Date Submitted: June 13th 2025

To: External Reporting Board

Tap/Click here to download submission

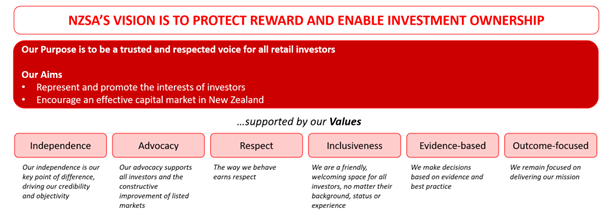

NZSA is a non-profit entity that is a trusted and respected voice of New Zealand investors. Our aims are to represent and promote the interests of investors and encourage an effective capital market in New Zealand.

We support XRB’s intent to balance global alignment with local relevance in a manner that supports effective disclosure and offers a pragmatic approach for New Zealand companies, investors and stakeholders – and appreciate the opportunity to comment in this Request for Information.

Consultation Response

Question 1: Which standards, overseas jurisdictions, or specific elements of international alignment are most important for you, and why?

We prioritise alignment with standards developed by the International Sustainability Standards Board (ISSB), particularly IFRS S2 Climate-related Disclosures.

Given ISSB’s wide international adoption, alignment facilitates cost efficiency, transferability, and easier access to global capital markets.

In particular, mutual recognition with Australian standards (AASB S2) is essential, given the close economic ties and established trans-Tasman regulatory frameworks. Alignment with Australia reduces duplication for dual-listed companies and ensures regulatory coherence across both markets.

However, we would wish to maintain an appropriate degree of requirement for NZ-based climate reporting entities, given their relative scale. For this reason, NZSA also supports the introduction of a differential reporting regime based on appropriate thresholds as highlighted in our submission to MBIE in February 2025.

Question 2: Is now the right time for New Zealand to amend or replace NZ CS to achieve closer international alignment with any other standards, and why?

NZSA does not support a complete replacement of the New Zealand Climate Standards (NZ CS). However, we agree that it is timely to move toward deeper international alignment, particularly considering the evolving global regulatory landscape.

Early alignment will mitigate future compliance costs and confusion for entities operating across jurisdictions. Immediate action will also enhance New Zealand’s reputation as a credible and forward-looking participant in global markets, mitigate the impact of future compliance costs and minimise corporate confusion for entities operating across multiple jurisdictions.

An internationally-aligned regime will also support clarity, consistency and comparability for investors.

Nonetheless, we Are cautious of sweeping changes that undermine reporting continuity. Reporting entities require stability to develop maturity and consistency in their disclosures. For that reason, any amendments should be incremental, well-signalled, and supported by clear guidance.

Inter-operability: NZSA sees benefit in improving the inter-operability of NZ CS with international standards, but believe it is not appropriate to consider replacing NZ CS in its entirety.

Thresholds and reporting: Given the relative scale of NZ companies, however, we believe that localised thresholds remain important in determining climate reporting requirements, and encourage consideration of a differentiated reporting regime, prioritising the disclosure of the strategy, governance and risk & opportunity components of NZ CS by smaller entities.

In some instances, greater international alignment is likely to deepen/broaden the current climate reporting requirement in New Zealand. We consider that the development of pragmatic reporting thresholds, with differentiated reporting requirements, is key in overcoming any unfair impact.

Breadth of disclosures: Some jurisdictions are explicitly moving beyond climate reporting, to include other forms of environmental sustainability disclosures, such as nature-based reporting based on TNFD. For investors and shareholders, this reflects broad-based disclosure supporting risk identification and mitigation – ultimately of benefit for investors.

While climate-related disclosures are foundational, companies across various sectors face other material environmental risks, including water scarcity, land-use change, pollution, and biodiversity loss. NZSA believes that principle-based governance, strategy, and risk & opportunity components featured in the NZ CS regime should be considered for as the basis for a wider scope of environmental sustainability disclosures that reflect these broader environmental risks over time.

However, a phased and proportionate approach to nature-based disclosures, beginning with voluntary guidance and materiality-based expectations, to reflect the scale and readiness of local entities. This ensures that companies can meaningfully address nature-related risks without being overwhelmed by compliance burdens.

We note growing momentum around the Taskforce on Nature-related Financial Disclosures (TNFD), particularly among European organisations. Guidance based on a pragmatic, simplified TNFD-aligned model applied on a voluntary basis could provide value without overburdening reporting entities.

Removal of director liability: To encourage disclosures, NZSA does not believe that directors should be held liable for climate or broader environmental statements.

Question 3: If closer international alignment is desirable, what process is most desirable (e.g., greater alignment of NZ CS or revoking NZ CS)?

We advocate for incremental adjustments to the NZ Climate Standards (NZ CS) rather than a complete replacement or revocation. NZ CS already reflects strong alignment with IFRS S2 and has driven meaningful improvements in sustainability disclosures, risk identification, and governance practices among New Zealand reporting entities.

A phased approach, similar to Australia’s staged implementation of IFRS S2, is preferable. This would enable entities to refine their systems and processes incrementally, support capability building, and avoid unnecessary compliance shocks. In our view, evolution, not disruption, is the most effective path forward.

We believe that the NZ CS provide a credible foundation. Gradual alignment with international standards (particularly the ISSB’s IFRS S2) will:

- Maintain regulatory continuity,

- Minimise transition costs and confusion,

- Preserve the momentum already created by the existing framework, and

- Enable entities to mature their reporting practices over time.

Where international developments extend beyond climate (e.g., into nature or broader ESG topics), we recommend that future alignment be guided by materiality and proportionality, allowing for differentiated reporting thresholds to reflect the diverse capacities of New Zealand entities.

Question 4: What information can you provide that closer international alignment would better achieve the stated purpose of climate reporting as per section 19B of the Financial Reporting Act 2013?

Closer alignment with international standards, particularly the ISSB’s IFRS S2 Climate-related Disclosures, directly supports the statutory purpose set out in Section 19B of the Financial Reporting Act 2013.

We consider that such alignment would:

- Enhance comparability, transparency, and disclosure quality across jurisdictions, allowing investors and stakeholders to assess climate-related risks and opportunities more effectively.

- Reduce regulatory friction for New Zealand-based multinational entities, enabling a streamlined, robust approach that lowers compliance costs and avoids duplicated effort.

- Facilitate better investment decision-making by delivering more consistent, decision-useful information to investors, improving the clarity and credibility of climate-related disclosures.

- Easier access to assurance capability for New Zealand entities.

Question 5: Are there any climate-related disclosure requirements you comply with that are not standards set by other jurisdictions? Should the XRB consider these?

The NZSA is not subject to mandatory climate disclosure requirements, as it is neither a listed issuer nor a large financial institution. However, through our work assessing corporate disclosures and advocating for improved transparency, we engage closely with climate reporting standards and market expectations.

We observe that many New Zealand companies are increasingly subject to non-jurisdictional climate-related disclosure expectations, often through international supply chains, investor mandates, or voluntary frameworks.

NZSA remains ‘framework agnostic’ in its approach to environmental sustainability disclosure. For example, we note that many organisations in New Zealand utilise common global frameworks, such as Global Reporting Initiative (GRI) standards, Sustainability Development Goals (SDG) or the Integrated Reporting (IR framework.

Where a company chooses to report against international standards (such as ISSB S2) or recognised voluntary standards (eg, GRI), we encourage XRB to consider recognition of the disclosure requirements of these standards through mutual recognition and/or inter-operability principles to avoid duplication for entities already reporting under these regimes.

Question 6: A Is mutual recognition important to you, and how would it impact your answers?

Mutual recognition is extremely important.

It allows entities to prepare one high-quality disclosure document applicable in multiple jurisdictions, significantly reducing reporting complexity and costs. For example, mutual recognition with Australia and Europe could substantially streamline reporting processes for New Zealand entities with international operations, benefiting stakeholders through enhanced clarity and reduced compliance burdens.

For investors, mutual recognition promotes greater comparability, and increases clarity and transparency in disclosures across markets.

As global standards such as IFRS S2 gain widespread adoption, formal recognition of equivalent disclosures from aligned jurisdictions (e.g. AASB S2 in Australia or CSRD in the EU) would support New Zealand’s credibility and competitiveness in global markets. It also ensures that companies are not penalised for early adoption or leadership in sustainability reporting outside of New Zealand’s regulatory perimeter.

Question 7: Do you have any other comments?

Risk Management: NZSA believes that an (unintended) positive impact of NZ CS has been an enhanced capability of overall risk management practices within climate reporting entities, contributing to improved maturity and depth of risk capability for corporates and investors alike.

CRE Scope: NZSA has consistently raised concerns about the current CRE definition, which hinges on market capitalisation and effectively excludes large unlisted entities from mandatory disclosure. This limits the regime’s coverage and undermines its objective of achieving economy-wide transparency on greenhouse gas (GHG) emissions and transition planning.

In contrast, several overseas jurisdictions are now capturing unlisted entities through inclusive thresholds. Under the EU’s CSRD, any company with two of the following: €25 million+ in assets, €50 million+ turnover, or 250+ employees is within scope, including non-EU entities.[1] Similarly, Australia’s proposed regime phases in entities meeting at least two of the following: AUD 500 million+ in revenue, AUD 1 billion+ in assets, or 500+ employees.[2]

NZSA has previously commented that the scope for “regulatory arbitrage” remains significant in this context. We encourage XRB to consider a broader scoping methodology aligned with international practice to mitigate regulatory arbitrage and support New Zealand’s capital productivity.

Differentiated Reporting Requirements: NZSA supports a principles-based approach to differential reporting. Jurisdictions such as Australia and the EU are adopting tiered reporting frameworks to manage compliance complexity. The EU CSRD phases in reporting obligations: large companies report first, with listed SMEs integrated in later waves.[3]

Similarly, Australia’s climate regime divides reporting duties across three groups, progressively lowering size thresholds and introducing materiality-based reporting for smaller firms. This approach ensures rigour for major emitters while allowing smaller entities time to build capacity. In this context, Scope 3 disclosures may warrant a phased or risk-weighted approach, subject to industry relevance and data availability.

Prescription vs Principle: NZSA notes the comment within the consultation document that the XRB “designed the disclosure requirements to be less prescriptive and more flexible in general to meet entities where they were at in terms of their reporting journey.”

NZSA considers this a key statement in the context of achieving practical outcomes that further the objectives of the CRD regime.

Assurance: A globally aligned approach to disclosure requirements is likely to improve the capacity, maturity and assurance consistency of assurance providers in New Zealand. It would also facilitate better cross-border assurance inter-operability, especially for dual-listed or multinational entities.

Local pragmatism: As noted above, we support the development of differential reporting approaches sensitive to entity size and capacity. (ref NZSA submission, February 2025).

This approach should be globally informed yet pragmatic in New Zealand’s unique economic context.

Thank you for the opportunity to make this submission.

Regards,

Oliver Mander

CEO, NZ Shareholders’ Association

June 13th 2025

[1] CSRD thresholds: Which companies have to report?; What US companies need to know about CSRD: PwC;

[2] Mandatory climate-related financial disclosures – Policy position statement

[3] Get ready for the Corporate Sustainability Reporting Directive