In addition to the article below, have a listen to this extract from The Long and the Short of it, from February 7th, with commentary from Paul Macbeth and Oliver Mander.

There is nothing like a day out visiting a company’s operations to understand the effectiveness of just how well a company does what it does, and how that sheets back to investors.

Judging by the positive reaction of the Ryman residents we encountered during our visit to William Sanders retirement village in Devonport last week, there is a clear demand for the package of services that Ryman offers – and an existing pipeline of customers that are happy to pay for them.

That formed the backdrop for the recent Ryman Healthcare Investor Day, which I attended on behalf of NZSA. Notwithstanding the insight into the inner workings of a large retirement village, there were a number of themes that stood out – and that should be front of mind for existing and potential investors.

Overall, the company presented a strategic reset grounded in care, cashflow and capital discipline – all improving underlying sustainable earnings in the long-term. And in this context, long-term really does mean exactly that.

The Context

From market darling to fallen star – such has been the experience of the company over the last 5 years. There are three traditional core sources of value supporting the ‘continuum of care’ retirement model in New Zealand: development income from the development of new units, sales of existing units and provision of care services.

Care services are funded in large part by the NZ Government, augmented by additional fees charged to residents. The lack of government funding meant that the preferred driver of Ryman’s growth in the period leading up to FY23 was the development of new villages. In the early part of this decade, Ryman had 16 villages at various stages of development – not only a huge capital commitment by the company, but also masking deeper issues in terms of underlying cashflows and debt. The style of development did not help; a move into vertical development was less conducive to unit sales, as an entire building had to be finished before a sale could occur.

The mis-steps of the past ultimately resulted in a freshly-minted Board and a renewed Executive team, who have taken significant steps (including two capital raises) to shore up the Balance Sheet and repay debt.

Tellingly, Ryman delivered its first period of positive Free Cash Flow in over a decade during the first half of FY26, accompanied by increased reporting transparency and a ‘cleanout’ of eyebrow-raising accounting practices.

Like any “boom-bust” cycle, the frenetic pace of development means that Ryman has cut back its development expectations for the next few years, as demand ‘catches up’ with the company’s existing stock of units. The company expects to favour “brownfield” developments in New Zealand through the extension of existing sites but continues to pursue “greenfield” opportunities in Australia, where there is greater scope for expansion.

Key Messages

1 – Ryman’s product mix will inflect towards care services and serviced apartments

In the last few years, the much smaller Radius Residential Care (NZX: RAD) has formed something of a beacon for an industry (and investors) looking for sustainable returns from the provision of aged care services.

It seems that Ryman Healthcare is now hitching its wagon to an expected uptick in the level of revenue from the provision of aged care services.

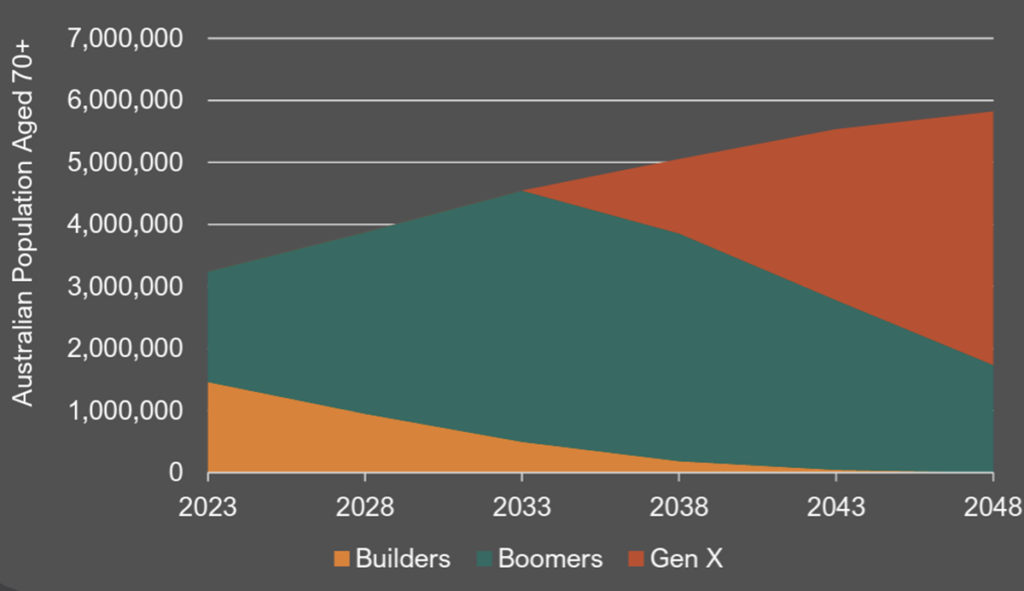

There are two key drivers: firstly, the potential for change in how the NZ Government funds aged care services and secondly, the provision of “ancillary services” through assisted living facilities to suit the new emerging demographic (Gen X) of retirement village customers.

There may yet be long-term upside in those expensive ‘vertical’ retirement villages, with apartments well-suited to either independent living or as “serviced apartment” options. Indeed, the company sees increased flexibility for residents in terms of ‘picking and choosing” the services they would like as a key growth driver. The trade-off for this service revenue opportunity will be the enhanced quality expectations of Ryman’s future Gen X customers, compared with previous generations.

Ryman is bullish around future changes to government funding, not least due to the recent changes in Australia that have formed something of a benchmark for New Zealand to consider.

From an investors perspective, there is still some political risk attached to this, with any proposed changes likely requiring bi-partisan support and also likely to catch the attention of NZ First leader Winston Peters.

Ryman’s is also bullish about expanding the range of non-government funded services able to be selected (and paid for) by residents. From a societal perspective, that enshrine’s what many are forecasting – an increasing divide between the retirement ‘have’s’ and the ‘have-nots’. From an investors’ perspective, it is likely to take some time to shift the mix of Ryman’s various offerings – and to develop the customer base that is likely to benefit.

Overall, Ryman expect to achieve per-bed EBITDAF of between $25k-$30k per annum in FY29, compared with today’s $15k.

The ability of the company to demonstrate success in execution against key implementation milestones will be critical, as will the ongoing evolution of the market in the way that Ryman expect.

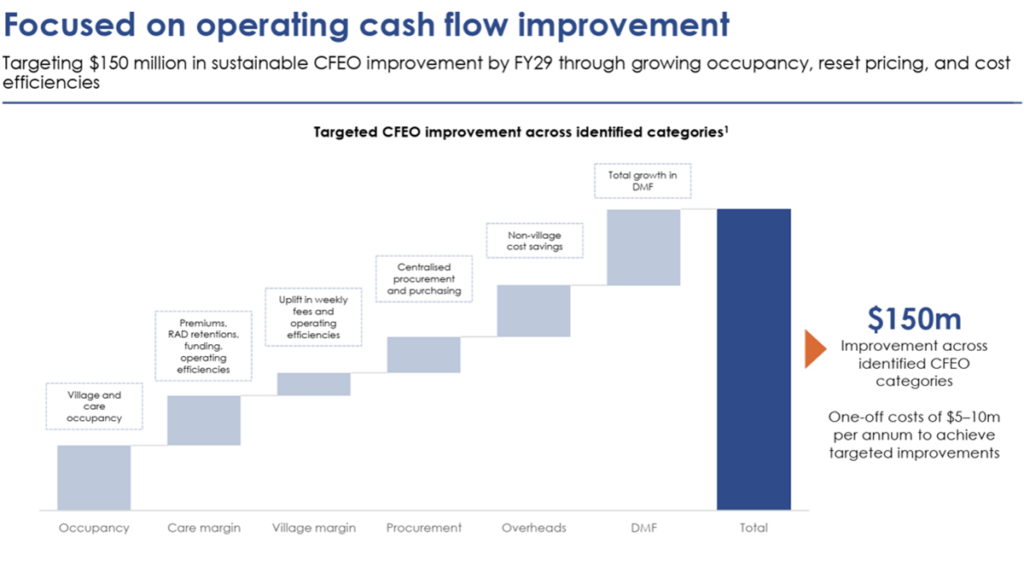

2 – Growth is on the agenda: but in collaboration with sustainable earnings recovery

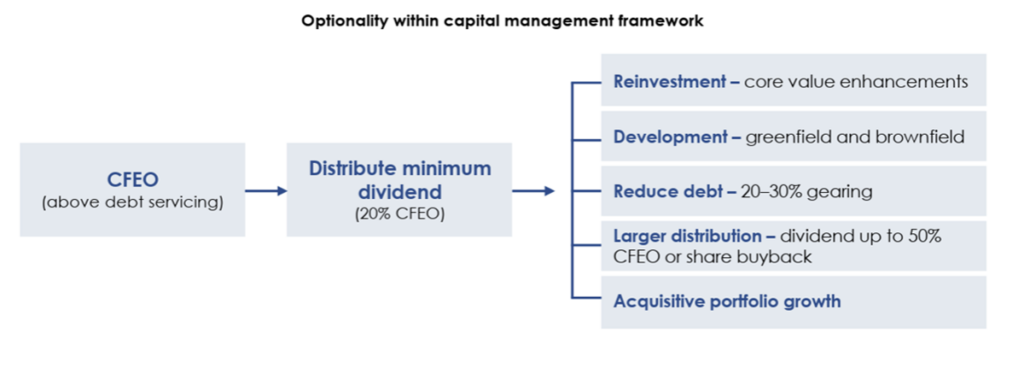

Ryman was clear that changes in its product mix will underpin near-term growth, with $150m in cashflow growth by FY29. But it also signalled that this transition towards resilient earnings was building a foundation for longer-term growth, reinforced by a new dividend policy set at a minimum of only 20% of cashflow from existing operations (CFEO).

This will offer optionality for future use of that cash – including acquistive growth.

Time will tell if investors offer Ryman the ‘license’ to pursue growth in future, but it is clear that the current executive and Board have no desire to repeat the poor capital allocation decisions of the past.

3 – No dividends until FY28

The clear message was that there would be no dividends before FY28. Even then, investors should expect to see cash retention by the company to support cautious growth.

This will be music to the ears of many long-term retail investors, who might have the ability to seek longer-term returns at a slightly higher risk profile. However, the timing of Ryman’s recovery (and eventual dividend flow) is less attractive to fund managers who compete to show the best returns on a yearly, quarterly and even a monthly basis.

For many fund managers, a certain other large listed retirement village operator is likely to offer more appeal, at least in the short term. Certainly, the immediate sahre price reaction to Ryman’s presentations appeared to highlight the different investment horizons between institutional and retail investors.

Interestingly, Ryman also noted the potential for share buybacks after that time, as an alternative means of improving ‘total shareholder return’. Given Ryman’s tax status, this position is likely to be well-supported by NZSA. More telling was the clear signal offered that the company wanted to retain cash from FY28 to support cautious growth, both organic and through acquisitions.

What this means for retail investors

For shareholders, the refreshed strategy represents the nail in the coffin from the previous asset-revaluation-driven investment case towards one grounded much more clearly in operating performance, cash generation and disciplined capital allocation.

That is music to NZSA’s ears, and reflects much of the engagement we have had with Ryman since 2021.

While this approach is likely to temper near-term development-led growth, it should improve the sustainability and resilience of futrue earnings, and reduces the reliance on favourable property cycles to sustain returns. The emphasis on recurring earnings, occupancy, pricing discipline and care margins should, if executed effectively, result in a more resilient earnings base across economic cycles.

It is also worth noting that the immediate market reaction following the investor day was mixed, particularly among wealth managers and institutional investors. As noted above, this appears less a rejection of the strategy itself than a reflection of differing time horizons and mandate constraints. Many institutional investors are focused on near-term earnings momentum and benchmark-relative performance, whereas Ryman’s refreshed strategy is explicitly framed around a multi-year operational and cashflow reset, with dividends not expected to resume until FY28.

In this context, retail investors are likely to play an important role in current share price stability. There is a likely cohort of retail investors are generally more aligned with longer holding periods, and the tolerance for the enhanced risk this implies.

And to be clear: there are risks. Will political outcomes provide a foundation to improve the returns from Ryman’s care offering? Will the company sell its overhang of units in a manner that does not depress development and/or resale margins? Will the market evolve towards a “service revenue basis” in the way that Ryman expects? Can the company deliver on its short-term milestones, to create the foundation for future growth?

Time will tell.

Oliver Mander

Oliver holds a small number of shares in Ryman Healthcare, purchased during 2025.