If you’re not yet a member, join now for access to a whole lot more!

November 8th 2025

KMD Brands Ltd (KMD)

The company will hold its Annual Shareholders Meeting at 10.00am Wednesday 19 November 2025.

The location is MUFG Pension & Market Services, Level 30, PwC Tower, 15 Customs Street West, Auckland.

You can also join the meeting online at this link.

Company Overview

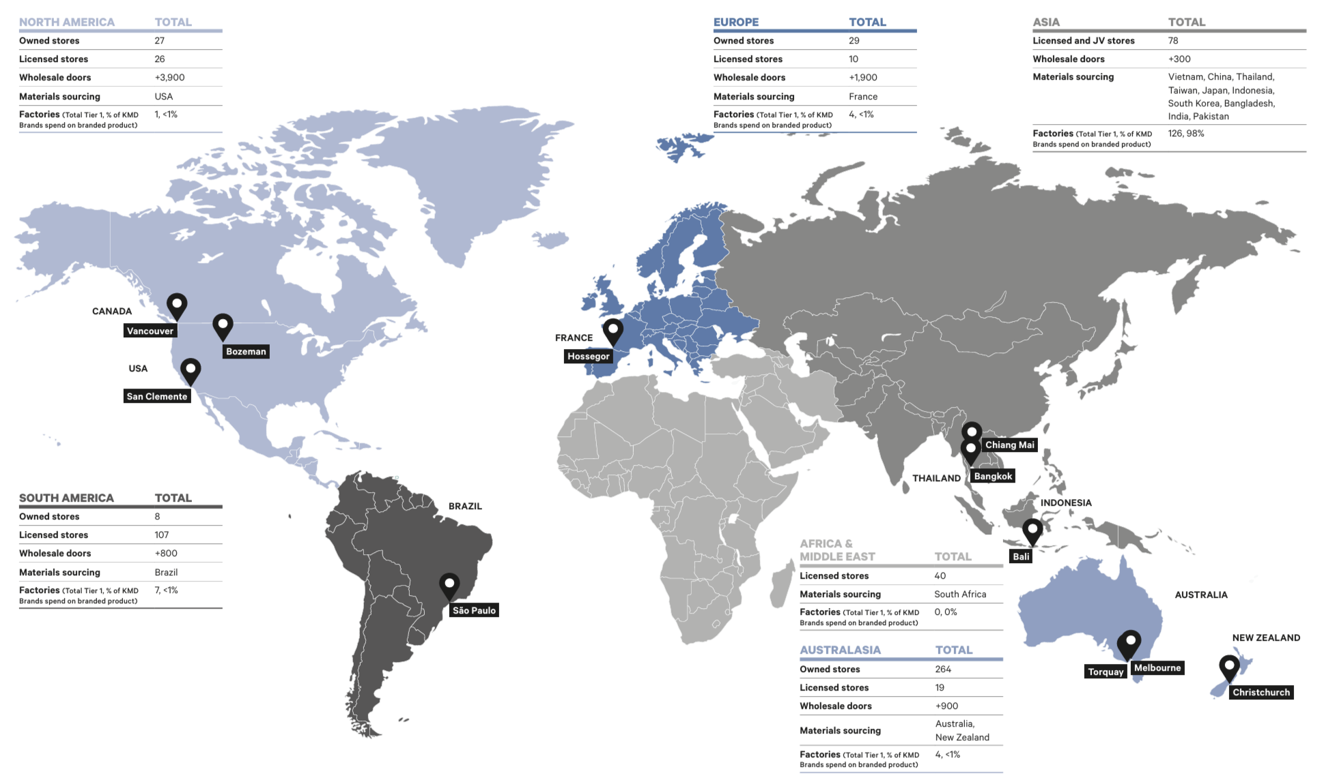

The company was founded in 1987 and listed on the NZX and ASX in 2009. It retails specialist outdoor clothing under the Kathmandu and Rip Curl brand, and footwear under the Oboz brand. It operates a combination of owned stores, licensed stores, joint venture stores, wholesale distributors and online sites in New Zealand, Australia, North and South America, Europe, Asia, Africa, and the Middle East.

In March 2025, the company announced Brent Scrimshaw, who had been appointed to the Board in October 2017, would replace Michael Daly as CEO and Managing Director.

Current Strategy

As of September 2025, the company has adopted a new strategy (announced to the market at at this link). The core basis is:

- Sustainable profitability (including a cost reset, restructure and store network review).

- Product innovation

- Energise the store portfolio (including a ‘refresh’ of the Kathmandu stores)

- Re-imagining digital and data intelligence (data-led decision making and supply chain).

Disclaimer

To the maximum extent permitted by law, New Zealand Shareholders Association Inc. (NZSA) will not be liable, whether in tort (including negligence) or otherwise, to you or any other person in relation to this document, including any error in it.

Forward looking statements are inherently fallible.

Information on www.nzshareholders.co.nz and in this document may contain forward-looking statements and projections. For any number of reasons, the future could be different – potentially materially different. For example, assumptions may be wrong, risks may crystallise, unexpected things may happen. We give no warranty or representation as to any future financial performance or any other future matter. We may not update our website and related materials for changes.

There is no offer or financial advice in our documents/website.

Information included on www.nzshareholders.co.nz and in this document is for information purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any person’s individual circumstances or objectives. Prior to making any investment decision, NZSA recommends that you seek professional advice from a licensed financial advice provider.

There are no representations as to accuracy or completeness.

The information, calculations and any opinions on www.nzshareholders.co.nz and in this document are based upon sources believed reliable. The NZSA, its officers and directors make no representations as to their accuracy or completeness. All opinions reflect our judgement on the date of communication and are subject to change without notice.

Please observe any applicable legal restrictions on distribution

Distribution of our documents and materials on www.nzshareholders.co.nz (including electronically) may be restricted by law. You should observe all such restrictions which may apply in your jurisdiction.

Key

The following sections calculate an objective rating against criteria contained within NZSA policies.

|

Colour |

Meaning |

|

G |

Strong adherence to NZSA policies |

|

A |

Part adherence or a lack of disclosure as to adherence with NZSA policies |

|

R |

A clear gap in expectations compared with NZSA policies |

|

n/a |

Not applicable for the company |

Governance

NZSA assessment against its key policy criteria are summarised below.

|

G |

Directors Fees: There is no disclosure as to whether retirement benefits or special exertion payments are available for Directors (or the circumstances under which they may be available), although we note that the Annual Report shows that no “other benefits” were paid to Directors.

|

G |

Director Share Ownership: Directors are not required to own shares, a position supported by NZSA. NZSA’s position is that this whilst this should be encouraged, it should be left to individual Directors depending on their circumstances.

|

R |

CEO Remuneration: The company discloses its remuneration policy on its website, which includes an overview of the remuneration philosophy applicable to the company. The People and Remuneration Committee is responsible for implementing the policy.

Incentives: The new CEO is paid a short-term incentive (STI) in cash and a long-term incentive (STI) by way of Performance Share Rights. He was also paid a sign-on bonus of $600,000 to purchase shares. NZSA does not favour such payments as past experience indicates that such payments have added no value to shareholders in the longer term. NZSA maintains that the CEO should be paid for past performance and value delivery, not on the expectation of future performance.

NZSA encourages fulsome disclosure in relation to any incentive payments made to the CEO, including disclosure of measures (or measure ‘groups’), weightings, targets, and the level of achievement versus target for each component associated with any awards. This methodology is supported by the new NZX Remuneration Reporting Template.

KMD Brands’ CEO Remuneration disclosure is amongst the worst of the NZ50.

The maximum STI is 90% of base salary. While the measures are disclosed, there is no disclosure of the weighting and level of achievement against each component.

Performance rights are awarded under the LTI at 150% of base salary. Vesting then occurs after a three-year performance assessment period. Measures include total shareholder returns which is favoured by NZSA. However, it is unclear from disclosures as to what LTI was actually paid in FY25 – given the change in CEO, NZSA expects that there were no payments.

NZSA is supportive of the weighting towards LTI for the CEO, in alignment with the long-term interests of shareholders.

We encourage KMD to look at the tables contained within the NZX template as a guide to support future CEO remuneration disclosures, in particular highlighting the differences between remuneration earned/awarded as compared to that paid/vested.

The company discloses both the gender pay gap and CEO/employee remuneration ratio.

Golden Parachutes: In the interests of transparency, NZSA believes there should be explicit disclosure around the severance terms and notice periods associated with the CEO, including whether specific termination payments are offered.

|

G |

Director Independence: A majority of the Directors are independent.

|

A |

Board Composition: Whilst the Annual Report includes a ‘collective’ skills matrix it does not attribute skill sets to individual Directors to demonstrate how they contribute to the governance of the company.

The company does not participate in the IoD’s Future Director (or similar) programme designed to develop and mentor the next generation of Directors. NZSA expect NZX50 companies to participate as part of a responsibility to develop and mentor the next generation of Directors.

The CEO is also a Director. NZSA believes there should be a clear separation between governance and management and that the CEO should report to the Board, not be a first amongst equals.

The nature of the company’s board indicates a commitment to thought, experiential and social diversity, with relevant experience for KMD Brands.

|

A |

Director Tenure: NZSA looks for evidence of ongoing succession or ‘staggered’ appointment dates that reduce the risks associated with effective knowledge transfer in the event of succession. We also prefer a term maximum of 9-12 years, unless there are exceptional circumstances that may apply.

The Chair David Kirk was appointed in November 2013. We would expect to see some indication of his future tenure as a demonstration of good succession planning. The other Directors appointment dates range from 2017 to 2022.

|

G |

ASM Format: KMD Brands Ltd is holding a ‘hybrid’ meeting, (i.e., physical, and virtual), a format preferred by NZSA as a way of promoting shareholder engagement while maximising participation.

|

A |

Independent Advice for the Board & Risk Management: NZSA looks for evidence, through disclosures, that a Board has access to appropriate internal and external expertise to support board assurance activities. We also look for evidence that Boards are across their risk management responsibilities.

The Board Charter notes that the Company Secretary has unfettered access to the Board, and vice versa and that Directors are able to seek external advice with the prior approval of the Chair. The Corporate Governance Statement notes that the internal audit function has been scaled back due to resource constraints, but the company considers that it has sufficient systems for evaluating and continually improving the effectiveness of its risk management and internal processes.

KMD offers a materiality matrix that describes the key issues facing the company, as well as its impact on the environment.

However, there is more limited disclosure of the key business risks and their mitigations. There is some disclosure of risk management and governance processes, including a (short) risk management policy.

Audit

NZSA assessment against its key policy criteria are summarised below.

|

G |

Audit Independence: Good disclosure.

|

G |

Audit Rotation: The company is one of very few that not only ensures the Lead Audit Partner is rotated at 5 years as required by the NZX Listing Rules but also discloses the date that the Lead Audit Partner and Audit firm was appointed (both 2021).

Environmental Sustainability

KMD Brands have not yet released their Sustainability Report; this will be published later in November. NZSA encourages the company to align reporting dates of financial and sustainability reporting in future. Disclosures from FY24 indicate the company offers a strong approach to environmental sustainability disclosures.

Ethical and Social

NZSA assessment against its key policy criteria are summarised below.

|

G |

Whistleblowing: Good disclosure.

|

G |

Political Donations: The company does not make political donations, as per its Code of Ethics

Financial & Performance

|

Policy Theme |

Assessment |

|

Capital Management |

G |

|

Takeover or Scheme |

n/a |

Kathmandu’s share price fell from $0.48 to $0.30 (as of 22nd October 2025) over the last 12 months – a 38% decline. This compares unfavourably with the NZX 50 which rose 4% in the same period. The capitalisation of KMD is $214m placing it 70th out of 115 companies on the NZX by size and makes it a mid-sized company.

|

Metric |

2021 |

2022 |

2023 |

2024 |

2025 |

Change |

|

Revenue |

$922.8m |

980.0m |

$1,103m |

$979m |

$989m |

1% |

|

EBITDA |

$208.0m |

$180.0m |

$200.1m |

$107.2m |

$50.6m |

-53% |

|

NPAT |

$63.4m |

$36.8m |

$36.7m |

-$48.3m |

-$93.6m |

n/a |

|

GP Margin |

59% |

59% |

59% |

59% |

57% |

-4% |

|

Inventory Turnover |

1.71 |

1.57 |

1.54 |

1.45 |

1.65 |

14% |

|

EPS1 |

$0.089 |

$0.051 |

$0.05 |

-$0.07 |

-$0.134 |

n/a |

|

PE Ratio |

18 |

21 |

17 |

n/a |

n/a |

|

|

Capitalisation |

$1,127m |

$747m |

$598m |

$313m |

$214m |

-32% |

|

Current Ratio |

1.86 |

1.80 |

1.78 |

1.60 |

1.39 |

-13% |

|

Debt Equity |

0.79 |

0.83 |

0.82 |

0.85 |

0.96 |

12% |

|

Operating CF |

$183.1m |

$81.8m |

$147.6m |

$144.7m |

$126.2m |

-13% |

|

NTA Per Share1 |

$0.18 |

$0.18 |

$0.19 |

$0.15 |

$0.09 |

-41% |

|

Dividend1 |

$0.05 |

$0.06 |

$0.06 |

$0.00 |

$0.00 |

n/c |

1 per share figures based off actual shares at balance date (not weighted average)

FY 25 continued the trend seen in FY24 with another disappointing year financially. The value of the stock declined dramatically on metrics that also declined across the board. The retail sector by all accounts has had a torrid time with cost-of-living pressures being felt in many jurisdictions and continues to do so.

Operating revenues rose 1% to $989m, but EBITDA declined 53% to $50.6m the lowest level we have seen. This is in stark contrast to the $200.1m reported in 2023. This was adversely affected by a goodwill impairment of $40.3m.

NPAT was -$93.6 providing EPS of -$0.134. KMD continued their goodwill impairment (a non-cash expense) and this amounted to $45.4m.

The gross profit margin fell slightly to 57% as margin contraction was felt across the retail sector. Inventory turnover rose to 1.65 but inventory levels did fall. Inventories were down to $254m and this flattered the operating cashflow which fell 13% to $126.1m. The large disparity between operating cashflow and profit can be explained by high depreciation expenses. For FY25, KMD had depreciation of $131m.

Although the financial results were disappointing, the company remains in a sound financial position with the current ratio at 1.60, and debt equity at 0.85. NTA per share is $0.15 owing to the large amounts of intangible assets ($667m) that KMD have on the books. Intangibles are mainly made-up Goodwill and Brands.

Dividends were not paid for the year (as per 2024) as the company posted a loss. The dividend policy remains aligned to earnings profile, with a target payout ratio 50% to 70% of underlying NPAT.

In an investor presentation released to market in conjunction with their annual results the company provide a trading update for the month of August where sales were up 10.5% over last year. KMD also state that “Wholesale sales trends are improving, but global uncertainty remains”.

The top 20 shareholdings are widely held by a variety of institutional investors. As of July 31st, Allan Gray Group was the largest shareholder with a 17.77% stake. Outside of the top 20, shares are widely held.

Resolutions

1. To re-elect Andrea Martens as an Independent Director.

Andrea Martens was appointed to the Board 1 August 2019. There is a comprehensive biography in the Notice of Meeting.

We will vote undirected proxies IN FAVOUR of this resolution.

2. That the Board is authorised to fix the auditor’s remuneration for the coming year.

This is an administrative resolution.

We will vote undirected proxies IN FAVOUR of this resolution.

Proxies

You can vote online or appoint a proxy at https://vote.cm.mpms.mufg.com/KMD/

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 10.00am Monday 17 November 2025.

Please note you can appoint the Association as your proxy. We will have a representative attending the meeting.

The Team at NZSA