NZSA Disclaimer

If there are two words that Fletcher Building investors never want to hear again, it is “significant items”.

That won’t happen in FY25. The company had already booked impairments (Iplex) and a loss on disposal (TradeLink) at the half-year, back in February, totalling approximately $251m, followed by a further $12m – $15m earlier this month related to the cost to complete everyone’s favourite building, the NZ International Convention Centre.

But it was the further $310m – $515m signalled at yesterday’s Investor Day that raised a few eyebrows in the room. NZ Shareholders’ Association has raised previously the long-term impacts of Fletcher’s “legacy” decision-making and the subsequent value destruction for shareholders.

The tradition continues.

The outcome can’t be sugar-coated. The upshot is that for FY25, shareholders are now bracing for yet another round of significant write-downs and provisions totalling up to $781m – approximately 20% of Fletcher’s market capitalisation.

Nonetheless, there was some content that should be music to the ears of jaded analysts and investors. The words de jour at the Investor Day were focused on capital management, capital allocation and Return on Invested Capital (ROIC), to a far greater extent than had been evident in previous company presentations.

There is also something different about this current crop of “significant items”, one that could offer some cautious positivity to Fletcher’s long-suffering shareholders. While previous significant items have all been about dealing with “legacy”, the expected significant items announced yesterday are all about “today”. This is the outcome of decisions made by this management team and the Board to “reset” the company. For the first time in many years, these “significant items” reflect a company looking forward – not backwards.

Also on the plus side, the newly refreshed Board and Executive team have moved decisively to de-centralise operations, simplify the portfolio and deliver meaningful cost savings.

Culture eats strategy for breakfast…

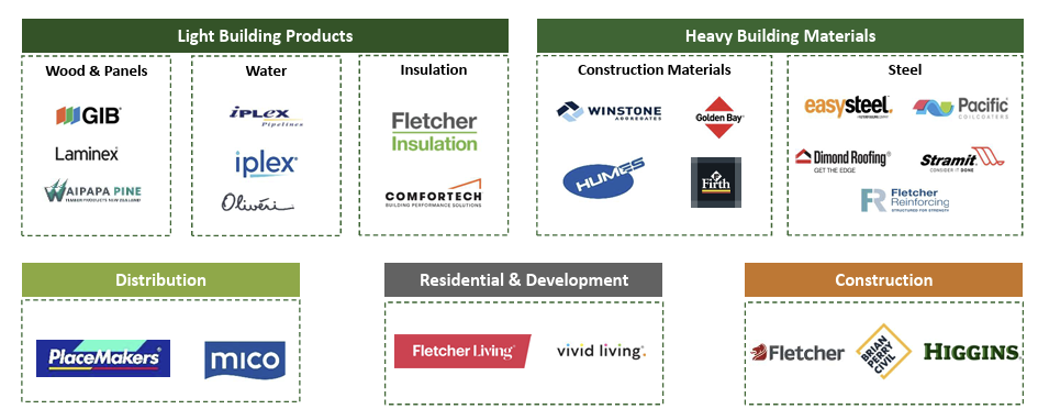

The company was upfront when it came to updating investors as to the key cultural actions it was taking. A key message was the shift from a centralised operating model – criticised for slow decision-making and blurred accountability – to a leaner, decentralised structure. Fletcher Building has reorganised its businesses into five sector-focused divisions, each led by General Managers empowered with clear financial targets and autonomy over local operations.

This combined effect of these two (massive) changes to the operating model aims to reduce corporate overhead and to foster a performance culture, where division leaders own both the upside and downside in their business.

Board Chair, Peter Crowley, and CEO, Andrew Reding, emphasised that empowered divisional leaders will be measured against industry-specific weighted average cost of capital (WACC) hurdles, ensuring that only businesses meeting or exceeding these returns remain in the portfolio. Early examples of de-centralisation actions include the dis-establishment of the Australian and Steel divisions (integrating those units into sector verticals) and the cessation of the group-wide SAP rollout that was now misaligned with the new, de-centralised operating model.

It’s difficult for NZSA to argue against these changes – we had previously highlighted that “a one-size-fits-all” model had likely been a factor in stifling responsiveness and increasing costs. This has come at a short-term cost however, with an estimated $50m – $60m in cash likely to be booked in FY25 as restructuring costs within the afore-mentioned “significant items”.

Portfolio Simplification and Cost Discipline

Another previous NZSA comment had been a desire for the company to review its portfolio of businesses, with a view to both simplification and an increase in return on capital.

We got what we wished for – although even we’re cringing at the $250m – $440m of potential (non-cash) “significant item” impairment and/or provision impact for FY25 that will affect FY25 profitability.

As noted above, it’s good to see the focus on capital management and returns. Reding noted that under-performing businesses were being subjected to a performance improvement plan to bring them up to scratch – there would be no ‘fire-sale’ divestments. Unsurprisingly, there would be no consideration of any acquisition either, until the company had its Balance Sheet under control and had earned the trust of its shareholders.

In that context, it was telling that slide 1 of the Investor Presentation referred to Fletcher’s medium-term focus on manufacturing and distribution of building products and materials. That implies the company has a spare construction division.

The presentation highlighted key initiatives undertaken by the recently refreshed Board and Exec:

- Capital raise and divestments: A $700 million equity raise and the sale of Tradelink for approximately AU$170 million have strengthened the balance sheet and provided working capital for turnaround initiatives. The company has also ceased some capital expenditure – including development of a new Frame & Truss plant at Felix Street in Auckland.

- Gross cost savings: Approximately $200 million of gross savings will be delivered in FY25, largely through facility closures, headcount reductions of over 620 FTEs, and the re-purposing of underutilised sites.

- Corporate overhead cuts: An initial $15 million of annualised fixed cost reductions have been realised from the changes in the operating model, with further savings likely as legacy projects conclude.

Additionally, “no-regrets” cash capital savings were achieved by pausing the SAP programme.

All the actions taken by the new Board and management to date signal a clear intent to improve long-term financial resilience. Capital decisions take years, even decades, to play out, as the nature of Fletcher’s past “significant items” have shown. A sharp focus on capital and portfolio decisions will at least mean that future Fletcher Boards will not be hung by the actions of their predecessors.

Those “significant items”…

While we’ve noted above the clear difference in ‘style’ of the FY25 crop of significant items, this list is your quick reference guide as to what we can expect in the FY25 accounts:

- Iplex Australia: A $177m pre-tax impairment taken at the half-year related to the remediation of legacy pipe quality issues in the Australian plastic piping business.

- Tradelink Disposal (HY25): A $58m loss on sale of the Tradelink wholesale plumbing division.

- NZICC Cost to Complete: An estimated $12m -$15m further cost to complete this project.

- Legal and Legacy Construction Costs: Approximately $10m – $15m of costs associated with defending historical Western Australian plumbing litigation and finalising outstanding construction legacy claims.

- Strategic Review Non-Cash Items: $250m – $440m in non-cash write-downs, reflecting goodwill and brand impairments, closure costs for mothballed facilities, and write-offs of onerous SAP implementation contracts identified through the strategic review.

- Strategic Review Cash Items: A further $50m – $60m of cash outflows for restructuring and redundancy payments as underperforming business units are either exited or restructured.

Daunting.

No doubt, auditors and independent valuers will role in determining whether the non-cash strategic review costs are closer to the lower or upper end of the range. Investors will want to make sure that reductions in carrying values are not the sole contributor to any improvement in “return on capital” in future years – something we will be at pains to assess and to encourage Fletcher’s to provide key commentary on.

With soft market conditions persisting across both New Zealand and Australia, the question is whether this “honest reset” of the balance sheet is a necessary clean-up or is lowering of performance expectations to reflect existing, long-standing underperformance.

Market Outlook and Execution Risks

It is still a soft market out there, in both New Zealand and Australia. The green shoots cautiously emerging across some sectors of our economy still look like economic weeds for Fletcher’s.

The company is currently operating at ‘bottom of cycle’. Its immediate fortunes depend on both its improvement actions (‘self-help’) and an upturn in market volumes. Much of the capital and cost discipline being imposed by the new Exec is aimed at helping the company deliver returns at bottom-of-cycle economics. A culture of disciplined execution will go a long way in a soft macroeconomic environment.

We heard that both the New Zealand and Australian construction markets face headwinds from higher-than-expected interest rates, regulatory uncertainty around infrastructure projects, and a slow ramp-up in government-led spending.

A rolling 12-month average of product volumes shows no meaningful recovery through Q3 FY25, and management cautions that material improvement is unlikely before FY27.

On the execution front, the ambitious cost-saving targets and portfolio simplification plans must be delivered without fracturing core operations. The success of a de-centralised model depends on the calibre and incentive structures of divisional leaders; now measured against clear ROIC and WACC targets but still tested by the challenge of turning around long-underperforming units.

The way forward

NZSA has long lamented “a long record of significant costs and sub-par returns” at Fletcher Building. We were highly supportive of the refreshed Board and leadership of the company, signalling a fresh approach for Fletcher Building.

Chair Peter Crowley and Cathy Quinn are the only survivors of the previous Board. They have staked plenty in supporting the actions of new CEO Andrew Reding, based on lessons from their longer-term involvement with the company. It stands to reason they are now most at risk from any loss of market confidence in the ‘new’ Fletcher.

New (ish) CEO Reding has not stood still in his 10 months in the job so far. Changing the cultural and performance DNA of Fletcher Building and its 24 component businesses was never going to be easy – and was never likely to happen with a year.

Regardless of investor disappointment at new write-downs, at least these are being caused by positive improvement actions. The company seems now to be confronting its legacy rather than being defined by it – a welcome change. In fact, the word ‘legacy’ was barely used (if at all) by the presenters at the investor day. Hallelujah.

For shareholders, there are a number of key questions:

- Will these deep changes to both the operating model and capital management framework unlock the latent value in portfolio businesses?

- Do investors trust that the actions taken are the right ones for the company?

- Does the bitter pill of yet more “significant items” for FY25 outweigh any positivity generated by the answer to the previous two questions?

NZSA believes that with a refreshed Board, empowered divisional leaders and a disciplined capital allocation framework, Fletcher Building may finally be on the right track.

However, we also acknowledge that execution risk is high, particularly within a soft market environment. We also note that even where actions have been taken, this may take some time to impact people and operations at the front line of Fletcher’s portfolio businesses. It will take some time yet to convince many shareholders or even customers that Fletcher’s has truly changed.

For shareholders focused on yield, there may be come difficulty in accepting the company’s capital management reset: the company noted that no dividends will be paid until the company hits the lower end of its net interest-bearing debt target of $400m – $900m (a clear signal for no dividends in FY25 and likely FY26).

For other shareholders, the tram lines have been set. While market recovery might only start in FY27, they will want to see evidence of improving return on capital and sustainable earnings ahead of that date.

And please, in the name of all that is holy, no more “significant items”.

Oliver Mander

One Response

Many thanks for your in-depth analysis, great value for money.

Thank you Oliver!