If you’re not yet a member, join now for access to a whole lot more!

20 October 2025

Move Logistics Limited (MOV)

The company will hold its Annual Shareholders Meeting at 2.00pm Thursday 30 October 2025.

The location is MUFG Pension & Market Services Level 30 PwC Tower 15 Customs Street West Auckland.

You can also join the meeting online at this link.

Company Overview

The company is one of the largest freight and logistics operators in New Zealand with a nationwide network of 39 facilities made up of branches, depots, cross-docks, and warehouses. Its operations cover Freight, Warehousing and Logistics, International, Specialist Lifting and Transport and Fuel. It employs over 800 people and has a fleet of over 500 trucks. It is listed on the ASX.

Paul Millward was appointed CEO in February 2025 after acting as interim CEO following the resignation of Craig Evans in September 2024.

Current Strategy

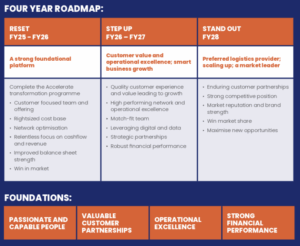

The company offers a clear articulation of its vision, aiming to be the “preferred freight and logistics company in Aotearoa New Zealand”. This is supported by some clear goals as well as a 4-year roadmap.

Disclaimer

To the maximum extent permitted by law, New Zealand Shareholders Association Inc. (NZSA) will not be liable, whether in tort (including negligence) or otherwise, to you or any other person in relation to this document, including any error in it.

Forward looking statements are inherently fallible.

Information on www.nzshareholders.co.nz and in this document may contain forward-looking statements and projections. For any number of reasons, the future could be different – potentially materially different. For example, assumptions may be wrong, risks may crystallise, unexpected things may happen. We give no warranty or representation as to any future financial performance or any other future matter. We may not update our website and related materials for changes.

There is no offer or financial advice in our documents/website.

Information included on www.nzshareholders.co.nz and in this document is for information purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any person’s individual circumstances or objectives. Prior to making any investment decision, NZSA recommends that you seek professional advice from a licensed financial advice provider.

There are no representations as to accuracy or completeness.

The information, calculations and any opinions on www.nzshareholders.co.nz and in this document are based upon sources believed reliable. The NZSA, its officers and directors make no representations as to their accuracy or completeness. All opinions reflect our judgement on the date of communication and are subject to change without notice.

Please observe any applicable legal restrictions on distribution

Distribution of our documents and materials on www.nzshareholders.co.nz (including electronically) may be restricted by law. You should observe all such restrictions which may apply in your jurisdiction.

Key

The following sections calculate an objective rating against criteria contained within NZSA policies.

|

Colour |

Meaning |

|

G |

Strong adherence to NZSA policies |

|

A |

Part adherence or a lack of disclosure as to adherence with NZSA policies |

|

R |

A clear gap in expectations compared with NZSA policies |

|

n/a |

Not applicable for the company |

Governance

NZSA assessment against its key policy criteria are summarised below.

|

G |

Directors Fees: The company does not disclose whether share options are offered. The Board Charter allows the payment of special exertion benefits, noting “that additional allowances be paid to a non-executive director, as appropriate, to reflect additional services provided to MOVE Logistics”. Julia Raue was paid additional fees in FY25, with the details disclosed.

We note a consultancy fee of $196,801 was paid to Greg Kern in FY25, a former director who stepped down within the financial year. No Directors fees were paid.

|

G |

Director Share Ownership: There is no formal requirement for Directors to own shares. Two of the three Directors own shares.

|

A |

CEO Remuneration: The company discloses its remuneration policy on its website, which includes an overview of the remuneration philosophy applicable to the company. The Governance and Remuneration Committee are responsible for implementing the policy.

Incentives: The CEO is paid base remuneration, a short-term incentive (STI) in cash and a long-term incentive (LTI) through performance rights awarded in February 2025.

NZSA encourages fulsome disclosure in relation to any incentive payments made to the CEO, including disclosure of measures (or measure ‘groups’), weightings, targets, and the level of achievement versus target for each component associated with any awards. This methodology is supported by the new NZX Remuneration Reporting Template.

The STI is awarded at a target of 30% of base salary. The measures, weightings, and level of achievement against each component are well-disclosed, with the overall STI award being made at 82.5% of target. NZSA notes the strong weighting of STI towards financial performance.

The LTI scheme is based on an award of 1.3 million shares in February 2025, vesting in June 2028 provided he maintains employment with the company. The fair value at grant date was assessed as 25c per share based on the market price adjusted for non-vesting conditions. The shares are currently trading at 21 cents.

The relationship of award to base salary is not explicitly disclosed, nor are we clear as to whether this forms part on an ongoing annual award.

NZSA does not favour a long-term incentive (LTI) based solely on tenure, with no other vesting conditions. We believe a long-term incentive should contain an element of total shareholder returns (TSR) preferable referenced to either the NZX or a comparator group of companies’ performance.

The company does not disclose the gender pay gap or the CEO/employee remuneration ratio.

Golden Parachutes: In the interests of transparency, NZSA believes there should be explicit disclosure around the severance terms and notice periods associated with the CEO, including whether specific termination payments are offered.

|

G |

Director Independence: A majority of Directors are independent.

|

G |

Board Composition: The Board comprises an independent Chair, an independent Director and a non-independent Director. We note the Annual Report “While the Board believes that five Directors is appropriate for a company the size and scale of MOVE, the recruitment of additional Directors has been paused while the business transformation is underway. The Board is confident that the current Directors have the skills to oversee the turnaround of MOVE and that the reduced size and cost savings will benefit shareholders during this period.”

The Annual Report includes a skills matrix; however, it does not attribute skill sets to individual Directors to demonstrate how they contribute to the governance of the company.

We do appreciate the transparent disclosure around the ‘moderate’ assessment of capability associated with ‘marketing’ and ‘diversity’ skills. In prior discussions with NZSA, MOV noted that their Board had undergone an independent review of their skills and their relationship to the skills matrix.

We expect the eventual appointment of one-two new Directors will cover the gaps in the skills matrix.

The nature of the company’s board indicates a commitment to thought, experiential and social diversity, with relevant experience for MOVE.

|

G |

Director Tenure: NZSA looks for evidence of ongoing succession or ‘staggered’ appointment dates that reduce the risks associated with effective knowledge transfer in the event of succession. We also prefer a term maximum of 9-12 years, unless there are exceptional circumstances that may apply.

Director appointment dates are 2023 and 2024 so this is a very new Board. We recognise and understand the circumstances that have created the situation however it will be important to establish some ongoing stability to ensure orderly governance into the future.

|

G |

ASM Format: Move Logistics Limited is holding a ‘hybrid’ meeting, (i.e., physical, and virtual), a format preferred by NZSA as a way of promoting shareholder engagement while maximising participation.

|

G |

Independent Advice for the Board & Risk Management: NZSA looks for evidence, through disclosures, that a Board has access to appropriate internal and external expertise to support board assurance activities. We also look for evidence that Boards are across their risk management responsibilities.

We note the Board Charter disclosure that “a committee or individual director may retain and consult with external advisers (including legal) at MOVE Logistics’ expense where the committee or individual deems it necessary to carry out its, his or her functions, with the approval of the Chair of the Board.” The Charter also states that the Board may rely on advice provided by internal staff. It is less clear, however, as to the extent that internal assurance staff have unfettered access to the Board.

The company offers thorough disclosure of financial, business, and operational risks (and their mitigations), and the processes by which these are governed.

Audit

NZSA assessment against its key policy criteria are summarised below.

|

G |

Audit Independence: Good disclosure.

|

G |

Audit Rotation: The company ensures the Lead Audit Partner is rotated at 5 years as required by the NZX Listing Rules. Then company discloses that the audit firm (PwC) was appointed in 2017 with the Lead Audit Partner appointed in 2021.

Environmental Sustainability

|

G |

Overall approach: MOVE Logistics has taken tangible steps forward in its climate reporting for FY2025. NZSA recognises that MOVE has aligned its climate disclosures to the four-pillar framework and provided detailed scenario analysis and emissions inventories across Scopes 1, 2 and 3. MOVE’s reporting makes clear that it has not yet developed a formal transition plan or long-term adaptation roadmap.

MOVE has taken several commendable steps outside the scope of mandatory climate disclosures. These include a 94-hectare native reforestation project, planning for a 5 MW solar array, improved waste and energy monitoring, and initiatives to optimise fleet efficiency and reduce resource use.

|

G |

Sustainability Governance: Climate issues are governed at the board level, with oversight delegated to the Risk Assurance and Audit Committee (RAAC). Climate risks are discussed alongside other business risks, and the board receives regular updates through management reporting and the CFO’s monthly GHG updates. A cross-functional Sustainability Committee also plays a role in day-to-day implementation. A board skills matrix includes “corporate social responsibility”, though further transparency on specific sustainability competencies would be welcomed. NZSA considers the governance framework to be sound, but notes that MOVE is still building its internal capability in this area.

|

A |

Strategy and Impact: MOVE has conducted climate scenario analysis based on the transport sector framework, considering short-, medium- and long-term horizons. Three divergent climate pathways were modelled and applied to its business model, and material physical and transition risks have been identified and integrated into the enterprise risk register. MOVE has outlined several near-term emissions-reduction activities, such as route optimisation, fleet upgrades and multi-modal freight, but has not yet disclosed a long-term transition strategy.

While NZSA acknowledges the operational challenges in decarbonising heavy logistics, we encourage MOVE to disclose a formal roadmap to support its 2030 targets.

|

G |

Risk and Opportunity: MOVE discloses a comprehensive range of climate-related risks and opportunities. However, for a number of identified risks and opportunities, no current initiative is yet in place. NZSA supports MOVE’s approach to climate risk assessment and encourages continued development of mitigation responses and wider integration into capital allocation and strategic planning.

|

G |

Metrics and Targets: MOVE has set 2030 emissions reduction targets for Scopes 1, 2 and 3 aligned to a 1.5°C pathway. GHG inventories are reported for four consecutive years, including intensity metrics. Progress toward targets is quantified, with FY25 data showing meaningful reductions from the FY22 base year, particularly for Scopes 1 and 2. While MOVE does not yet disclose interim milestones or a staged plan for target delivery, its performance suggests progress is being made. NZSA encourages the company to formalise progress markers and link targets more clearly to internal operational KPIs and future investment planning.

|

G |

Assurance: MOVE’s Scope 1 and 2 emissions received reasonable assurance in FY25, and Scope 3 received limited assurance. NZSA considers this level of assurance appropriate at this stage, but in future, encourages MOVE to broaden assurance coverage beyond emissions to include climate-related governance and risk disclosures, to align with evolving best practice.

Ethical and Social

NZSA assessment against its key policy criteria are summarised below.

|

G |

Whistleblowing: Good disclosure.

|

A |

Political Donations: Whilst the Annual Report discloses donations there is no disclosure around whether political donations are made, NZSA expects an explicit disclosure.

Financial & Performance

|

Policy Theme |

Assessment |

|

Capital Management |

G |

|

Takeover or Scheme |

n/a |

MOVE’s share price was steady at $0.21 (as of 8th October 2025) over the last 12 months. This compares unfavourably with the NZX 50 which rose 7% in the same period. The capitalisation of MOV is $27m placing it 94th out of 114 companies on the NZX by size and makes it a small company.

|

Metric |

2021 |

2022 |

2023 |

2024 |

2025 |

Change |

|

Revenue |

$356.8m |

$349m |

$348m |

$302m |

$289m |

-4% |

|

Operating Profit |

$13.4m |

$8.7m |

$2.1m |

-$35.1m |

-$3.0m |

n/a |

|

NPAT2 |

$0.9m |

-$4.2m |

-$5.8m |

-$47.2m |

-$14.9m |

n/a |

|

EPS1 |

$0.01 |

-$0.036 |

-$0.056 |

-$0.377 |

-$0.122 |

n/a |

|

PE Ratio |

175 |

n/a |

n/a |

n/a |

n/a |

|

|

Capitalisation |

$130m |

$145m |

$86m |

$27m |

$27m |

n/c |

|

Current Ratio |

0.46 |

1.17 |

0.83 |

0.55 |

0.60 |

9% |

|

Debt Equity |

7.9 |

3.48 |

3.08 |

9.38 |

19.50 |

108% |

|

Operating CF |

$43.2m |

$33.9m |

$38.4m |

$18.7m |

$25.3m |

36% |

|

NTA Per Share1 |

$0.19 |

$0.47 |

$0.47 |

$0.20 |

$0.08 |

-61% |

|

Dividend1 |

n/a |

n/a |

n/a |

n/a |

n/a |

|

1 per share figures based off actual shares at balance date (not weighted average)

2 Attributable to Shareholders of the Company

The accounts are consolidated, meaning that MOVE’s subsidiaries where a controlling interest is held are 100% incorporated in the financial statements, with a deduction for minority interests

It would not be an understatement to say MOV still suffer from unprofitable operations and a balance sheet problem. This was the 4th consecutive year of reporting a loss. The debt-equity ratio has also ballooned to 19.50, based on a sharp 58% decline in equity from $27.2m to $11.4m. We note that IFRS 16 exacerbates the issue, with a high proportion of leases.

The company has managed to restructure its debt, and most of the current portion we commented on last year has been re-classified as non-current. Notwithstanding this, the total interest-bearing debt is still high at $23.2m, with $5.3m being current.

There is more information on these debt facilities in note 12.5 on pages 67-68 of the annual report. The company has provided good transparency on the key banking covenants they face, although borrowing costs themselves are not disclosed. Given the nature of the company’s balance sheet, this would form key information for shareholders.

Operational difficulties remain. Group revenues fell a further 4% to $289m, but pleasingly operating expenses declined by 13.4%. While resulting in an operating loss of -$2.9m, this was a significant improvement on last year’s -$35.1m. After adjusting for finance expenses and tax the company posted a NPAT attributable to shareholders of the company of -$14.9m delivering EPS of -$0.122.

Also on a positive note, Operating cashflows are in the black, and rose 36% to $25.3m. It must be noted that although the company has made a loss, there are large depreciation components which explain the disparity between NPAT and Operating cashflow. Depreciation for FY25 was $32.9m.

NTA per share fell to $0.08 and MOV trades at a 167% premium to their NTA.

A results presentation, released in conjunction with their annual results, provides some forward looking statements and a strategy for growth and the company do say they are on track to achieve their FY26 target: a return to positive normalised EBT.

Gregory Peter Whittam is the largest individual shareholder with a 7.07% holding in MOV.

Resolutions

1. That the Board is authorised to fix the auditor’s remuneration for the coming year.

This is an administrative resolution.

We will vote undirected proxies IN FAVOUR of this resolution.

Proxies

You can vote online or appoint a proxy at https://vote.cm.mpms.mufg.com/MOV/

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 2.00pm Tuesday 28 October 2025.

Please note you can appoint the Association as your proxy. We will have a representative attending the meeting.

The Team at NZSA