Tap/Click here to download policy

Date Approved: October 2024

Effective From: January 2025

Future Review Date: October 2027

Application: This policy applies to all NZX listed companies.

Purpose: NZSA maintains a range of policies to positively influence the behaviour of all participants in the NZX listed company sector. These policies should be read in the context of the NZSA Policy Framework Statement.

Preamble

This policy document combines three previous policies (Executive Remuneration, Remuneration Reporting and Golden Parachutes) into a single policy document.

The change in the title of the policy also signals a narrowing of scope of the policy, to focus on CEO Remuneration rather than the broader Executive team. This does not imply that NZSA will not focus on appropriate remuneration design for other executives – but is recognition that we expect a differing level of disclosure for the CEO compared to other executives.

During June-December 2023, NZSA worked within the NZX Corporate Governance Institute to offer a practical reporting solution in the form of a template for listed companies (NZX Remuneration Reporting Template). From NZSA’s perspective, the development of this template recognises three key aims when it comes to remuneration disclosure:

- Clarity: The ability for a reader to understand remuneration disclosures, in particular related to incentive schemes that can span multiple years.

- Consistency: Introducing a common language for remuneration disclosure and setting a clear expectation as to remuneration disclosures.

- Comparability: Enabling a reader to more easily compare CEO remuneration with other NZX-listed companies.

This new policy, coupled with the NZX Remuneration Reporting template, also replaces the long-standing “NZSA Framework for reporting of CEO Remuneration” as a practical template for CEO Remuneration reporting.

NZSA recognises that disclosure of CEO remuneration in New Zealand has been at a lower standard than that expected by most domestic and international investors.

While this policy is focused on CEO Remuneration, NZSA supports disclosure of the core principles related to remuneration design at a corporate level as per the NZX Remuneration Reporting Template.

1.0 Policy: CEO Remuneration

General Principles

1.1 NZSA expects disclosure on remuneration governance arrangements., together with any remuneration objectives and/or policies.

a) We do not support a Managing Director or CEO (who sits on the Board) being included within the Remuneration Committee.

1.2 NZSA expects clear disclosure around remuneration policy for the CEO and its rationale. As per the NZX Remuneration Reporting Template, this includes the target structure of remuneration components, including:

a) The relative weighting of remuneration components (Base, STI, LTI)

b) Market positioning for the setting of remuneration

1.3 The structure and disclosure of CEO remuneration should be concise, easily understood and transparent to investors.

a) Disclosure should offer a clear distinction between base remuneration, incentive-based cash payments and incentive-based reward in shares and/or performance rights.

b) Base remuneration should include KiwiSaver contributions made by the issuer, leave entitlements and any other entitlement related to ‘ordinary pay’.

1.4 NZSA continues to expect disclosure of the core principles and structures related to remuneration design for all company employees.

Base Remuneration

1.5 NZSA expects clear disclosure around the level of base remuneration and its rationale. We expect to improve our benchmarking surrounding CEO base remuneration as CEO remuneration disclosures improve (see section 2.2).

1.6 Superannuation (KiwiSaver) employer contributions should be at the same percentage rate as that applicable to other employees.

Incentives

1.7 Incentive awards to CEO’s should be awarded in recognition of superior performance.

a) NZSA expects this to be evidenced through the disclosure of measures, their weightings and the level of achievement versus disclosed targets.

b) NZSA recognises that the use of “measure groups” rather than measures may be useful in preserving commercial confidentiality.

c) Where ‘measure groups’ are used, NZSA expects disclosure of achievements compared with targets to be shown via a percentage benchmark, with the target for the measure group representing 100%.

1.8 The relationship of incentive structure award to base remuneration should be clearly disclosed.

a) For incentives based on cash, NZSA expects disclosure of both the minimum and the maximum amount able to be awarded and paid under the scheme, expressed as a percentage of base remuneration.

b) For incentives based on performance rights and other share-related structures, the minimum and maximum amount awarded should be disclosed. NZSA recognises that no maximum payment (vesting) value can be calculated in this situation.

1.9 NZSA expects issuers to relate the amount of CEO remuneration paid (base remuneration, cash-based incentive, share-based incentive) to the year in which it was earned.

a) While we recognise that statutory disclosures require only the amount paid each year to be disclosed, this creates a lack of meaning in the remuneration disclosure as it relates to earnings by the CEO and underlying company performance

b) This approach is supported by the NZX Remuneration Reporting Template.

1.10 Vesting of share-related incentive awards should be based on disclosed performance hurdles that are aligned with the interests of shareholders.

1.11 For share-based or performance-right based long-term incentive (LTI) structures, NZSA expects full disclosure of the conditions under which shares or performance rights are awarded and vest.

a) NZSA expects that at least one shareholder return measure is used to support the extent of vesting (see discussion in section 2.4).

b) We do not support a sole tenure-based measure playing any role in the determination of vesting outcomes.

c) We expect that vesting occurs after a minimum assessment period of three years. NZSA will look favourably on longer assessment periods.

1.12 NZSA prefers a weighting of incentives towards long-term incentives (LTI) at award, as compared with short-term incentives. For share-based incentives (including performance rights), this provides greater incentive for a CEO to enhance the future vesting value of the award, better aligning CEO interest with those of shareholders.

1.13 NZSA supports an appropriate level of short-term incentive (STI).

a) As per section 1.12, NZSA expects that the total incentives awarded/earned are weighted towards a long-term incentive.

b) NZSA expects they should be used only where the performance targets support and are entirely consistent with the company’s long-term goals.

c) As per section 1.7, we expect full disclosure of the metrics associated with an STI.

1.14 NZSA will consider the following factors when looking at the quantum of incentives available for the CEO;

a) Size

b) Business Complexity

c) Level of corporate maturity

d) Risk appetite

e) Any other relevant factor

1.15 NZSA is supportive of a company-wide approach to incentives, including access to employee share schemes.

1.16 NZSA expects disclosure of both CEO vs ‘median worker’ ratio and gender pay gap metrics as part of remuneration disclosures, on the basis of a CEO base remuneration benchmark. We note that disclosure of median worker pay should still allow shareholder calculation of total pay ratio (including incentives) on either an awarded or paid basis.

Golden Parachutes and Handshakes

1.17 For an incoming CEO, NZSA does not support non-performance related “golden handshakes”, including those offered to compensate for benefits foregone at previous employers. For shareholders, such payments represent a payment for little or no benefit.

a) NZSA recognises differences in approach across different countries. NZSA will consider the appropriateness of any performance rights or share-based structures offered to incoming CEO’s as an inducement on a case-by-case basis.

b) In any case, however (and as with our position on long-term incentive structures), NZSA expects the use of performance measures to determine vesting outcomes over a minimum three-year period. We do not support outcomes solely based on tenure.

1.18 For an existing CEO, NZSA believes there should be explicit disclosure around the severance terms associated with the CEO, including whether specific termination payments are offered.

a) Our interest is in encouraging a “no surprises” approach to the benefits accruing to a CEO on termination or resignation.

b) NZSA does not support the payment of special retirement allowances or benefits, beyond those contained within the employment contract.

c) Even where the company has an existing CEO, NZSA expects disclosure within the Remuneration Policy as regards the nature of recruitment incentives offered to any future CEO recruitment. As noted in section 1.17(b) above, any recruitment incentive should be treated as a form of long-term incentive.

d) NZSA does not generally support the use of one-off “retention” payments to existing CEO’s, particularly where these are used to create value for the CEO where LTI schemes have not vested. Nonetheless, we will consider retention remuneration arrangements on a case-by-case basis.

1.19 For a departing or departed CEO, NZSA expects that any redundancy and other “golden parachute” payments made are disclosed. We expect these to be in line with the disclosures made under section 1.18.

1.20 NZSA opposes special payments to a CEO on the successful completion of a takeover or merger of their company, regardless of whether these are paid by the target company or the purchasing company.

2.0 Commentary

2.1 Two Strikes: In developing this policy, NZSA notes that New Zealand-based issuers operating in Australia are often subjected to pressure from Australian analysts to adopt a similar ‘two strikes’ regime as exists in Australia, where shareholders vote on the Remuneration Report.

a) NZSA does not advocate for the introduction of a ‘two strikes’ regime in New Zealand.

b) This reflects the different jurisdiction of New Zealand in relation to the ability of any shareholder (with no threshold) to bring a binding ordinary resolution to a company’s shareholder meeting. Australia has a 5% threshold for shareholders to bring an ordinary resolution to a shareholder meeting.

c) NZSA also notes that many of the remuneration votes have been conflated with other issues, rather than being a vote for or against remuneration.

d) Last, we note that the ‘two strikes’ rule in Australia appears to have done little to curb ongoing increases in executive remuneration outcomes, has contributed to overly complex remuneration structures and disclosures and has not curbed practices that offer reward to CEO’s with no proven benefit to shareholders (eg, ‘golden handshakes’ that act to induce a new CEO to an issuer.

2.2 Base Remuneration: NZSA believes that base remuneration should be set at levels that reflect market capitalisation, the degree of required transformation, organisational maturity and other corporate complexity factors.

a) Company performance should be seen as a “neutral” (average) factor in base remuneration, with above-average performance reflected in incentive payments.

b) NZSA will likely increase its benchmarking of CEO base remuneration in coming years, with this data becoming publicly available on its website.

2.3 Malus/Clawback for share-based incentives: NZSA is likely to support structures that include an element of either malus (pre-vesting) or clawback (post-vesting) provisions, with a criteria as to when they are able to be used or applied. These structures are not common in New Zealand, but are increasingly utilised for trans-tasman issuers.

2.4 Absolute Return vs Relative Shareholder Return: NZSA expects a shareholder return measure to be included as part of any long-term incentive. While both methods clearly align the CEO with long-term shareholder interests, we do recognise limitations associated with each.

a) An absolute return introduces the impact of external factors – such as interest rate changes and economic conditions – that are not in the control of the CEO. A CEO is therefore less likely to achieve vesting criteria in ‘downward’ cycles, offset by a greater probability of achieving those same criteria in ‘upward’ cycles.

b) This indicates that due care is required in establishing vesting conditions, to ensure they are set at mid-cycle conditions.

c) A relative measure compares the company’s total shareholder return to that of a comparator group. In this situation, the selection of appropriate market competitors / peers becomes critical.

d) Both methods could be subject to ‘short-termism’ at vesting, as CEO’s take actions to influence share prices. For this reason, NZSA will look favourably on additional ‘retention periods’ beyond the vesting date.

e) For shareholders, a ‘relative return’ methodology could result in vesting conditions being met for the CEO, at a time when shareholders have received no return – albeit is more likely to be related to factors within a CEO’s control.

f) NZSA notes that 24% of LTI performance measures in NZ are based on a combination of relative and absolute Total Shareholder Return – with a positive absolute shareholder return gate to avoid the issue articulated in section 2.4(e) above.

2.5 Company-wide STI structures and share plans:NZSA is generally supportive of schemes that allow all employees to share in the company’s success. We believe that this plays a positive role in employee motivation and retention.

a) While this may result in dilution for shareholders (depending on the scheme’s design), this is likely to be offset by productivity gains and the retention of key institutional knowledge across the organisation as a whole.

b) Employee share ownership may also result in greater alignment of interests with shareholders.

2.6 Correlation of incentives to performance: There are a number of different commentaries and academic research papers debating the merits of incentive structures and their impact on corporate performance.

NZSA recognises there is limited New Zealand-based research into this topic, and will endeavour to maintain its own dataset helping investors to determine the worth of incentive structures. Most studies acknowledge that a company’s performance outcomes are the result of a ‘team effort’ rather than the efforts of a single individual. Other key academic findings include;

a) Relationship to risk: the use of share-based incentive structures as part of long-term incentives encourages CEO’s towards a risk-based assessment of activities that can drive enhanced long-term returns. This is particularly acute in smaller, less mature companies.

b) Incentive Plan design: the structure of the incentive framework is a factor in the ongoing relationship of incentives to corporate performance.

c) Performance outcomes: Share-based incentive levels generally correlate with performance, but at a diminishing marginal rate. Ultimately, at high levels of incentive award, performance outcomes turn negative as this is reflected in risk-taking.

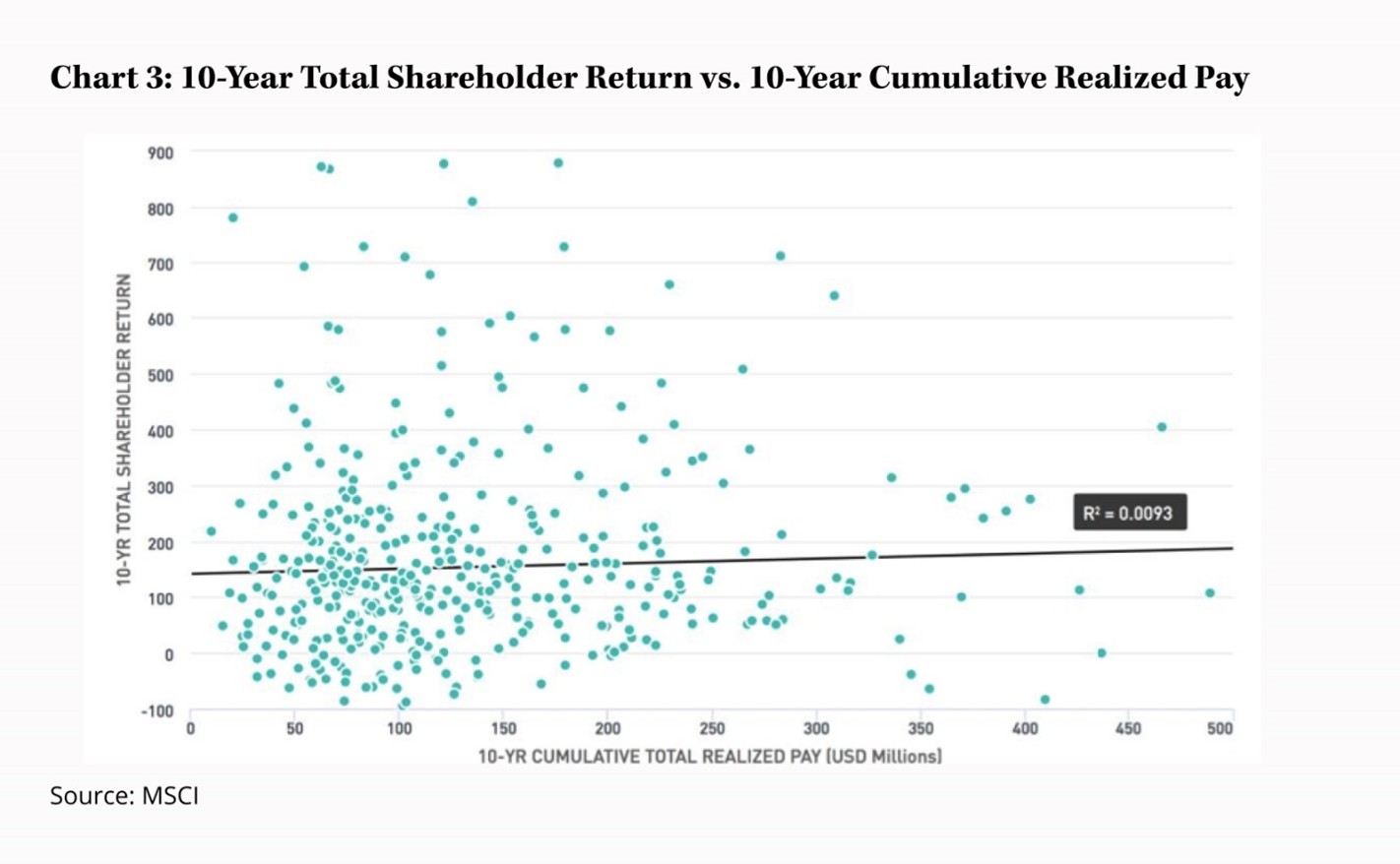

2.7 Public perception: Despite the academic view expressed in section 2.5, there remains much debate as to the merits of CEO incentive structures. The chart below (used by NZSA in the past) reflects a 2016 analysis by MSCI comparing 10 year cumulative realised pay to 10 year performance.

a) Given that CEO pay has expanded at a rate greater than median worker compensation over the last 40 years, it is likely this incorporates the ‘diminishing marginal return’ and ‘negative return’ factors expressed in section 2.5(c) above.

b) This perhaps reinforces the need for the quantum of incentives to be set at appropriate levels – enough to incentivise a measured risk-based approach, without being so much as to prioritise risk at the expense of likely performance outcomes.

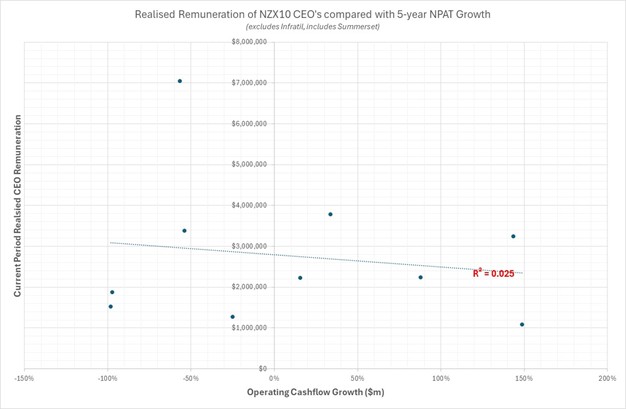

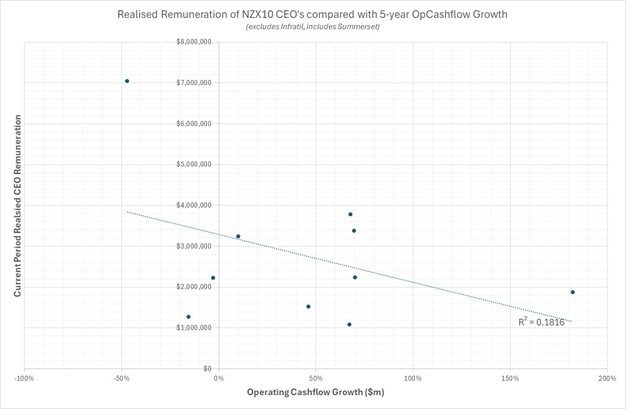

c) For New Zealand, NZSA is likely to increase its level of data collection and analysis in future years, to allow an effective comparison of base remuneration, incentives and company performance. An initial view of current NZX10 companies (excl. Infratil, including Summerset) is shown in the charts below. This reflects the non-correlated approach associated with the global data above.

2.8 Benchmarks: On the basis of the commentary above, NZSA will consider the factors expressed in section 1.14 as we establish our own NZ-based benchmarks for CEO remuneration. The aim is to create a NZ-based dataset focused on independent, fact-based commentary on CEO Remuneration structures and quantum levels.

2.9 ‘Granted’ vs ‘Realised’: NZSA notes the muddled approach of many New Zealand companies to CEO remuneration reporting in the past, a situation partly encouraged by a requirement to disclose “total remuneration paid”.

a) With the increasing use of share-based awards and payments, this inevitably leads to ‘conflation’ between base remuneration earned in the reporting year, the payment of a short-term incentive related to the previous year and the vesting of share-based rights or options from an award made anywhere between 1-5 years previously.

b) NZSA notes an improvement in 2024 disclosures following the development of the NZX Remuneration Reporting Template in late 2023.

2.10 ‘Australian-isation’: Many New Zealand listed issuers are either subject to scrutiny by Australian-based analysts or operate internationally, with US-based CEO’s and management teams or spanning ‘Australasian’ businesses.

a) NZSA recognises pay disparities in New Zealand as compared with the US or Australia. For a business to compete for an appropriate CEO, a New Zealand-based entity may have to look at greater-than-expected quantum levels of total CEO remuneration, as compared with a typical NZ-based business.

b) Australian-based ASX entities are subject to a different regime surrounding the remuneration report, where shareholders vote on the report each year. NZSA notes that New Zealand operates as a different jurisdiction, where it is easier for shareholders to bring a Resolution to a shareholder meeting compared with Australia.

c) We understand that Australian-based analysts will want to use the same models and frameworks they use within Australia to assess New Zealand companies. However, the blind focus on presenting a remuneration report for a shareholder vote ignores the different rules applicable within New Zealand.

d) Despite this commentary, NZSA is unlikely to object if a remuneration report is brought to market for a shareholder vote.

e) NZSA notes that the development of the Remuneration Reporting regime in Australia has done little to curb excess in CEO Australian remuneration outcomes.

f) We continue to hold concern that less favourable elements of Australian remuneration practices (eg, golden handshakes) may become part of the New Zealand remuneration landscape as New Zealand companies compete for talent.

2.11 Internal vs External Recruitment: Similar to Director succession, the succession plan of a CEO is likely to form a key risk for shareholders, with CEO recruitment (rightly) held as a key role of any Board. As noted in a recent HBR article “A failed CEO succession can disrupt employees’ work, cause senior talent to jump ship, damage the company’s reputation, erase enormous value, and ruin the careers and legacies of the outgoing CEO, the board, and the designated successor.”

a) NZSA notes different forms of CEO succession – in particular ‘planned’ or ‘forced’, with methodology being to support succession through ‘internal’ or ‘external’ recruitment approaches. We have witnessed two ‘forced’ successions recently in New Zealand, with Directors stepping into ‘acting’ CEO roles.

b) Globally, planned successions account for two-thirds of all CEO transfers.

c) Struggling companies are more likely to go-to-market for an externally recruited CEO.

d) NZSA notes that most research supports internally-sourced CEO’s as creating better returns for shareholders (continuity, institutional knowledge). However, this is more likely to occur as part of a ‘planned succession’ process – where a forced succession results in the Board recruiting an external candidate, the performance of an incoming CEO is dependent on the financial and operating condition of the organisation at the time they are recruited.

2.12 Role of NZX Remuneration Reporting Template: NZSA is supportive of the NZX template supporting an improvement in the remuneration disclosures of NZX listed companies.

a) While voluntary, we encourage issuers to adopt the template – it forms a practical tool to provide greater clarity on remuneration disclosures, with minimal additional work required by the issuer.

b) NZSA notes the relatively poor state of NZX company disclosures on CEO remuneration. We believe that issuers using this template will go some way to avoid calls for further regulation or requirement. Use of the template will result in disclosures comparable with ASX listed companies for CEO remuneration, but in a form that is much less complex for the user of the report.

2.13 Companies Act Requirements: The Companies Act offers little by way of required remuneration disclosures. Section 211(g) requires issuers to disclose remuneration paid to employees above $100,000 in bands of $10,000. NZSA has submitted on simplification of this disclosure regime. We also note that the focus on ‘paid’ masks the actual amounts earned by employees each year, particularly relevant for higher earners (including the CEO).

3.0 Key Regulatory Requirements

Companies Act 2003

Takeovers Act 1993

Takeovers Regulations 2000

NZX Listing Rules

NZX Corporate Governance Code

References

NZX Listing Rules

NZX Corporate Governance Code

NZX Remuneration Reporting Template

Internal vs External CEO’s (October 2016)

Effectiveness of CEO pay-for-performance (November 2000)

CEO compensation and firm performance (February 2021)

ACSI Review: CEO pay in ASX200 companies (July 2023)

PWC New Zealand Executive Reward Report – May 2024

Power, Influence, and CEO Succession (July 2024)

Are CEOs worth the money? – Intelligent Investor (Oct 2024)

Definitions

Earned: means money received or no due to be received by a CEO that is no longer at risk (eg, base remuneration, STI related to the current financial year).

Awarded: An entitlement related to an incentive that is subject to future assessment or conditions (eg, award of performance share rights under a long-term incentive scheme).

Vested: Securities under an incentive scheme that have been subjected to assessment and to which a CEO is now entitled to receive.

Paid: the dollar amounts actually paid to an employee within a reporting period (regardless of when they were earned).

Related Policies

Policy 20 – Takeovers Policy

2 Responses

Hi Oliver, I read in NZ Herald today that a new template for reporting CEO remuneration for NZX companies are in the works by NZSA. Can you please give an indication of when that will be published? Thanks

Hi Anjali…this has been published by the NZX as a “Remuneration Reporting Template” in December 2023. You can check out the template at this link: https://www.nzx.com/regulation/nzx-rules-guidance/tools-and-resources/nzx-remuneration-reporting-template