climate-related risks, as well as identified opportunities. These are contextualised within Sky’s wider Enterprise Risk Management (ERM) framework and tied to specific mitigation measures. Risks such as increased power usage due to more extreme temperatures or operational disruptions from weather events are addressed through targeted mitigations, including infrastructure resilience and planning upgrades. Opportunity identification remains pragmatic, but it also includes strategic supplier partnerships and media-based contributions to broader environmental awareness.

|

G |

Metrics and Targets: Sky reports verified Scope 1 and Scope 2 emissions, along with selected Scope 3 categories, and provides intensity metrics and three years of comparative data. However, the company continues to take a conservative stance on target-setting, citing uncertainties in Scope 3 estimation and a desire to avoid premature commitments.

NZSA also notes that the acquisition of Discovery NZ requires a restatement of base year (2023) emissions, which is likely to result in a change to reduction targets.

No formal reduction targets or adaptation milestones have been published as of FY25. It has also withdrawn from the Toitū CarbonReduce programme due to misalignment with Toitū’s evolving assurance requirements.

|

A |

Assurance: Sky obtained limited assurance from PwC for Scope 1 and 2 emissions only. Scope 3 remains unaudited, in line with the extension to adoption provisions. NZSA encourages expanding the climate-related assurance scope in future cycles.

Ethical and Social

NZSA assessment against its key policy criteria are summarised below.

|

G |

Whistleblowing: Good disclosure.

|

G |

Political Donations: The Annual Report includes an explicit disclosure that no political donations were made.

Financial & Performance

|

Policy Theme |

Assessment |

|

Capital Management |

G |

|

Takeover or Scheme |

n/a |

Sky Television’s share price rose from $2.79 to $3.44 (as of 20th October 2025) over the last 12 months – a 23% increase. This compares favourably with the NZX 50 which rose 4% in the same period. The capitalisation of SKT is $474m placing it 51st out of 115 companies on the NZX by size and makes it a mid-sized company.

|

Metric |

2021 |

2022 |

2023 |

2024 |

2025 |

Change |

|

Revenue |

$724.8m |

$752.9m |

$757.6m |

$767m |

$758m |

-1% |

|

NPAT |

$47.5m |

$62.2m |

$51.0m |

$49.2m |

$20.6m |

-59% |

|

EPS1 |

$0.27 |

$0.36 |

$0.353 |

$0.344 |

$0.147 |

-59% |

|

PE Ratio |

6 |

6 |

7 |

8 |

23 |

|

|

Capitalisation |

$341m |

$376m |

$355m |

$370m |

$474m2 |

28% |

|

Current Ratio |

0.91 |

1.38 |

1.11 |

1.10 |

0.95 |

-14% |

|

Debt Equity |

0.66 |

0.57 |

0.55 |

0.52 |

0.53 |

3% |

|

Operating CF |

$152.4m |

$148.0m |

$129.7m |

$154.9m |

$135.8m |

-12% |

|

NTA Per Share1 |

$0.60 |

$1.14 |

$0.94 |

$1.05 |

$0.95 |

-9% |

|

Equity Per Share1 |

$2.40 |

$2.83 |

$3.18 |

$3.26 |

$3.19 |

-2% |

|

Dividend |

n/a |

$0.073 |

$0.15 |

$0.19 |

$0.22 |

16% |

1 per share figures based off actual shares at balance date (not weighted average)

2 as of October 20th

SKY’s revenues decreased slightly by 1% to $758m, and NPAT was down 59% to $20.2m after some substantial rises in costs, most notably Broadcasting and Infrastructure costs which were up 19% to $104m. NPAT was also affected by accelerated amortisation of content (non-cash) and $2.3m of transaction costs associated with the acquisition of Discovery NZ. EPS of $0.147 were reported.

Cashflows from operations were down 12% to $135.8m, although on a cents per share basis have delivered $0.99 per share. The large disparity between operating cashflows and Net Profit is largely made up of depreciation and amortisation, which came in at $89m.

NTA per share fell to $0.95. Shares trade at a 261% premium to NTA; the SKT balance sheet is dominated by intangible assets with $308m of goodwill and intangibles.

The company is in a sound financial position with a current ratio of 0.95, cash balances of $32m and no long-term debt with a low debt-equity ratio of 0.53.

Dividend payments continue to increase, with dividends of $0.22 paid in FY25. Dividends are fully imputed. The company has a 3-year goal to double dividends from FY23.

A detailed investor presentation was provided and this presentation contains some forward-looking statements; these can be found on page 28. NPAT guidance was not provided “as SKT are no longer guiding on NPAT as it is not considered a meaningful metric for market valuation purposes”.

For FY26 the company expects:

- Revenue between $745m – $770m

- EBITDA between $142m – $162m

- Dividend at least $0.30

ACC are the largest shareholder, with a 10.6% holding in the company. The NZ Superannuation Fund owns a further 7.4%. Shares are otherwise widely held.

Resolutions

1. That the Board is authorised to fix the auditor’s remuneration for the coming year.

This is an administrative resolution.

We will vote undirected proxies IN FAVOUR of this resolution.

2. To re-elect Philip Bowman as an Independent Director.

Philip Bowman was appointed to the Board 1 September 2019 and is the Chair. most recently re-elected by Shareholders on 2 November 2022. He has led several major global companies and served on the board of a significant number of public and private companies. Philip brings knowledge of the media sector, including having served on the board of Sky UK for ten years. Other roles include Group Finance Director of Bass, CEO of Bass Retail, CEO of Allied Domecq, CEO of Scottish Power, CEO of Smiths Group, senior non-executive director of Burberry, Chair of Liberty, Chair of Coral Eurobet, Chair of Miller Group, and non-executive director of Scottish & Newcastle. He currently sits on the boards of two other listed companies, KMD Brands and Ferrovial SE. Philip has a degree with honours in Natural Sciences (University of Cambridge) and Master in Natural Sciences (University of Cambridge).

We will vote undirected proxies IN FAVOUR of this resolution.

3. To re-elect Dame Joan Withers as an Independent Director.

Dame Joan Withers was appointed to the Board 17 September 2019. She has a 25-year career in the media industry, including CEO positions at Fairfax and the Radio Network, as well as being the former Chair of TVNZ. Joan’s depth of governance experience includes her current roles as Chair of The Warehouse Group and as a Director of ANZ Bank New Zealand and Origin Energy. She has previously held Chair positions at Auckland International Airport and Mercury NZ. Joan is a Trustee of the Louise Perkins Foundation and was formerly Chair of a steering committee working to increase the percentage of South Auckland Māori and Pacific Island students taking up roles in the health sector. She holds a Master of Business Administration from the University of Auckland. In 2015, Joan was named Supreme Winner in the Women of Influence Awards and Chairperson of the Year in the Deloitte Top 200 Management Awards. In 2024, Joan was made a Dame Companion of the New Zealand Order of Merit for services to business, governance, and women.

We will vote undirected proxies IN FAVOUR of this resolution.

4. To re-elect Mark Buckman as an Independent Director.

Mark Buckman was appointed to the Board 21 March 2022. He is a business leader based in Australia with a deep background in technology digital innovation, marketing, media and broadcasting, and customer engagement. His executive career has spanned North America, UK/ Europe, and APAC, with roles at Foxtel, Telstra, the Commonwealth Bank of Australia, and McCann. Mark was the Group Managing Director of Telstra Media overseeing the company’s PayTV and digital platforms portfolio and Delegate Director across Telstra’s media investments. Mark is the Managing Partner, Leadership Advisory at Hourigan International and specialises in board and c-suite advisory. Mark is actively involved as an advisor in tech startups and is a past advisor to Tech Central. He is a senior advisor to Accenture and his governance credentials include the boards of OzTAM, the Australian free-to-air television consortium, technology start-ups and social enterprises. Mark has also completed postgraduate studies in Sustainability and Circular Economy at Cambridge, in Artificial Intelligence at MIT and in Cybersecurity at Harvard University.

We will vote undirected proxies IN FAVOUR of this resolution.

Special Resolution.

Resolution 5 is a special resolution, requiring approval by a majority of 75% or more of the votes cast by Shareholders entitled to vote and voting on the resolution.

5. To approve the NZ Rugby Rights Transaction.

Sky and NZ Rugby (on behalf of SANZAAR Rugby Unions) have reached agreement on the terms of a five-year broadcast partnership, commencing January 2026 following expiry of the Current SANZAAR Rights, which agreement is conditional on Sky Shareholder approval and subject to final documentation. Accordingly, Shareholders are now being asked to approve the proposed acquisition by Sky of the New Zealand media rights for certain rugby matches and competitions played in the period from 1 January 2026 up to 31 December 2030 (referred to as the Next Rights Period) that are controlled by the SANZAAR Rugby Unions.

The full details are set out in the Notice of Meeting.

We will vote undirected proxies IN FAVOUR of this resolution.

Proxies

You can vote online or appoint a proxy at https://www.investorvote.com.au/

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 10.30am Wednesday 19 November 2025.

Please note you can appoint the Association as your proxy. We will have a representative attending the meeting.

The Team at NZSA