NZSA Disclaimer

This morning, the market woke to news of a $525m capital raise from Contact Energy, as well as the company’s 1H26 financial report. The raise comprises a $450m underwritten institutional placement and a $75m share purchase plan (SPP) targeting retail shareholders.

The company has reserved the right to accept oversubscriptions for the SPP. Pricing for the SPP will be the lower of the Placement price or the 2.5% discount to the 5-day VWAP of Contact on the NZX over the five trading day period up to, and including, the closing date of the Retail Offer.

There are a few quick ‘take-outs’ for NZSA, all of which relate in some way to the capital management challenges facing the sector.

Purpose

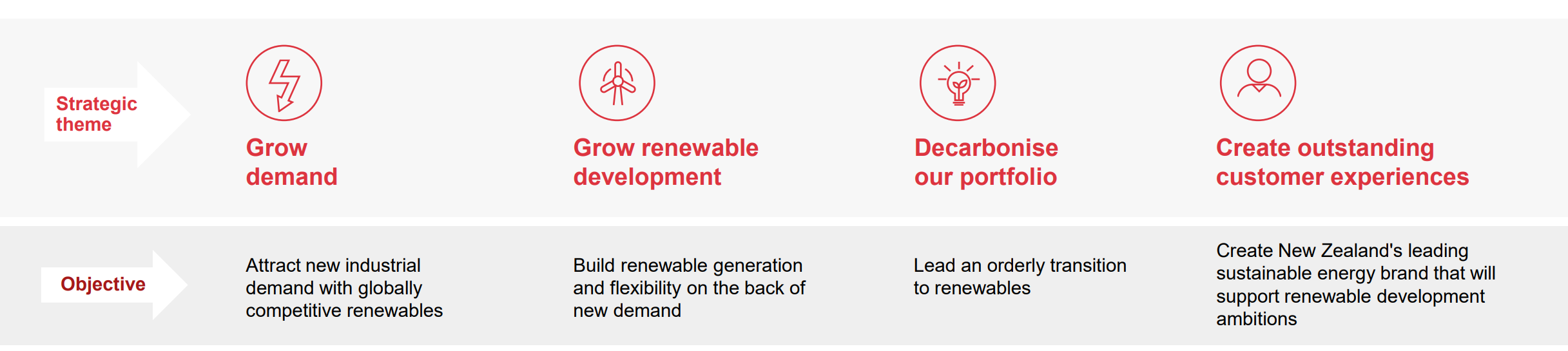

The purpose of the capital raise is to allow the company to invest in new generation projects. With the industry facing massive investment thanks to demand growth and the changing nature of electricity generation, NZSA sees this as long overdue. For Contact specifically, the capital raise supports the company’s own growth ambitions under its ‘Contact 31’ strategy (see image below) – the focus on growth in renewables development and de-carbonisation has always signalled a capex-intensive approach to market transition, whatever form of funding stream is used to support that.

We’ve noted with interest the government’s statements in late 2025 that they would support a capital raise by the 3 ‘mixed ownership’ companies (Meridian, Mercury, Genesis). We have also seen evidence of new players to the industry investing in new electricity generation assets. Last year, the audience at an NZSA event featuring the CEO’s of the four major gentailers was left under no illusions: the sector was facing a $30 billion capital investment requirement to address new generation challenges head on.

Financials

It is great to see the reduction in Contact’s debt ratios, with the Debt/Equity ratio falling from a high of 1.47 in June 2025 to a much more pleasant 1.19 as at December 2025. This step change has likely been driven by the share-based nature of the Manawa Energy takeover completed during late 2025. Nonetheless, total debt has increased as the company also used its leverage to support that acquisition.

Both profitability and earnings per share seem strong in the context of wider sector performance, perhaps reflecting what Contact told us at the time of the Manawa acquisition: that the assets of the respective companies were neatly correlated to reduce earnings volatility.

It’s likely the capital raise will support further balance sheet stability.

Dividend and Cash

Contact has announced a $0.16 dividend, with an “ex-date” designed to exclude the new shares issued under both the placement and the SPP. Fair enough too, that is last year’s business.

However, NZSA continues to believe that the level of dividend (for both Contact and its sector peers) should be considered in the context of the sector’s wider capital management requirements. A $0.16 dividend is equivalent to a nearly $160m payment obligation for Contact (admittedly, before the impact of any dividend reinvestment is taken into account) – paid at the same time that the company is raising $525m targeting future-focused investment.

While Contact’s role in the market, like other gentailers, has traditionally been as a defensive, dividend-yielding share, NZSA would prefer to see a more ‘sustaining’ approach to balancing dividends, capex needs / growth and debt. We do acknowledge that this represents a different approach to the sectors current ‘separation’ of income and capital cash flows. Currently, Contact’s dividend policy is based on 80-100% of operating cashflows; we’re curious to explore whether using a measure of free cashflow (FCF), coupled with a lower payout ratio, will support an enhanced growth profile of the company over the next decade.

While this approach may reduce dividends in the short-term, a focus on ‘total shareholder returns’ (including share price growth) is likely to serve shareholders more efficiently over the longer-term by reducing transaction costs associated with capital transactions and creating greater investment flexibility for Contact.

For some shareholders in the sector, well-trained to high dividend yield expectations (including the Government with its large shareholding in Contact’s sector peers), this may be a challenging concept. But it also reflects the changing nature of energy generation in New Zealand, and the growth opportunity on offer. The high dividend expectations of shareholders may well limit the opportunities available to the current sector incumbents, creating a short-term sugar hit at the expense of long-term value.

Capital Raise structure

For shareholders though – whether you participate or not – it is important to make an ‘active’ decision. The nature of a share purchase plan means that any non-participation will result in dilution; this a differnet structure to a renounceable rights issue, where shareholders have the potential to realise value whether they participate or not.

The key question is what dilution might look like in value terms.

For some shareholders, that equation might make sense: save the cash outlay required to invest right now, but still maintain dividends and potentially suffer a smaller post-capital raise share price. Using an estimated price of $8.75 (the low end of any placement), the actual value loss on a per share basis could be very small. Dividends per share may take a hit in the short-term, as new projects come to fruition, but are likely to be value accretive longer term.

On the other hand, participating in the capital raise will see a shareholder part with cash right now, but also offer exposure to the potential upside of new investments.

Many large companies raised capital during 2025. However, this is the largest capital raise in some time that is focused on optimising growth funding; a likely reason for the relatively small discount to the prevailing share price. For many shareholders, participating (or not) in a large NZX capital raise focused on growth could be something of a novel concept.

Let’s hope it becomes less novel.

Oliver Mander