If you’re not yet a member, join now for access to a whole lot more!

20 October 2025

South Port Limited (SPN)

The company will hold its Annual Shareholders Meeting at 11.00am Wednesday 29 October 2025.

The location is South Port Board Room, Administration Building, Island Harbour, Bluff.

Please note for those attending the meeting, not only will a Driver’s Licence ID be required to be presented at the security gate to gain access onto the South Port Island Harbour, but advance notice of the name/s of people wishing to attend is to be relayed by contacting Sharon Jennings by phone (03) 212 6009 or email sjennings@southport.co.nz. This is a mandatory requirement under the Maritime Security Regulations.

You can also join the meeting online at this link.

Shareholders attending online will not be able to vote online, however they will be able to ask questions virtually during the Annual Shareholders’ Meeting. The meeting will be recorded, and the recording made available at the conclusion of the meeting at www.southport.co.nz.

Company Overview

South Port is the southernmost commercial port in New Zealand, located at Bluff. It has been operating since 1877 with the company formed in 1988 to take over the assets of the former Southland Harbour Board. It listed on the NZX in 1994. In 2016, it established its off-port Intermodal Freight Centre (IFC) located adjacent to the KiwiRail railhead in Invercargill. This allows importers and exporters in the Southland and Otago regions to distribute their products in a timely and efficient manner.

Clare Kearney, who has served on the Board since 2016, will retire at the ASM.

Current Strategy

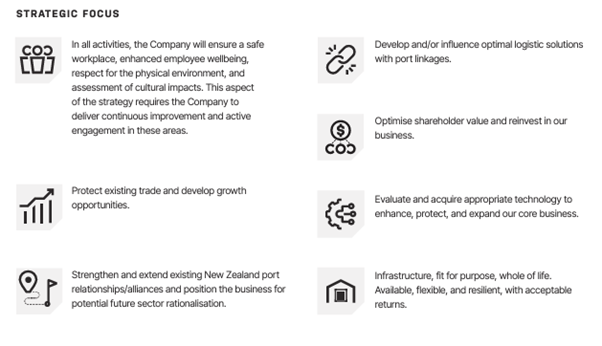

The company’s purpose is “to facilitate the best logistic solutions for the region.” This is supported by seven key themes, as highlighted in the Annual Report:

Disclaimer

To the maximum extent permitted by law, New Zealand Shareholders Association Inc. (NZSA) will not be liable, whether in tort (including negligence) or otherwise, to you or any other person in relation to this document, including any error in it.

Forward looking statements are inherently fallible.

Information on www.nzshareholders.co.nz and in this document may contain forward-looking statements and projections. For any number of reasons, the future could be different – potentially materially different. For example, assumptions may be wrong, risks may crystallise, unexpected things may happen. We give no warranty or representation as to any future financial performance or any other future matter. We may not update our website and related materials for changes.

There is no offer or financial advice in our documents/website.

Information included on www.nzshareholders.co.nz and in this document is for information purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any person’s individual circumstances or objectives. Prior to making any investment decision, NZSA recommends that you seek professional advice from a licensed financial advice provider.

There are no representations as to accuracy or completeness.

The information, calculations and any opinions on www.nzshareholders.co.nz and in this document are based upon sources believed reliable. The NZSA, its officers and directors make no representations as to their accuracy or completeness. All opinions reflect our judgement on the date of communication and are subject to change without notice.

Please observe any applicable legal restrictions on distribution

Distribution of our documents and materials on www.nzshareholders.co.nz (including electronically) may be restricted by law. You should observe all such restrictions which may apply in your jurisdiction.

Key

The following sections calculate an objective rating against criteria contained within NZSA policies.

|

Colour |

Meaning |

|

G |

Strong adherence to NZSA policies |

|

A |

Part adherence or a lack of disclosure as to adherence with NZSA policies |

|

R |

A clear gap in expectations compared with NZSA policies |

|

n/a |

Not applicable for the company |

Governance

NZSA assessment against its key policy criteria are summarised below.

|

G |

Directors Fees: Excellent disclosure.

|

G |

Director Share Ownership: The company offers clear disclosure that “…it is not compulsory for directors to own shares in South Port, they may buy South Port shares and hold them as a long-term investment.” This is in line with NZSA policy: NZSA encourages directors to own shares but does not support compulsion.

|

A |

CEO Remuneration: The company discloses its remuneration policy on its website, which includes an overview of the remuneration philosophy applicable to the company. As of July 2025, the company has established a People and Performance Committee, with remuneration governance falling within its remit.

Incentives: The CEO is paid a short-term incentive (STI) in cash and a long-term incentive (LTI) by way of share performance rights. This is the first year that the CEO has been awarded an LTI.

The STI is set at a dollar maximum, which translates to approximately 16% of base remuneration. The measures, weightings and achievement against each measure are disclosed with the award at 84% of the maximum.

There is no disclosure as to the basis for the award of performance rights associated with the LTI scheme (e.g. percentage of base remuneration), although the number of rights awarded is disclosed. The LTI vests after three years, based on achievement of absolute total shareholder return (TSR), relative TSR and earnings per share. Unfortunately, however, the actual targets are not disclosed.

NZSA encourages the company to adopt disclosure according to the NZX Remuneration Reporting Template. This would clearly set out the relationship of incentive opportunity to base remuneration, show performance against targets and (for future years) remove any ‘conflation’ between when remuneration is earned (or awarded) and when it is actually paid (or vested).

The company does not disclose the gender pay gap or the CEO/employee remuneration ratio.

Golden Parachutes: In the interests of transparency, NZSA believes there should be explicit disclosure around the severance terms and notice periods associated with the CEO, including whether specific termination payments are offered.

The Annual Report states “The Chief Executive is entitled to redundancy compensation if his/her employment is terminated as a result of redundancy, however no retirement benefits, sign-on bonuses or retention payments are offered.” We appreciate this disclosure but encourage the company to consider disclosure of the associated notice periods.

|

G |

Director Independence: A majority of Directors are independent.

|

G |

Board Composition: The Annual Report includes a ‘collective’ skills matrix. We continue to encourage individual disclosure to support assurance of individual skills relating to the governance of the company. Notwithstanding this comment, we note the bias of skills towards infrastructure/capital projects, financial acumen, risk management and health & safety – appropriate as key skills for South Port.

In February 2025, the Board appointed Sam Grant as an Intern Director to gain governance experience. NZSA supports such initiatives and expects NZX Top 50 companies develop and mentor the next generation of Directors. This is particularly relevant in the context of SPN being Southland’s only listed company.

The nature of the company’s board indicates a commitment to thought, experiential and social diversity, with relevant experience for South Port.

|

A |

Director Tenure: NZSA looks for evidence of ongoing succession or ‘staggered’ appointment dates that reduce the risks associated with effective knowledge transfer in the event of succession. We also prefer a term maximum of 9-12 years, unless there are exceptional circumstances that may apply.

We note that the Chair, Philip Cory-Wright was appointed to the Board in 2010, succeeding long-serving Rex Chapman as Chair from 2023. The other Directors were appointed between 2016 and 2023. Last year, we commented that Cory-Wright’s tenure holds some degree of succession risk for shareholders and we encourage the company to continue with a transparent approach to ongoing succession.

|

A |

ASM Format: South Port Limited is holding a physical meeting and a “Teams” meeting that allows shareholders to join the meeting online and ask questions but not vote at the meeting. The expectation of shareholders is that companies will hold a virtual meeting that allows online voting at the meeting. In addition, we refer to the conditions of entry to the physical meeting. In the interests of shareholder relations, we would expect the company to address both issues prior to the 2026 ASM.

|

G |

Independent Advice for the Board & Risk Management: NZSA looks for evidence, through disclosures, that a Board has access to appropriate internal and external expertise to support board assurance activities. We also look for evidence that Boards are across their risk management responsibilities.

The company notes in its Board Charter that Directors are able to access external advice to support or validate decision-making, with the prior approval of the Audit and Risk Committee. It also discloses that the Company Secretary has unfettered access to the Board. The company does not have an internal audit function.

The company provides thorough disclosures in relation to its financial risks and includes a table of business and operation risks and their mitigation in the Annual Report. It has published a separate Climate- Related Disclosure Report.

Audit

NZSA assessment against its key policy criteria are summarised below.

|

G |

Audit Independence: Good disclosure.

|

G |

Audit Rotation: Whilst the company ensures the Lead Audit Partner is rotated at 5 years as required by the NZX Listing Rules, it does not disclose if the Audit Firm is rotated at 10 years.

We note the auditor is appointed by the Office of the Auditor General. We are pleased to note following our comments last year the Annual Report discloses Deloitte were appointed in 2022 and the Lead Audit Partner was appointed in 2025.

Environmental Sustainability

|

G |

Overall approach: South Port has adopted four adoption provisions in FY25 (including Scope 3 assurance). While South Port still applies these adoption provisions, the company shows evidence of gradually building its capability towards full disclosure. The company also reports on broader environmental areas. Waste management is actively monitored, with emissions disclosed from general and non-municipal solid waste, wastewater, and recycling of port plastics. This reflects a structured approach to waste minimisation and resource use. While biodiversity is not a central disclosure theme, references to coastal and marine resilience underscore an awareness of the port’s environmental impact on its regional ecosystem.

|

G |

Sustainability Governance: The board and the Audit and Risk Committee retain oversight of climate-related risks, while management responsibilities are vested in the CEO, CFO, and the Infrastructure and Environmental Manager. Importantly, South Port has established a Sustainability Committee, comprising all members of the Executive Leadership Team, which meets six times a year to oversee climate-related matters. In addition, the board skills matrix explicitly identifies ESG experience as a capability, demonstrating recognition of sustainability expertise at the board level.

|

G |

Strategy and Impact: South Port has prepared a Transition Plan, an Energy Master Plan, and a Sustainability Strategy, all of which are aligned with the UN Sustainable Development Goals. Scenario analysis has been conducted. South Port integrates climate-related considerations into capital planning and highlights alignment of asset lifecycles with long-term climate horizons.

|

G |

Risk and Opportunity: The company provides comprehensive disclosure of both transition and physical risks (such as sea-level rise, storm surge, and energy transition impacts) as well as potential opportunities (including modal shift to coastal shipping and renewable fuels). These are assessed against short-, medium-, and long-term horizons and embedded within the broader corporate risk framework.

|

G |

Metrics and Targets: South Port discloses Scope 1, 2, and selected Scope 3 emissions, with one year of comparative data. However, no quantified reduction targets have yet been set, which remains a gap. The company notes the intention to further develop its decarbonisation approach but has not committed to measurable climate targets.

|

A |

Assurance: Limited assurance has been provided by Deloitte over Scope 1 and Scope 2 emissions. As South Port matures its climate reporting, NZSA encourages the company to extend assurance to cover Scope 3 emissions and the broader suite of environmental claims.

Ethical and Social

NZSA assessment against its key policy criteria are summarised below.

|

G |

Whistleblowing: Good disclosure.

|

A |

Political Donations: Whilst donations are disclosed in the Annual Report there is no disclosure around whether political donations are made. NZSA expects an explicit statement on the matter.

Financial & Performance

|

Policy Theme |

Assessment |

|

Capital Management |

G |

|

Takeover or Scheme |

n/a |

Southport’s share price rose from $5.43 to $7.85 (as of 16th September 2025) over the last 12 months – a 45% increase. This compares favourably with the NZX50 which rose 4% in the same period. The capitalisation of SPN is $206m placing it 64th out of 115 companies on the NZX by size and makes it a mid-sized company.

|

Metric |

2021 |

2022 |

2023 |

2024 |

2025 |

Change |

|

Revenue |

$47.3m |

$48.6m |

$53.6m |

$56.1m |

$63.3m |

13% |

|

Gross Profit |

$18.8m |

$21.4m |

$23.2m |

$22.9m |

$27.7m |

21% |

|

NPAT |

$10.7m |

$12.8m |

$11.7m |

$7.4m |

$13.3m |

81% |

|

EPS1 |

$0.408 |

$0.489 |

$0.446 |

$0.281 |

$0.508 |

81% |

|

PE Ratio |

23 |

18 |

17 |

19 |

15 |

|

|

Capitalisation |

$249m |

$232m |

$195m |

$141m |

$206m |

45% |

|

Current Ratio |

1.11 |

1.22 |

0.64 |

1.80 |

1.63 |

-10% |

|

Debt Equity |

0.39 |

0.59 |

0.63 |

0.72 |

0.65 |

-10% |

|

Operating CF |

$15.8m |

$13.7m |

$16.4m |

$12.8m |

$23.7m |

85% |

|

NTA Per Share1 |

$1.89 |

$2.11 |

$2.28 |

$2.30 |

$2.54 |

11% |

|

Dividend1 |

$0.27 |

$0.27 |

$0.27 |

$0.27 |

$0.28 |

4% |

1 per share figures based off actual shares at balance date (not weighted average)

FY25 was a great year for Southport and nearly all metrics we monitor improved.

Revenues rose 13% to $63.3m and operating expenses, although rising, were kept in check which meant SPN managed a 21% increase in Gross Profit of $27.7m. Finance and other costs were also kept in check which meant a much-improved NPAT of $13.3m (up 81%) was reported giving the shareholders of Southport EPS of $0.508, and places SPN on a lower PE of 15.

Similarly, Operating cashflows rose 85% to $23.7m.

The company is in a stable financial position with some long-term debt ($31m) and a debt equity ratio of 0.65. The current ratio is robust at 1.63.

Dividends rose slightly to $0.28 declared for the year. Dividends are fully imputed.

Page 36 of an investor presentation, released in conjunction with their annual results, provides some non-quantifiable outlook statements.

Unlike last year, the company has not provided forward looking earnings guidance for FY26.

Southland Regional Council is the largest shareholder with a 66.48% controlling holding.

Resolutions

1. To re-elect John Schol as an Independent Director.

John Schol was appointed to the Board in November 2022. He is both a Fellow Chartered Accountant and a Chartered Member of the Institute of Directors. He holds a Master of Business Administration (MBA) and a Certificate of Public Practice with Chartered Accountants Australia New Zealand (CAANZ). As an executive director of the award-winning accounting firm Malloch McClean +MORE, John provides strategic, facilitation, mentoring and governance advisory services to the commercial, local government and professional services sectors. Other non-executive governance roles include Invercargill City Holdings Limited, Busck Group Limited, and The Gap 2014 Limited.

We will vote undirected proxies IN FAVOUR of this resolution.

2. To elect Derek Hind as an Independent Director.

Derek Nind has extensive port knowledge having, previously held senior commercial roles across three New Zealand ports over the last 30 years. Derek is the Managing Director, 360 Logistics Group. He was previously the CEO of CentrePort where he was instrumental in leading the business through the devastating impacts of the Kaikoura Earthquake, recovery, and regeneration. Derek has previously held several governance roles in the logistics and property sectors.

We will vote undirected proxies IN FAVOUR of this resolution.

3. That the Board is authorised to fix the auditor’s remuneration for the coming year.

This is an administrative resolution.

We will vote undirected proxies IN FAVOUR of this resolution.

4. To increase the Directors Fee Pool by 6.5% to $562,000.

In July 2025, the Board established a Health and Safety Committee and a People and Performance Committee. Previously the whole Board had undertaken these responsibilities. These committees are standard across NZX companies.

The proposed increase is to cover the fees of the Chair and Members of these committees. The Chair and Directors Board fees will remain unchanged.

The Notice of Meeting refers to the Report from PwC in FY23 that benchmarked the then Pool at 89% of the comparator group median of $600,000. The proposed increase will take the Pool to 94% of the median.

This assessment is supported by NZSA’s own analysis.

We will vote undirected proxies IN FAVOUR of this resolution.

Proxies

You can vote online or appoint a proxy at https://nz.investorcentre.mpms.mufg.com/voting/SPN

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 11.00am Monday 27 October 2025.

Please note you can appoint the Association as your proxy. We will have a representative attending the meeting.

The Team at NZSA