July 2021

We’re back with Grace and Dave, to see how they are getting on since they made their big decision a fortnight ago to pursue their investment goal.

They’ve been busy! Grace and Dave made a concerted effort to take a holistic approach to their investing, blending their own experiences and beliefs with some snippets of investment concepts they’d heard from the occasional financial commentator on the news.

They were both surprised at just how hard it was to know where to start. The only thing Grace could remember was to “not put all your eggs in one basket”.

They also thought hard about their own experiences and how that could relate to the investment decisions they were making.

Grace loves her job; she believes that effective healthcare and treatment makes a difference to everyone at some point in their lives. Dave thought about the jobs he’d worked on, for residential and commercial property developers in Christchurch’s construction boom. They’ve both observed Christchurch’s infrastructure slowly improve post-quake, but it still feels like there is a long way to go. Dave doesn’t think it’s just Christchurch – as a former Wellingtonian, training as a plumber, he remembers the well-documented state of Wellington’s water pipes.

Like most, they worry about the impact that human activity has on the planet. Does that make all investment a bad thing to do? How might a changing planet affect their investments?

Invest in what you understand. Your life experience matters.

Once they started looking through the TradeDoor app, however, they realised there were a few more concepts to think about. For example, they worked out they could buy funds traded on the NZX (ETF’s – exchange-traded funds), which was like an investment in many companies.

Grace liked the idea of investing in companies directly, simply because it sounded more fun. Dave liked the idea of ETF’s because it meant you didn’t have to do anything once you bought them (shortly afterwards, they learned that was actually a thing – a ‘passive’ investment).

Investment Choices

Grace set up a simple spreadsheet, with a few columns in the sheet – just how could she “spread the eggs” around? (Don’t go there, Mr. Hipkins – perhaps we should use the word diversification from now on). They settled on two key elements to determine this: geography (where was the company?) and sector (what did it do?).

diversification matters

it reduces risk and builds long-term resilience into your future returns

They both soon realised that it would be more practical for them to have most of their money invested in ETF’s rather than individual companies. TradeDoor allowed them to purchase US shares, for example, but there was a huge list of companies to invest in – how could they choose?

They made a conscious choice to limit any investments in companies solely to New Zealand, which they felt they could better relate to, and diversify their investments outside of New Zealand by using the range of funds available on the NZX.

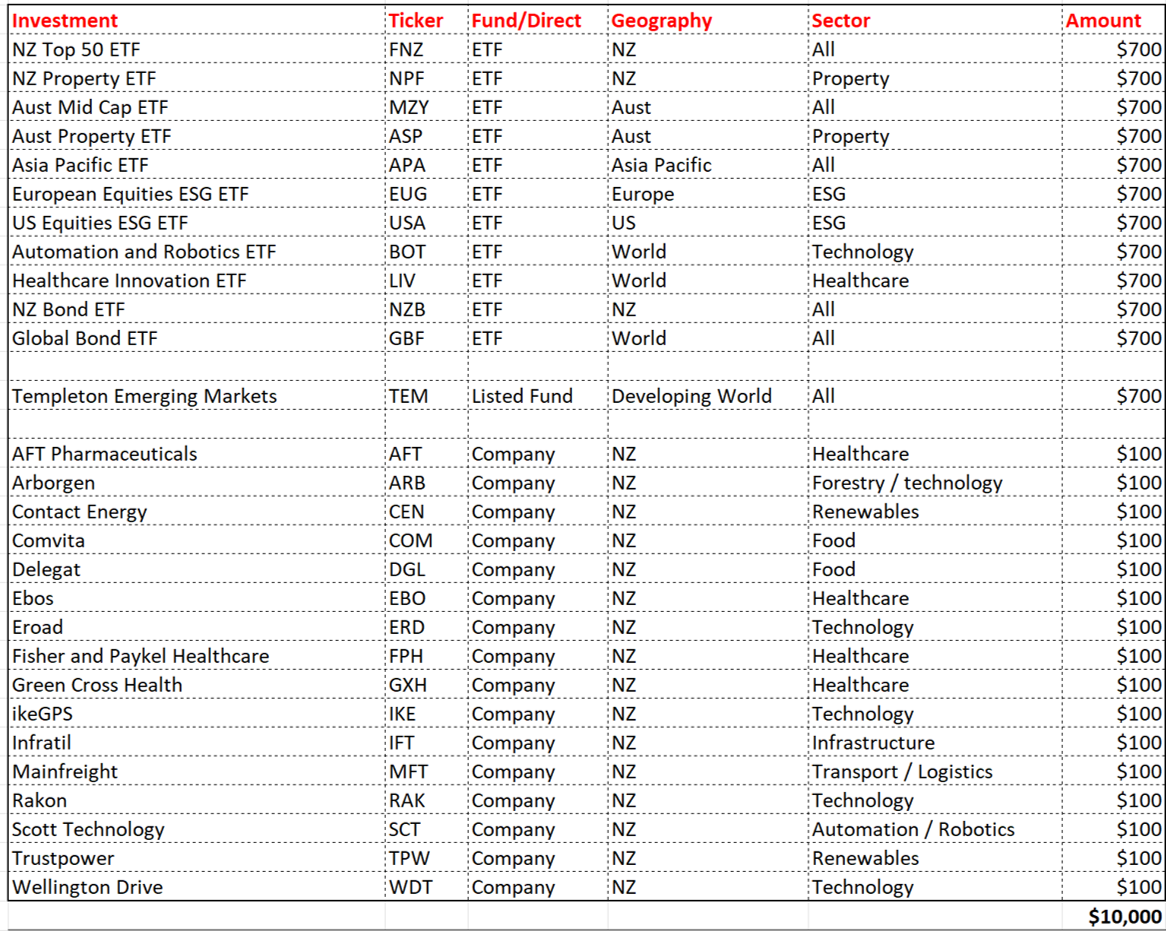

After a couple of hours of a lot of talking, Grace’s spreadsheet looked something like this:

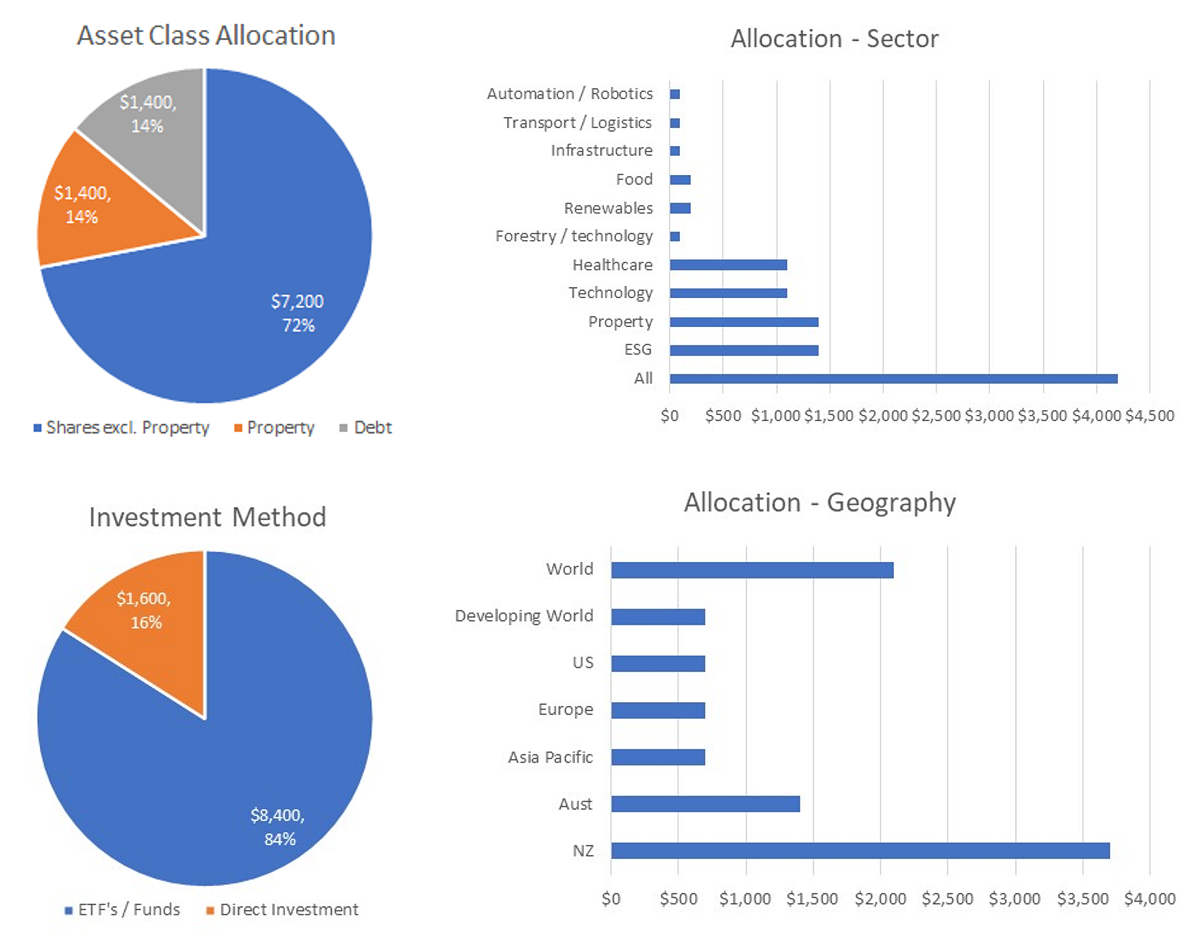

After a few evenings, the couple had a clearer idea of what their planned portfolio might look like. It might look like a big stretch to go from an empty spreadsheet to the one shown below – but Dave’s idea of using ETF’s to achieve a balanced portfolio across different sectors and geographies turned out to make this an easier process.

use ETF’s to diversify your portfolio

Grace was still keen to keep a few ‘direct investments’ in companies, based on the sectors they were passionate about, plus a couple of additional companies they thought looked good from the information provided on TradeDoor’s app.

The amount to invest in each was the last column they agreed. Both realised that New Zealand is utterly tiny compared to the US or Europe (or just about anywhere else). On the other hand, both Grace and Dave felt they could get their heads around New Zealand. Grace created some graphs to summarise what their portfolio looked like. They noted they would have $3,700 invested (37%) in New Zealand, with around $2,800 invested in ‘World’ or ‘US’ markets. Was that the right balance? Time will tell.

It is important to know that NZSA does not endorse any of the companies or funds highlighted in this article. ‘Grace’ and ‘Dave’ are fictional characters; any resemblance to any person, living or deceased, is not intentional. ‘TradeDoor’ is not an actual share trading platform.

The commentary in this article is for information and/or commentary purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any real person’s individual circumstances or objectives.

2 Responses

Speaking as a DIY investor, I appreciate the idea and effort here to help beginner or amateur investors. But the process illustrated here is overly simplistic even for DIY investors. It is dangerous too as it may unintentionally give the uninformed the idea that investment decisions can be made with such basic considerations.

The challenges faced by DIY investors are many. Nonetheless, it is possible for DIY investors to learn and apply some basic fundamental analyses in making investment decisions. Some basic understanding of technical analysis might also be helpful in determining entry and exit points, particularly if one is buying shares of a company directly. It is also possible and necessary for the DIY investor to understand the characteristics and performance of each sector, industry and geographical wise.

I advocate both DIY investing (not day trading or speculative investing) and using the services of professional fund managers. DIY investing is not easy and people who venture into it should do so with care and preparation.

Agree with you on that. In some ways almost felt like I was reading a story book with the real messages almost getting lost.

One thing I note missing here is “Research” and instead we here Grace & Dave “liked the idea…” suggesting emotive investment, which can be dangerous in itself.

My personal opinion…if you don’t like spending some time reading & doing research, then the best place to do investing within the walls of Sky City.