This time last year, NZSA prepared a summary of shareholder meetings that had occurred during 2021 – and what that implied for both the workload and the time travel requirements of retail investors.

We learnt that most meetings occurred in a relatively narrow window between mid-September and late-November, that 35 days had more than one shareholder meeting and that a total of 28 companies had their ASM at exactly the same date & time as another.

So what happened in 2022?

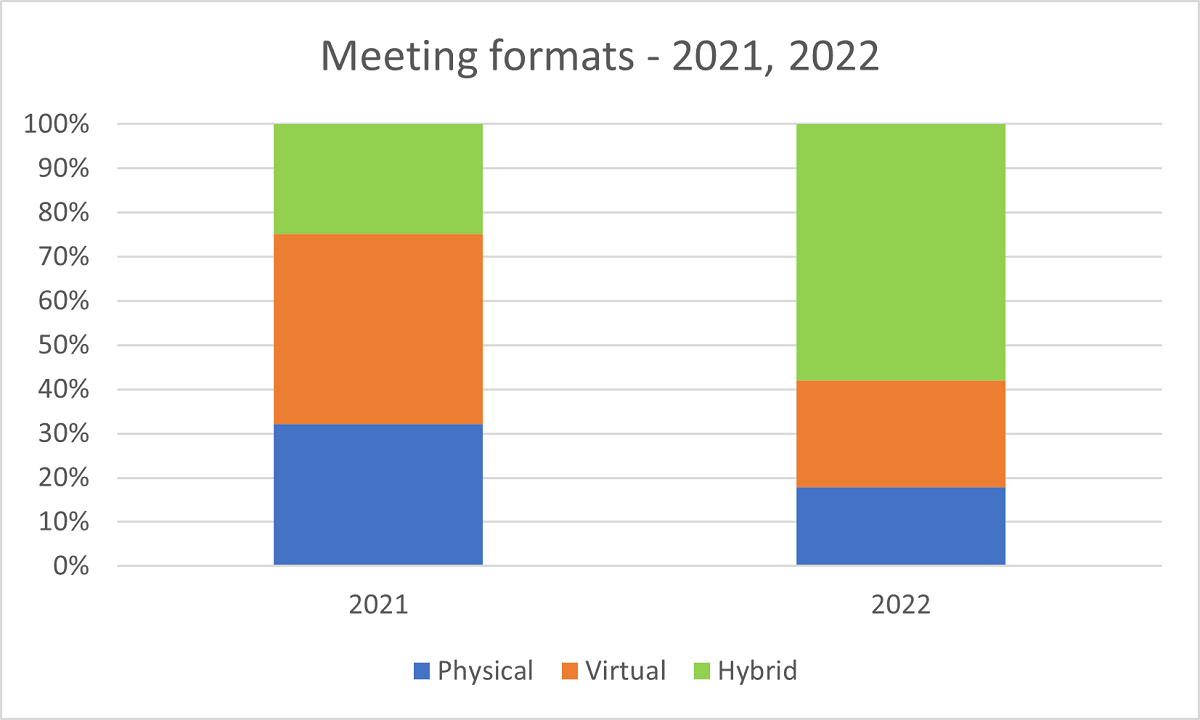

Hybrid, virtual and physical

The key trend during last year has been a move towards ‘hybrid’ meetings for many companies, following the virtual enforcement created for many as a result of Covid-19. NZSA’s Shareholder Meetings Policy is supportive of a hybrid meeting format, as this blends the best of both worlds for investors. The format allows out-of-town shareholders to attend who would otherwise not be able, while still allowing those present to maintain effective dialogue with Directors.

This isn’t always popular with issuers. A common complaint from Directors in NZSA’s conversations is the cost of undertaking a shareholder meeting (either physical or virtual) and then “adding on” an incremental cost to provide for the other format, a complaint exacerbated by falling physical attendances.

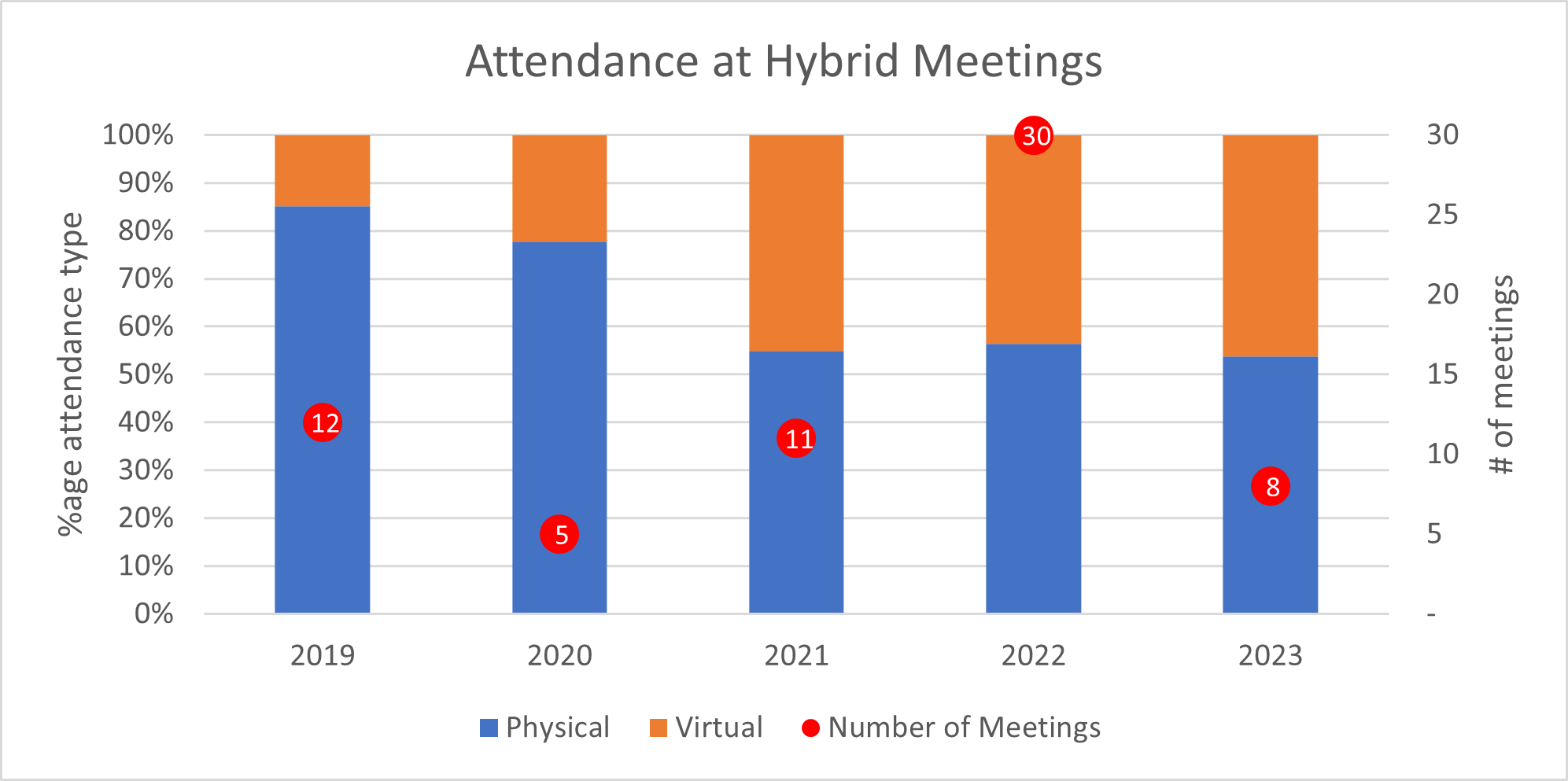

NZSA has worked with a large sample of (anonymised) data on annual attendances from 2019 to the most recent meetings in 2023. The conclusion shows that overall attendances declined by around a third during Covid-19, with (perhaps) the green shoots of a recovery occurring in 2023 (albeit off a very small sample size). This trend has affected all meeting types, whether virtual, hybrid or physical.

For hybrid meetings only, the fall in attendance has been more severe – a drop of around 60%. This drop mostly occurred during 2021, ie, prior to the large increase in issuers joining the ranks of this meeting type in 2022. So while more (smaller) issuers might be picking up the hybrid mantle, this is unlikely to fully explain the fall in overall attendance.

There is little doubt that the impact of Covid-19 affected the nature of how shareholders attended meetings from 2020 – 2022. As an average, physical attendances at a ‘hybrid’ meeting format have indeed reduced during the Covid-19 period and have (so far) not recovered in 2023 – again, however, the small sample size means it’s difficult to draw conclusions. Are we still in a post-Covid lull? Or has the allure and convenience of the little screens that surround us influenced how we view meetings?

Worryingly, while physical attendances have declined, average virtual attendances have broadly remained flat (or at best, not increasing anywhere near enough to compensate for the physical attendee decline). So while physical attendees are declining in number, those attendees are not necessarily attending online either. This potentially highlights a larger issue than a simple meeting format.

Bucking the trend, some companies appear to have increased their physical attendees over the period, although that may be a reflection of the resolutions being discussed.

Our sample data does not currently include any issuer who has held a hybrid meeting in 2019 and 2023. And of course, Covid-19 is likely to have affected attendances in the intervening years.

On an average basis, it is worth noting that the average number of virtual attendees at a hybrid meeting has remained relatively flat since 2019. The decline in overall attendance has impacted those who attended physically – but they are not necessarily attending online either. This potentially highlights a larger issue than a simple meeting format.

From an investor perspective, a survey of NZSA members carried out in April 2023 highlighted a potential misalignment between shareholders and their Boards; while Directors look to minimise cost of shareholder meetings, more than 75% of survey respondents see it as “good cost”, one that allows shareholders effective representation. Less than 10% thought a move to virtual meetings only would suffice.

What is also clear is that shareholders would love to hear more from company executives as well as the Board.

Interestingly, many respondents noted the role and quality of NZSA’s proxy service in their decision to not attend meetings. It’s likely that as individual investors continue to move towards funds or DIMS (discretionary investment management service) arrangements as an alternative to direct investment, the perceived impact on company shareholder meetings will continue. NZSA itself is facing the impact of that very real trend.

The conclusion? For investors as a whole, when it comes to physical shareholder meetings, it truly might be a case of ‘use it or lose it’. And for issuers, it’s possible there is a need to think creatively about how they manage information flow to investors as a whole – this is not just a question of meeting format. That could include a range of responses, from utilising cheaper in-house approaches to the physical component of a shareholder meeting to re-thinking how a shareholder meeting could sit within an investor day (inclusive of both institutional and retail investors).

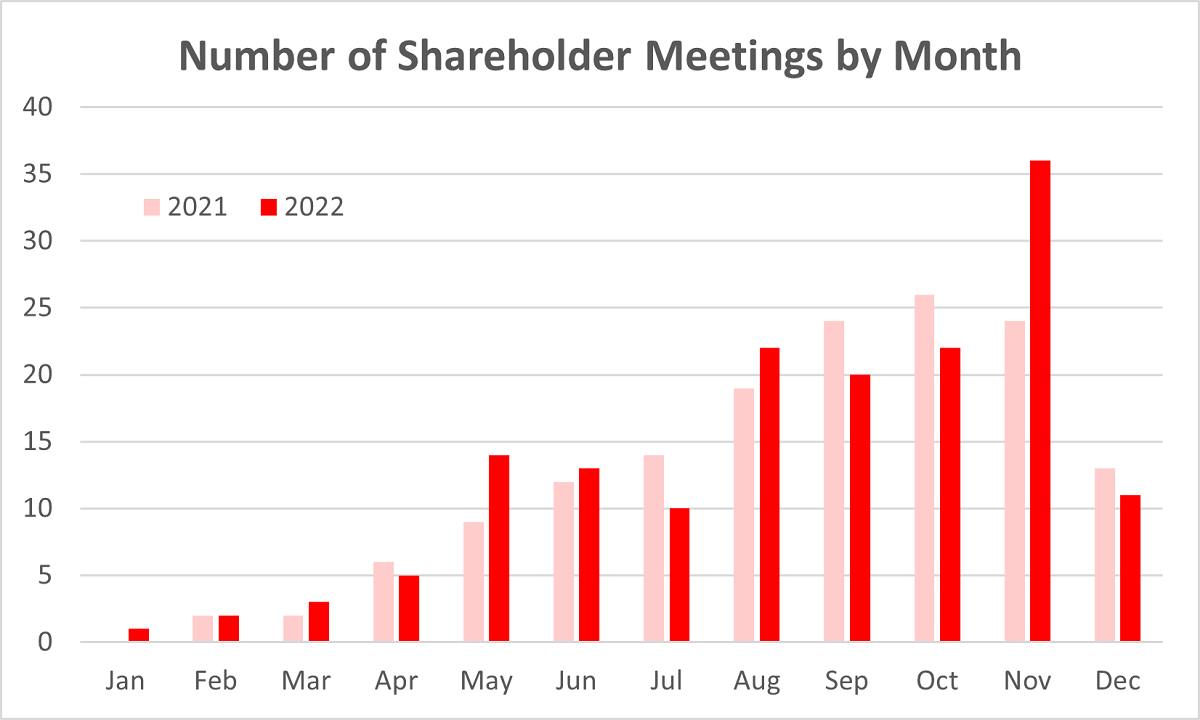

Timing

When it comes to scheduling, a key observation is that if we thought the window was tight during 2021, it was even more so in 2022. In 2021, 65 shareholder meetings occurred in the 10 week period following September 19th. For a similar period in 2022, that increased to 70 shareholder meetings – but that included 36 in November alone, a significant increase on any calendar month in 2021.

We noted that the most popular time for a meeting was at 10:00am or 10:30am. This has actually increased as a preference during 2022, with a third of shareholder meetings occurring at this time (2021: 27%).

A feature of 2021 were the 28 listed companies who held meetings at exactly the same date and time as another listed entity. Pleasingly, this actually decreased slightly this year, to 22 companies spread across 11 dates. It’s something we continue to highlight; as of now, NZSA actually have a tool that we are able to ‘launch’ to issuers to help them plan their meetings. We’d like to refine that a little further, so that we can offer a practical solution for 2024.

The busiest weekly workload in 2022 was the week ending November 19th with 12 companies (2021: October 30th, 14).

In general, these match-ups are less likely to cause issues for most investors than some of the conflicts we observed in 2021 (you can see last year’s shareholder meetings report at this link). We note that the sparsely-attended Chorus meeting (held in Wellington) occurred at the same time as the meeting for Fletcher Building (held in Auckland) – although we’re not sure this made a significant difference for either, given the different cities. Some shareholders questioned the scheduling conflict between two North-shore based companies (Kingfisher and AFT Pharma) – this was acknowledged (with the benefit of hindsight) by KFL Chair Andy Coupe in a later conversation with NZSA.

The ability to attend a shareholder meeting and question your directors is a key element of shareholder agency – and is worth protecting. NZSA will keep working to make it easier for everyone.

Oliver Mander