Welcome to the August 2022 edition of Scrip. We’re really pleased to have contributions in this edition from three different perspectives, highlighting potential pathways for companies to list and create their relationships with retail investors. Our thanks to Joshua Woo (JW Legal), Gavin Lonergan (Direct Capital) and Blair Harrison (ASX) for the time and thought they have put into their articles.

We know this is not fully representative; but nonetheless, we hope it is informative. There are multiple pathways open to New Zealand companies who are seeking greater investment – each with their own constraints and benefits.

The series of articles has, of course, turned out to be very timely. Are recent events at NZ Automotive (NZX: NZA) a symptom of a broader, underlying problem with the corporate maturity of companies coming to market? Just what will emerge from the recently-released consultation process kicked off by NZX on its rules and recommendations relating to capital raises? And how do the broader set of options available for NZ-based companies affect NZSA’s own set of best practice policy statements relating to capital raise?

Capital Raise

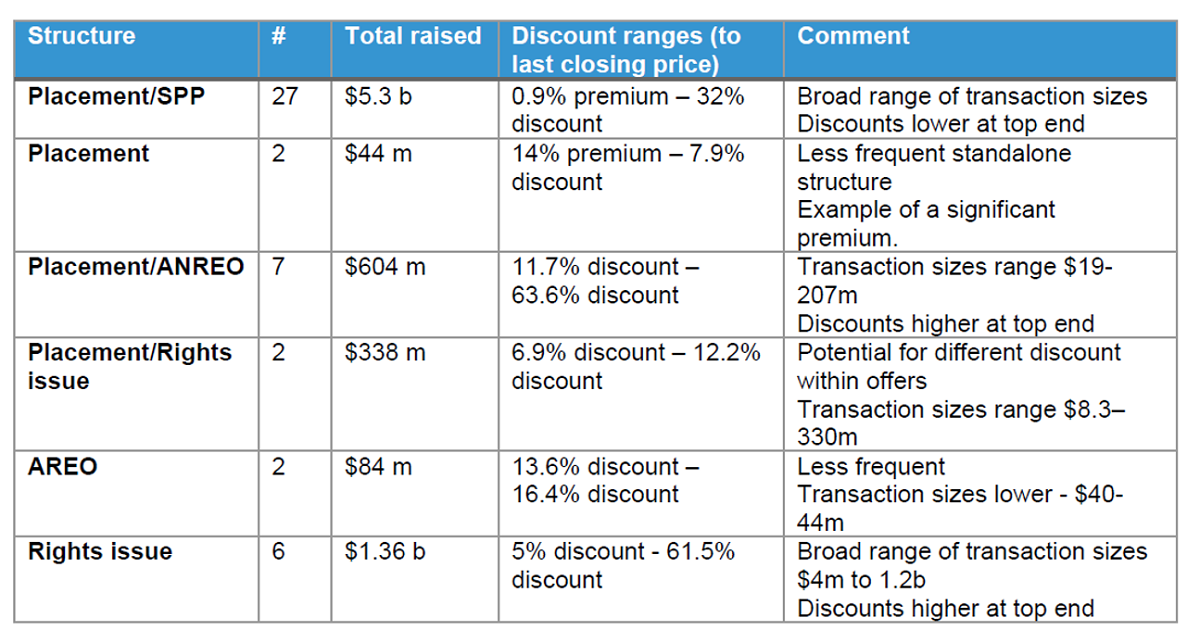

We’re not positing any answers to these questions just yet. But it’s an insight into the work coming up over the next few weeks. Regardless of the answer, we want to enhance and maintain the level playing field for retail investors. The table below, provided by NZX as part of their consultation paper, gives an insight into the nature of capital raises completed in New Zealand since early 2020. This represents a signficant departure from NZSA’s policy, solely focused on pro-rata renounceable offers.

In the competition for listings, the forms of secondary market capital raise methodologies highlights a key difference between the ASX and NZX: an ANREO structure (accelerated, non-renounceable rights offer) is the most popular form of secondary market capital raise methodology in Australia. Could the chase for new listings on this side of the Tasman result in some imperfect consequences for retail investors? Possibly. For now at least, the NZ investment ecosystem and its principles are heavily dependent on what the behemoth that happens to be our closest neighbour does.

Expansion of coverage for investors

There is one thing already apparent – NZSA will be required to continue to expand the range of its assessments, supporting shareholders who now have the ability to invest in many different forms. We’ve already started – our assessments of companies, and the relatonships that support them, now extend across nearly the entire NZX. Unlisted (USX) companies are covered as are all NZ-based companies listed on the ASX.

But we can’t stop there. The emergence of Sharesies, the continued increase in the provision of DIMS (discretionary investment management services) platforms and the establishment of new exchanges (like Catalist) mean that our role must expand to ensure that the rights of shareholders can be effectively represented – no ,matter where they choose to make their investment decisions.

That means we are likely to run head on into the key differences, compliance requirements and philosophies that define the principles of different public (and private) markets available for New Zealanders.

Oliver Mander