Date Submitted: January 28th 2022

To: NZ RegCo

Tap/Click here to download submission

NZSA response to NZX Consultation NZX Code of Corporate Governance

The NZ Shareholders’ Association (NZSA) would like to thank NZX for the opportunity to comment on the review of the NZX Code of Corporate Governance (referred to as “the Code” in this submission document). We look forward to the release of the next consultation paper and upcoming workshops in March-April 2022.

Context for the Review and Submission Process

- Do you agree with the objectives of the review?

NZSA supports the objectives of this review, as expressed within the ‘objectives’ sub-heading within the consultation document.

We do note that the Page 5 of the document notes that the NZX “intends to retain the Code’s regulatory settings as recommendations that issuers may adopt and adhere to on a voluntary basis”. NZSA believes that the core principles within the Code should be considered as mandatory compliance activities.

- Do you have any comments on the timeline for the review?

NZSA is comfortable with the timelines and process of the review, particularly the workshop process planned for March-April 2022.

- Are there any review areas where NZX should undertake a ‘deep-dive’ to review the adequacy of the current Code settings?

- Mandatory Requirement: NZSA believes that some elements of the Code should form part of the core compliance requirements for issuers within the Listing Rules. In particular:

- A statement that directors who have served greater than 12 years cannot be considered as independent (similar to Singapore Stock Exchange rules). NZSA believes this should apply to all issuers.

- The inclusion of mandatory climate change reporting as per the Taskforce on Climate-related Financial Disclosures (TCFD) standards. NZSA notes that the upcoming NZ climate-related disclosure (CRD) regime will be based on the TCFD standards.

- Other areas as discussed in our submission response in Review Area One, para. 4.

- Costs: We are also mindful of the relative compliance costs of disclosure for small or mid-cap companies and intend to perform further analysis on these costs during 2022. Our hypothesis is that compliance costs indirectly affect investors and the pool of companies available for investment.

- NZSA believes that further standardisation of disclosure will ultimately reduce costs as expectations and requirements are clear from the outset.

- We would also encourage NZX to review the appropriateness of a ‘compliance continuum’ approach, both within the Listing Rules and as part of the Code, linked to market capitalisation. This may allow an effective balance between upholding (and improving) minimum governance standards and improving compliance costs for smaller issuers.

- Mandatory Requirement: NZSA believes that some elements of the Code should form part of the core compliance requirements for issuers within the Listing Rules. In particular:

- Do you have any other feedback on the proposed engagement framework for the review?

- Principle 1: NZSA questions why the NZX is not including a review of Principle #1: Code of Ethical Behaviour as part of this review process.

- Internal Review: NZSA would be interested in further detail associated with how NZX measures compliance with the Code and would welcome the opportunity to work more closely with NZX to share its own assessments and monitor compliance with the Code.

- Principle 1: NZSA questions why the NZX is not including a review of Principle #1: Code of Ethical Behaviour as part of this review process.

Review Area One: ‘Comply or Explain’

- What are your experiences of reporting under a ‘comply or explain’ model?

NZSA reviews the Annual Reports of all NZX issuers, and rates issuer disclosures against our policies. We follow up with issuers where there is a discrepancy or issue that requires clarification or discussion. In general, we note the relatively high level of engagement by corporates with this approach – supporting the ‘comply or explain’ model. - What is the overall quality of issuers’ ‘comply or explain’ reporting practices?

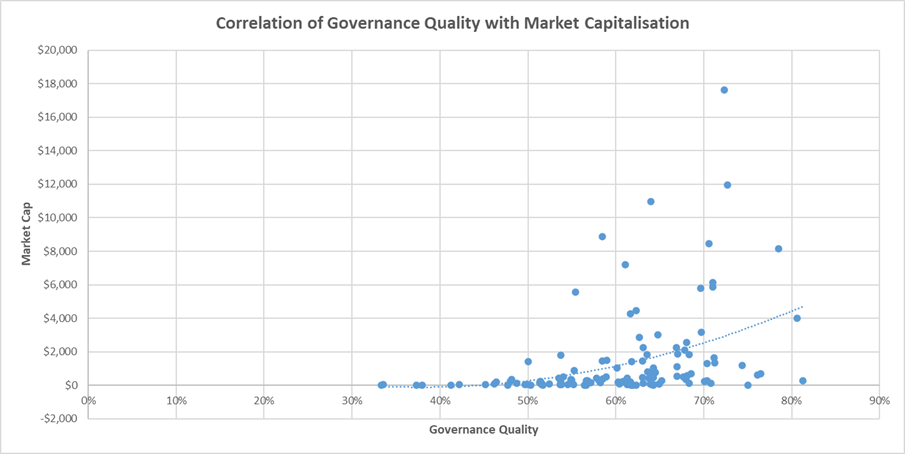

In general, NZSA notes that issuer compliance with our policies is correlated to the size of the issuer; the larger the issuer the better the compliance. Mid-cap and small issuers appear to have difficulty in explaining their reporting in relation to the Code; in some cases it is clear there is little reference or understanding.

The chart below shows the relationship for issuer compliance with NZSA policies during 2021, correlated to market capitalisation. It is important to not take this chart out of context – NZSA recognises exceptions to its policies and situations that supports different approaches. At a general level, however, the relationship is clear. While NZSA policies include our own factors, they are based on the Code – the chart serves as a useful proxy for Code compliance.

- Are there any specific recommendations where additional guidance should be given as to how to explain non-adoption of a Code recommendation?

We recommend guidance be given that the Annual Report of issuers should include a “Governance” section that directly reflects the eight Principles (in order) with the issuers required to report their own practise against the Code in clear terms. - Are there any recommendations that should be compulsory that should be addressed by way of an amendment to the Listing Rules?

NZSA believes that many of the recommendations expressed in the Code should form a part of the Listing Rules (i.e., mandatory disclosure and compliance), as a way of improving governance standards and practices. Specifically:- All recommendations in Principle 2 (Board Composition & Performance)

- All recommendations in Principle 3 (Board Committees)

- All recommendations in Principle 4 (Reporting & Disclosure)1

- All recommendations related to disclosure in Principle 5 (Remuneration)

- All recommendations in Principle 8 (Shareholder Rights & Relations), although this may require clarification on exceptions applicable to 8.4.

NZSA believes that development of an appropriate ‘continuum’-based approach (as discussed in para.3 of the “Context” submission above) will help alleviate any concerns expressed by issuers in relation to compliance costs.

1 NZSA notes that it has found examples where the CEO (who is on the Board) also serves on the audit or remuneration committee (or both). We do not believe this arrangement serves the interests of shareholders.

Review Area Two: Director Independence

- What difficulties do issuers have in applying the current principles-based assessment of a director’s independence?

NZSA continues to query many issuers in relation to director independence. This is often on the basis of observing significant tenure or cross-relationships between directors across different public companies. For smaller issuers, there is sometimes confusion as to who can be considered independent, with some taking the more ‘prudent’ approach in their descriptions.

We note the NZX website pages for issuers often contains incomplete descriptors. NZSA believes every issuer should be required to standardise their director descriptions as:- Independent Non-Executive

- Non-Independent Non-Executive.

- Non-Independent Executive

- CEO / Managing Director

- What is the overall quality of issuers’ ‘comply or explain’ reporting practices in relation to the director independence recommendations in the Code?

We note some Annual Reports, particularly mid and small caps do not include a full descriptor of the Directors designation in the Director Profile section. - Are there any factors which are currently included in the Code that are irrelevant to an issuer’s assessment of a director’s independence?

NZSA believes al the factors expressed in the Code related to Director’s independence are relevant. - Are there any additional factors that should be included in the Code that issuers should consider in relation to director independence?

NZSA would like to see a mandatory requirement (i.e., Listing Rule) that where a director’s tenure exceeds 12 years, they cannot be described as independent. NZSA’s position is that a director should serve a maximum 9 year term, unless they are a founder, significant shareholder, would cause a significant loss of institutional knowledge or hold unique skills that cannot be replaced.

NZSA utilises public records associated with director appointment dates as part of an evidence base to assess a company’s focus on succession planning. This approach is less than perfect but is driven by a lack of publicly available information produced by directors relating to board succession plans. NZSA believes the addition of a factor recommending that issuers disclose succession plans would add value to an assessment of director independence.

We note the difference in approach between the NZX’s ‘factor-based’ approach and the ASX ‘comply and explain’ approach. NZSA remains comfortable with the NZX approach. - How relevant is a director’s tenure to the consideration of his or her independence, and is more guidance required in the commentary to the Code to clarify the relevance of tenure to a director’s independence?

As stated above, NZSA believes tenure is an important factor in determining independence. There is also the matter of capture and influence by a strong CEO, especially if that person is also a director. We note the Malaysian Stock Exchange Rules requires a shareholder vote on Director independence after they have served 9 years.

Please note that NZSA has three policies relevant for this discussion, available on our website.

- Director Tenure (currently in consultation)

- Director Independence

- Board Composition (to be reviewed in 2022)

Note that amendments to the NZSA “Director Tenure” policy are currently in consultation. A copy of the proposed policy has been provided to the NZX and is also contained in Appendix 1 of the pdf version of the submission document. We are also in the process of reviewing NZSA requirements under the “Board Composition” policy.

Review Area Three: Remuneration

- Do you consider that any amendments are required to the Code in relation to the setting and/or reporting of director and/or executive remuneration? If so, please provide evidence to support your submission.

Executive Remuneration: NZSA believes New Zealand issuers should be required to disclose executive remuneration, especially for the CEO, more in line with other jurisdictions. Currently, our assessments have shown that most NZX issuers offer scant information that do not comply with the Code. There is a wide range of reporting quality adopted across NZX issuers on executive remuneration.

At worst, the CEO’s remuneration is not identified, and it is left to the readers of the Annual Report to assume it is the highest level in the scale of those paid over $100,000.

Even large issuers have difficulty explaining their CEO’s remuneration, particularly in relation to the methodology (metrics/measure groups, targets, level of achievement) associated with short and long-term incentive payments. NZSA has been told by some issuers that the CEO’s remuneration is commercially sensitive therefore they are reluctant to make full disclosure.

NZSA is happy to provide further details / examples in direct dialogue with NZX.

We believe the disclosure implied by our own publication referenced in the consultation paper should be required by all issuers, so there is a consistent standard of reporting.

Director Remuneration: We have also been advised that some Remuneration Consultants will not allow issuers to publish their Reports supporting Director Fee increases as they remain the consultants’ Intellectual Property. We do not consider this approach appropriate and have discussed the matter with key providers of Director Remuneration reports in New Zealand.

NZSA policy expects a full report to be published so that shareholders can make an informed decision. In general, NZSA will vote undirected proxies against any resolution for increased directors fees not supported by a transparent report. - Should the commentary to the Code include any additional or different matters that should be considered as a relevant factor for setting executive and/or director remuneration?

We believe the focus should first be on improving executive remuneration reporting quality based on the current standards.

Please note that NZSA has policies relevant for this discussion, available on our website.

- Executive Remuneration (to be reviewed during 2022)

- Director Fees (currently in consultation)

Note that amendments to the “Director Fees” policy are currently in consultation. A copy of the proposed policy has been provided to the NZX and is also contained in Appendix 2 of the pdf submission document.

Review Area Four: Shareholder Meetings

- Should the Code commentary to recommendation 8.2 be amended to encourage issuers to enable shareholders better access to an issuer where virtual meetings are held?

NZSA policy is that issuers should hold hybrid meetings to ensure shareholders have the opportunity to participate. We further believe this should be mandated as an NZX Listing Rule.

Note that NZSA does NOT support the recent amendments to the Australian Companies Act allowing issuers to substitute their physical meetings with a virtual-only meeting.

NZSA has a policy that sets out its requirements for shareholder meetings: Shareholder Meetings Policy - Do you have any objections to NZX’s proposal to prefer hybrid meetings over physical meetings?

Hybrid meetings are NZSA preferred option. We believe NZX should consider this as a mandatory requirement for all issuers. - What do you consider to be the benefits of a hybrid meeting model? In particular, do you consider that there would be time and cost savings for issuers who facilitate hybrid rather than physical meetings?

Hybrid meetings maximise shareholder engagement by allowing shareholders to participate if they can’t get to the physical meeting. We note the increase of younger investors who can’t always get to a physical meeting during working hours and also investors living in non-main centres across New Zealand and internationally.

We believe the cost of the technology to hold a virtual meeting is not excessive and that, as a Shareholders Meeting, issuers should be prepared to facilitate the meeting for the benefit of the shareholders. - Are there any other matters in relation to shareholder access to issuers that should be addressed by way of an amendment to the Code?

On a practical note, shareholders report difficulty asking questions at a virtual meeting. NZSA believes issuers should encourage technology that mirrors the physical meeting – including the ability for attendees to ask verbal questions (rather than in writing) and also have the opportunity for a supplementary or clarification question.

We believe issuers should be facilitating interaction with their shareholders. An Annual Shareholder Meeting is one part of a wider shareholder engagement and communications plan.

Review Area Five: Shareholder Participation in Capital Raising

- Is the quality of issuers’ disclosures as to why they have not followed recommendation 8.4 sufficient to provide meaningful information for investors and other stakeholders?

In general, NZSA feels that disclosures made by issuers raising capital as to why they have not followed recommendation 8.4 are insufficient.

In discussions between issuers and NZSA, the major reasons given for non pro-rata shareholder offers relate to:- Timing: for example, a capital raise made to fund acquisition where settlement timing constraints do not allow for an accelerated rights entitlement offer (AREO).

- Issuers are targeting shareholder diversity, with the aim of reducing their cost of capital. Somewhat ironically, rather than a diverse base of retail shareholders, this can result in a single international institutional placement.

- Underwriting costs – created by uncertainty in markets, such as that caused by Covid-19.

NZSA recognises the need to have multiple forms of capital raise methodologies. However, we also believe that existing shareholders should have the opportunity to participate on a pro-rata basis, regardless of methodology.

In some instances, we have seen some evidence that issuers are mindful of this when not using a pro-rata methodology – for example, undertaking analysis of their shareholder base and introducing mechanisms (such as broker stamp duties) to ensure that all shareholders are able to maintain their holdings.

NZSA would like to see additional disclosures included in 8.4 that show:

- the percentage of individual shareholders that had the opportunity to maintain their pro-rata holding in the company following a non pro-rata capital raise

- the process/logic used by the Board to determine the (non pro-rata) capital raise structure

- Is there particular information that issuers have difficulty in disclosing when explaining an approach that differs from recommendation 8.4

We do not feel there are any barriers to disclosure. - Should the commentary to recommendation 8.4 encourage issuers to make specific disclosure of any particular matter when a non pro-rata offer has been made?

See our comments above. NZSA would like to see additional disclosures included in 8.4 that show:- the percentage of individual shareholders that had the opportunity to maintain their pro-rata holding in the company following a non pro-rata capital raise.

- the process/logic used by the Board to determine the (non pro-rata) capital raise structure and what options were considered.

- Explicit reporting on shareholder dilution (i.e., shareholdings pre and post cap raise)

- Should the commentary to recommendation 8.4 include specific factors that issuers should consider when structuring a capital raise, if so what factors should be included?

NZSA is apprehensive at specifying particular factors, as these could be utilised by issuers looking to avoid a non pro-rata offer.

We note the commentary provided to NZSA by issuer stakeholders as shown above.

Review Area Six: Environmental, Social and Governance Reporting

- What is your purpose for reviewing an issuer’s ESG reporting information?

NZSA is in the midst of introducing a Sustainability Policy to be applied as part of its Company Assessment Reporting for members, which also inform our proxy voting intentions.

Investors have multiple reasons for investing in a specific entity, with sustainability now of increasing importance to a broad range of retail investors. Sustainability information is required to determine a company’s risks and opportunities from externalities – including climate change, other environmental or social factors. - How frequently do you review and issuer’s ESG report?

NZSA looks at ESG reports of each NZX listed entity (where they exist) at least annually. - What is your primary source of an issuer’s ESG disclosures?

While NZSA recognises that an issuer’s website may contain relevant ESG information, we would prefer to utilise a company’s annual report or associated documents as the primary source of ESG information, with relevant links to external information sources as required. - Do you consider that an ESG report must be included in an annual report, or should it primarily be housed on an issuer’s website? Do you consider that an issuer’s annual report needs to refer to the location of ESG reporting information and that some level of integration is necessary?

See comments in (3) above. NZSA fully appreciates that there may be some requirement for integration between various information sources; this is no different to existing governance aspects (such as a Board Charter on a company’s website).

Nonetheless, we would prefer to see core ESG summary reporting contained withing a company’s annual report or equivalent, with links to supporting data. - Does the Code contain appropriate guidance for issuers in relation to ESG reporting, if not what amendments should be made?

NZSA would prefer to see the existing ESG guidance note contained directly within the Code, as a separate principle covering non-financial reporting (i.e., not as part of principle 4.3).

In terms of guidance provided, NZSA feels it may be appropriate to work in collaboration with the XRB Climate-Related Disclosures process to avoid rework or duplication of effort. We note that the existing guidance note refers to the identification of risks and opportunities driven by environmental and social factors (similar to TCFD); such disclosure is supported by NZSA and we would welcome NZX efforts to improve these requirements.

For non-climate change ESG reporting, NZSA would like to see a greater focus on other forms on non-financial reporting, including H&S, diversity and staff turnover measures. - Should the ESG Guidance Note or Code be updated to reflect the New Zealand legislative requirements for TCFD reporting?

Yes – recognising that this may again be subject to further review. - There is no legislative requirement for modern slavery reporting for New Zealand companies, to what extent should this type of reporting be brought within the non-financial reporting recommendations contained in the Code?

As part of a new principle within the Code focused on non-financial disclosures, NZSA would prefer to see a greater range of disclosure associated with ‘social’ risks, metrics and measures included within the Code, similar to the Singapore Exchange approach.

This may cover some issues within Principle #1: Code of Ethical Behaviour – NZSA feels that this principle should be included within the scope of the Code review in the context of a broader discussion around non-financial disclosures.

Examples may include:- Modern Slavery

- H&S disclosures

- Corruption

- ‘Whistleblower’ reporting

- Diversity metrics (age, gender, ethnicity)

- Staff turnover

- Gender pay gap

- Should there be greater alignment between the Code and the ASX Code in relation to ESG reporting?

NZSA would prefer a more global alignment to non-financial / ESG reporting.

Review Area Seven: Diversity Practices

- Are the Code’s settings appropriate in relation to diversity practices? If not, what amendments should be made?

NZSA believes that a board culture encouraging diversity of thought, the willingness of board members to constructively challenge each other and board members maintaining an open mind contributes significantly to long-term organisational performance.

In an objective sense, we acknowledge that such a broad-based measure of cultural-based diversity is difficult to measure.

NZSA believes the NZX could utilise Code recommendations as part of an active approach to encourage both diversity within issuers and disclosure of key social diversity measures, as this provides an objective approach towards understanding diversity around the board table.

Regardless, NZSA believes that (collectively) the Board must maintain its ability to challenge itself and bring the appropriate skills required to govern the company to the Board table. - Are the Code’s settings appropriate in relation to diversity reporting? If not, what amendments should be made?

NZSA notes that a level of base reporting is included as mandatory within the Listing Rules. While this is appropriate, NZSA believes that the inclusion of both pay equity (equal pay for equal work) and gender pay-gap reporting should also be included directly within the Code. - What are your views in relation to a recommendation to report against a target determined by NZX that would specify thresholds for gender diversity on boards, which is similar to the approach taken by ASX?

As per our response in para. 1 above, NZSA believes that diversity is a broader measure than gender, but ‘board culture’ measurement is problematic.

In this context, NZSA supports the adoption of a ‘target’ for gender diversity to be established as a recommendation within the Code, with a ‘comply or explain’ approach for issuers that do not achieve the target. - Does the Code’s guidance in relation to ESG reporting appropriately take account of diversity considerations?

The current ESG reporting guidance note does not adequately take into account diversity considerations. However, as stated in 6.7 above, NZSA would support an outcome where diversity, environmental and social reporting was considered as a new ‘Non-Financial Reporting’ Principle within the Code.

Review Area Eight: NZX Corporate Governance Institute

- Do you support the introduction of the NZX Corporate Governance Institute?

NZSA supports the introduction of the NZX Corporate Governance Institute, and appreciates the intention expressed by NZX to include NZSA as a representative of retail investors. - Which stakeholder groups do you consider should comprise the NZX Corporate Governance Institute?

NZSA agrees with the recommendations made in the consultation paper. NZX may also wish to consider Governance NZ within its stakeholder group. - Do you agree that the mandate of the NZX Corporate Governance Institute should act as an advisory body to NZX?

NZSA supports this initiative and feels the status of an advisory body to NZX is appropriate.