NZSA Disclaimer

There has been an emerging trend during 2023. Clearly, the ‘cost of living’ crisis impacting the lives of most New Zealanders at the supermarket each week is weighing on the minds of directors when it comes to their own pay and that of their CEO’s.

This week’s blog article focuses on the real-life case studies (EBOS, Tourism Holdings, Fletcher Building and Gentrack) that have emerged over the last 7 days.

Director Fees

For the entire 2022 calendar year, the 150 entities covered by NZSA proposed 22 increases to the director fee pool. So far this year, out of the 92 assessments we have issued, the number stands at 23 – we still need to complete assessments of approximately 50 issuers over the next few weeks.

Not all of these proposed increases result in an immediate increase in director’s take home pay. In some cases, a Board may propose an increase to the director fee pool to allow for additional ‘headroom’ for unexpected projects or duties above and beyond that which would normally be expected. Nonetheless – the total fee pool is important for shareholders as it represents the upper limit of liability they owe to their representatives. Where headroom exists in a fee pool, NZSA expects clear conditions to be expressed around how it will be used.

Most shareholders would not disagree that an investment in strong, effective and capable governance is worth making. The key question for shareholders usually comes down to the relevant quantum, influenced by factors such as performance, complexity and size.

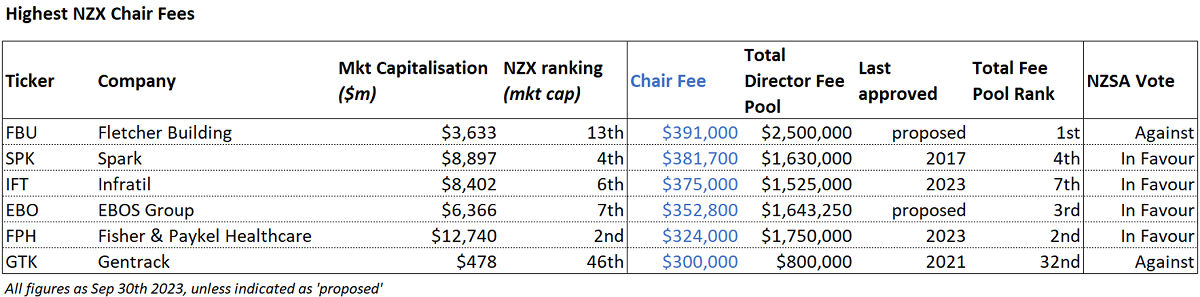

NZSA looks for corroborating evidence to support increases – including a report that can give shareholders some effective guidance as to how increases compare with others. We also maintain a database of directors fees for NZX listed companies that allow us to assess the validity of a Board’s proposal for an increase in their fees – given a range of relevant factors.

This week alone, we have assessed three different proposals for director fee increases – at EBOS, Tourism Holdings and Fletcher Building. All three companies share a concern that is not-so-quietly expressed by many directors, relating to the disparity between the pay rates of Australian-based directors as compared to that of New Zealand. There’s also growing angst that the fees paid to professional directors simply don’t offer the right level of reward for the sheer amount of risk they are taking on, a narrative given some recent oxygen by the recent Mainzeal decision.

EBOS Group

The EBOS increase of 5% (last increase: 2021) is supported by a report prepared by KPMG and is based on a sample of KPMG-selected, ASX-listed comparators at 50-200% of EBOS’ market capitalisation. The report summary has been shared with EBOS’ shareholders. Unfortunately, the comparator companies are not disclosed and NZSA also raised an eyebrow at the comparator group selected – an upper limit of companies that are double EBOS’ size (200% market capitalisation) does not seem particularly reasonable.

Nonetheless, the proposed new fee pool falls within the upper limit (just) of NZSA’s calculated range, so we have elected to vote discretionary proxies ‘in favour’ of the proposal.

The scale of difference between New Zealand director fees and those of Australia becomes apparent when NZSA’s upper limit for EBOS is the equivalent of somewhere between the 19th and 40th percentile, according to the Australian-based data prepared by KPMG. For the Chair of EBOS, a heavily Australian-based company, it must be frustrating to realise that your Chair fee is the fourth-highest on the NZX – but only at the 19th percentile of ASX-listed companies (at least, according to KPMG).

Tourism Holdings

Tourism Holdings (thl) is a much smaller company than EBOS – but one that is clearly on a performance improvement mission as it recovers from the lows of the Covid-induced cratering of its financial fortunes. It has not reset its director fee pool since 2018. The company released no supporting evidence in its proposal to raise its fee pool from $750k to $850k, on the grounds that “the expense of commissioning an independent director fee benchmarking report in this instance … is significant in proportion to the increase proposed and because no recommendation is being made for a market-relative adjustment to fees paid to any Director in relation to their normal duties (beyond the future ability to provide for inflationary adjustments).”

thl also note that the existing fee pool is reaching its ceiling, with only $15,000 of ‘headroom’ remaining for special projects undertaken by directors. We can’t help noticing that Infratil, a company that seems to make a specialty of special projects, operates with only $20,000 of headroom as part of a fee pool approved by shareholders earlier in 2023.

A 14% increase in fees should give shareholders pause for thought, and should have warranted the thl Board to think harder about an independent report. After all, approving a fee pool means that directors can pay up to that amount without any further approval, regardless of any stated intention.

On the flip side, the argument surrounding a fully-committed (current) pool is valid – not to mention the increased size of the company following its value-accretive merger with Apollo Holdings last year, the 5-year timeframe since the last shareholder approval and generally solid performance. Like EBOS, the company also has some Australian directors, as part of its multi-national business.

In this case, NZSA will vote undirected proxies ‘in favour’ of the increase. It’s a ‘line’ call – even though it falls just outside the upper limit of our calculated range, the company’s performance and achievements over the last 12-18 months are transformational in nature and are likely to lead to further performance enhancement.

Fletcher Building

Ironically, this is probably the easiest decision we’ve made this week – NZSA is voting against a proposed 20% increase in the fee pool for the Fletcher Building Board from $2.0m to $2.5m.

In many ways, though, the proposal offers some similarity to that proposed by thl. The company is increasing the fee pool to allow for ‘headroom’, with no change to director fees promised in FY24. Like thl and EBOS, Fletcher Building includes some Australian-based directors, with commensurately higher expectations. And like thl, the company has not provided any independent report or benchmarking to support its proposal.

That is where the similarities end. In terms of headroom, the current fee pool still allows for $370k of potential flexibility for additional work. The proposed level of $2.5m is far above what similar companies (size and complexity) allow as a fee pool for their directors. In fact, we’ve assessed that if Fletcher Building doubled in size overnight, the current fee pool could still be too much, let alone the proposed increase. Even without the proposed increase, Fletcher Building’s fee pool is the largest on the NZX ($2.0m) with the Chair earning $391,000 – again, the largest of any NZX-listed company.

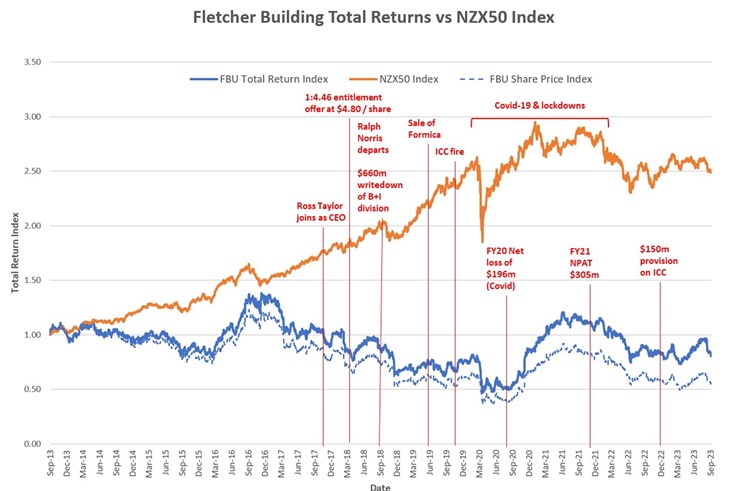

Last, we come to the other key factor we look at – performance for shareholders. The company states, without a hint of irony, that the proposed increase “is consistent with the Company’s performance and total shareholder returns.“

From an objective perspective, it’s likely that a long-term Fletcher Building shareholder might have the capacity to disagree, as highlighted by the following graph.

As one famous kiwi politician said to another: “Show me the money!”

There are some emerging bright spots on Fletcher Building’s horizon. The company’s underlying earnings before interest and tax (EBIT) for FY23 is a record – albeit before allowing for yet more cost provisions associated with it’s infamous ‘legacy’ project – Auckland’s International Convention Centre. Indeed, the total return for shareholders (assuming re-invested dividends) has broadly kept pace with the NZ50 Index since the time of the ICC fire that represented yet another milestone crisis for FBU.

Perhaps what this graph really shows is the long-term importance of governance – both good and bad. We should perhaps be mindful that the current Board has spent the last 5 years unpicking the legacy of the previous Board and management – as the ICC project and last year’s very public spat over plasterboard supply shows, the long-term impact of strategic decisions can outlive the decision-makers for some time. From an external perspective, an unexpected fire and Covid has not helped their cause.

The unfolding Iplex manufacturing and/or installation issue in Western Australia, for which the company has booked a $15m provision so far, may also be weighing on current share price performance.

But even if a shareholder takes a positive view on Fletcher’s outlook – that the ghosts of past Board decisions have been exorcised – why are shareholder’s being asked to pay in advance of the evidence that would be provided by increasing shareholder returns?

The decision to propose a resolution to increase fees by 20% represents poor judgement by the Board and a tone-deaf attitude to the struggles facing individual shareholders.

Too often, there’s a perception that shareholders are the ‘capitalists’ in the room, looking to bolster their returns at the expense of the working classes. The success of KiwiSaver should, and must, change that perception. With over 3 million members as of June 2023, the chances are that nearly every working-age New Zealander is a shareholder in Fletcher Building. It is likely that most of them do not earn the $391,000 earned by the Fletcher Building Chair – the highest paid Chair on the NZX.

As a median wage worked in New Zealand, would you pay in advance for an implied promise, with no guarantee of delivery, when you are facing a 20% increase in your grocery bill each week?

To the Board of Fletcher Building – we’re calling on you to pull the resolution proposing the increase in Directors Fees from the Annual Shareholders Meeting – and come back to shareholders when you’ve delivered something for them.

To the financial institutions who represent millions of indirect Fletcher Building shareholders, we ask you to think about the clients you represent and where they would prefer to spend their cash right now.

We will respect you for it.

CEO remuneration

Generally, shareholders do not vote on amendments to CEO or executive pay structures. It’s the job of directors to ensure that pay for CEO’s is reasonable – and manage the ever-critical balance between securing and retaining the best possible executives for the job at a minimal cost to shareholders.

When it comes to CEO pay, the notion of a “fair day’s pay for a fair day’s work” feels like an almost quaint, outdated notion. This is not to say that the outcomes are unfair for shareholders – but simply reflects the myriad of pay structures that accompany CEO’s. It still astounds me that there is not a single CEO pay structure on the NZX that is directly comparable to another. One could argue that is a good thing – pay structures are designed to serve the unique need of the company and individuals.

The alternative view is less charitable – that the complexity inherent in many CEO pay structures are designed in part to obfuscate and confuse. There is an entire industry that has grown up around the development and assessment of executive pay structures. Arguably, that has become a systemic conflict of interest – the more complex the pay structure, the more external advice is likely to be required.

On that basis, pay simplification is not something that the remuneration industry is inherently likely to encourage.

NZSA generally advocates for alignment between the returns experienced by shareholders and the incentives offered to a CEO. It’s unlikely that shareholders experiencing a 100% increase in share price would begrudge a 100% increase in the value of a CEO’s incentives.

At Gentrack’s upcoming special meeting on October 10th, however, shareholders are being asked to vote on a package of long-term incentives that will see the CEO, Gary Miles, receive potential value representing an approximately 400% increase in value compared to the (already generous) current incentive scheme, for a corresponding 100% increase in value for shareholders. The same incentive scheme is being offered to Gentrack’s executive team.

In practice, that means the executive will pocket $94m worth of shares for an incremental market capitalisation of $624m (ie, 15%) over 3 years – should that be achieved, together with an earnings per share ‘gate’. This would represent total dilution for shareholders of around 8.5%. Of the potential $94m worth of shares, the CEO would receive $24.5m. That potential value is, of course, in addition to the annual short-term incentive paid (up to 100% of the CEO’s salary) and base remuneration of around $900,000 per annum.

If sunshine and roses come to pass, the value that Gary Miles will receive will average close to $10m between now and October 2026.

If you’re an NZSA member, you can see our full commentary at this link.

CEO remuneration can be notoriously difficult to understand from the (often skimpy) disclosures provided by most NZX-listed companies. On a separate note, we’re working hard behind the scenes to introduce policy and template recommendations to help with that. But as far as we can tell, $10m a year would place Gentrack’s Gary Miles (at full vesting) at the very top of New Zealand’s CEO pay table. Gentrack has some form at creating ‘fulsome’ pay structures – Chair, Andy Green, comes in 6th place on the list of NZX-listed Chair fees.

The company is performing well, with a share price now at around $4.80, compared with approximately $1.20 in October 2020. However, the CEO has been effectively compensated for the last 3 years, including a recruitment bonus of 500,000 shares and the award of performance rights at up to 120% of his base salary. This is already a generous incentive scheme by New Zealand standards – so much so, that NZSA voted against one of the resolutions that established it back in 2021.

Also, Gentrack operates mainly in the UK market; both the Chair and CEO are based there. Certainly, Gentrack needs to conform to the market expectations prevalent in the UK – a key factor in determining base remuneration. That perhaps offers some justification.

Incredibly enough, this is a harder decision than the numbers make it sound. If someone earned $6, kept $0.80 and gave you the rest – you are still $5.20 better off – that’s similar to what is going on here. And NZSA has often talked about the advantages of incentive schemes that are in alignment with shareholders. Philosophically, therefore, we have less of a problem with the structure of the scheme – but we do believe that the scheme as proposed does not fairly apportion the balance of benefits between CEO incentive and the risk associated with shareholder capital.

How much is too much? We don’t necessarily know the answer to that. But we know that in this case, NZSA will vote undirected proxies against the proposed scheme.

A philosophical note…

NZSA is a clear advocate of rewarding CEO’s who manage companies in a manner that is rewarding for shareholders. We often hear from directors as to the necessity of developing incentive schemes and retention benefits to ensure they can recruit and/or retain the very best people for their business.

I am minded, however, of Mary Schmich’s famous Chicago Tribune column of June 1997 – popularised by Baz Luhrmann as the ‘Sunscreen song’ in the late 1990’s.

Whatever you do, don’t congratulate yourself too much, or berate yourself either. Your choices are half chance. So are everybody else’s.

Mary Schmich, Chicago Tribune, June 1997

The point is that while place great Directors and CEOs on a pedestal, they are successful not just because of their personal qualities – but also because at some time, in some way, the stars have simply aligned for them. Now, I am also a believer in making your own luck and taking actions that improve the probability of success in the future. But I also believe that for every great leader that we revere, there are other great leaders who are comfortable working as a local store manager of your local Warehouse store.

We are the sum of our personal choices. Our careers are only a subset of that.

How much is too much? Is this a discussion that gives way to the base human emotion of envy? I hope not. NZSA is clear in its reward-based philosophy and data-driven evidence base that supports our assessments. Nonetheless, remuneration disparity (partly driven by envy) has become a marker of the societal challenge that has beset the Western world in recent decades – a widening of the gap between rich and poor.

Such are the philosophical differences to risk and reward that drive such deep divisions amongst the politically motivated. It’s called democracy – whichever side of the philosophy takes your fancy, we are all the richer for it.

Although perhaps not quite in the same way as the Chairs of Fletcher Building and EBOS, nor the CEO of Gentrack.

Oliver Mander

One Response

very enlightening appreciate the work gone into the work preparing this article. Really feel that renumeration should’nt be based on profitability because that is what they are being paid for in the first place, that is why they are employed, and that is what they should be paid for. Are all employees of these companies getting pay increases at the same rate?